Petrovietnam Reports Impressive Financial Results for the First Ten Months

Offshore oil and gas drilling operations. Illustration

|

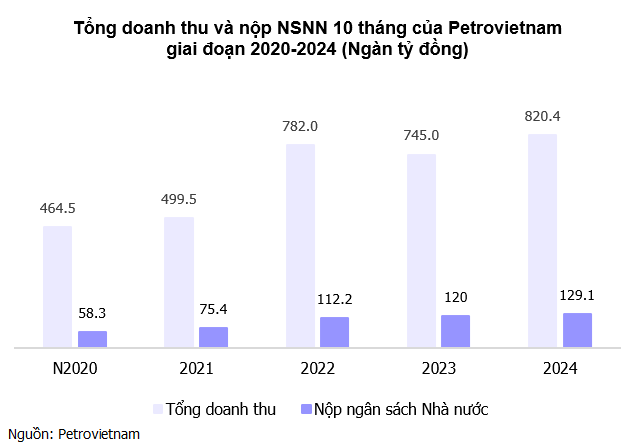

Total revenue for the first ten months exceeded VND 820 trillion

At the October work conference held on November 13, Petrovietnam reported that all key production indicators for October exceeded the plan by 3-84.3%, with all indicators showing growth compared to September. At the same time, Petrovietnam also exceeded all financial targets for October 2024 by 16% – 3.7 times.

As of the end of October, the Corporation has basically completed and exceeded all plan targets assigned by the Board of Members by 0.1-18.3%, with many indicators showing growth compared to the same period in 2023, such as urea production, electricity production, gasoline production, and NPK production.

The total revenue of the Corporation for the first ten months reached VND 820.4 trillion, up 10% over the same period, completing the assigned plan ahead of schedule. The Corporation’s budget payment for the first ten months reached VND 129.15 trillion, up 7%.

Among the Corporation’s member units, 10/22 units exceeded the consolidated revenue plan, and 17/22 units achieved revenue growth compared to the same period.

As of October, the Corporation’s disbursed value reached VND 27.1 trillion, up 90% over the same period. The Corporation’s investment value reached VND 23.3 trillion, twice as much as the previous year.

Mr. Le Manh Hung, Chairman of the Board of Members of Petrovietnam, said that the Corporation is determined to implement the proposed management plan. Especially, it aims to exceed and achieve the highest key targets, such as total revenue striving to exceed VND 1 quadrillion, consolidated profit, and budget payment striving to achieve the highest level with growth compared to 2023.

Chairman of the Board of Members of Petrovietnam Le Manh Hung

|

Developing Two Growth Scenarios for 2025

On November 14, Petrovietnam held a meeting to discuss the production and business plan for 2025. The Corporation’s member units shared the view that the context of the coming year will face challenges due to market volatility and unpredictable international geopolitical tensions, which can disrupt the supply chain of oil and gas equipment/commodities and incur additional costs.

Based on this, Petrovietnam developed two growth scenarios:

In the scenario of an oil price of 70 USD/barrel, the revenue target is nearly VND 810.1 trillion, and the budget payment target is over VND 91.3 trillion.

In the scenario of an oil price of 75 USD/barrel, the Corporation raises the revenue target to over VND 843.1 trillion, and the budget payment target to nearly VND 94.4 trillion.

While assessing that the two scenarios are calculated with full consideration of conditions, opportunities, and challenges, Mr. Le Ngoc Son, General Director of Petrovietnam, suggested the need for an additional management scenario as a basis for proposing overall implementation solutions.

General Director of Petrovietnam Le Ngoc Son speaking at the meeting

|

For 2025, Mr. Son identified LNG as the driving force in the gas sector, electricity from the Nhon Trach 3&4 power plant, and investment and service growth from offshore wind power. Along with the opportunities, challenges remain due to the varying predictions of oil and LNG prices by global organizations, given the complex world situation, wars, and geopolitical tensions. Another challenge is the supply of gas in the Southeast region, especially with the scenario of running at high capacity…

Regarding solutions, Mr. Duong Manh Son, Deputy General Director of Petrovietnam, suggested considering a balanced investment plan to ensure the Corporation’s business efficiency, while focusing on core issues in each field.

According to Mr. Nguyen Van Mau, Member of the Board of Members of Petrovietnam, the production targets set in the plan need to clarify the design capacity and identify existing problems that need to be overcome. An essential task, according to Mr. Mau, is to thoroughly handle stagnant investment projects and turn this into a specific task for monitoring. In terms of finance, it is necessary to focus on the plan to balance capital sources and arrange capital for large projects, marking a step forward in managing cash flow.

After listening to the contributions, Mr. Le Manh Hung, Chairman of the Board of Members of Petrovietnam, noted that the Corporation needs to build an economic forecasting and management measurement model to integrate the country’s and the world’s macro-economy into the Corporation’s micro-operations, thereby developing the most accurate growth scenario for 2025.

Unlocking Profits: POS to Dish Out 400 Billion VND in Dividends, with PVS Reaping the Rewards

Joint Stock Company for Installation, Operation and Maintenance Services of Offshore Oil and Gas Works (UPCoM: POS) plans to pay a 10% cash dividend for 2023 (1,000 VND per share), with its parent company, PVS, standing to benefit the most.

PV Power’s Electrifying October: A $2.2 Billion Turnover Triumph

Let me know if you would like me to continue crafting compelling content for your project!

PV Power, a leading energy company listed on the Ho Chi Minh Stock Exchange (HOSE: POW), has released its business performance report for October 2024.