Source: CafeF – Vietnam International Bank’s Headquarter

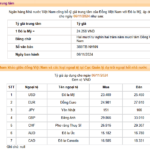

On November 11th, Quang Kim JSC, a newly established company in May 2024, reported to the Ho Chi Minh City Stock Exchange (HOSE) its purchase of 17.2 million VIB shares of Vietnam International Bank.

Quang Kim JSC, headquartered in Hanoi, primarily operates in the wholesale food industry. Its legal representative is Ms. Do Xuan Ha, the company’s General Director, and sister of Mr. Do Xuan Hoang, a member of VIB’s Board of Directors.

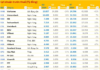

According to VIB’s semi-annual governance report for 2024, Mr. Do Xuan Thu, father of Mr. Hoang, chairs the Board of Directors at Quang Kim JSC. The Hoang family holds a significant presence in VIB’s shareholder structure, as disclosed in August 2024, with Mr. Hoang owning over 125.5 million VIB shares (4.949%), and Mr. Thu holding more than 32.8 million shares (1.277%).

Mr. Hoang’s three children, Do Thu Giang, Do Xuan Son, and Do Xuan Viet, collectively hold over 71.86 million VIB shares. The transaction by Quang Kim JSC, estimated at a cost of over VND 310 billion based on the closing price of VND 18,200 per share on November 11th, marks a significant investment in VIB.

Prior to this transaction, Quang Kim JSC did not own any VIB shares. Post-transaction, the company’s ownership in VIB stands at 0.577% of the bank’s charter capital. Including the holdings of individuals related to Quang Kim JSC, the total ownership reaches over 275.8 million VIB shares, equivalent to 9.258% of the bank’s capital.

As a result of this transaction, Quang Kim JSC and its related parties now collectively hold 9.836% of VIB’s charter capital, representing more than 293 million VIB shares.

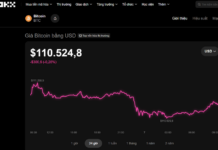

The Greenback’s Freefall: A Sudden Surge

The US dollar surges on the black market, with a notable spike. While the selling rate in banks witnesses an increase, the buying rate takes a contrasting dip.

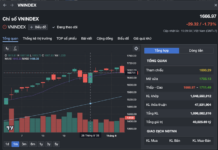

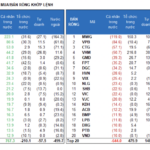

Why Are Bank CEOs Still Buying and Selling Stocks in a Bear Market?

(NLĐO) – The stock market remained gloomy on November 5, but the banking sector witnessed a positive trend as a flurry of insider activities signaled potential buying opportunities.