Source: General Statistics Office

|

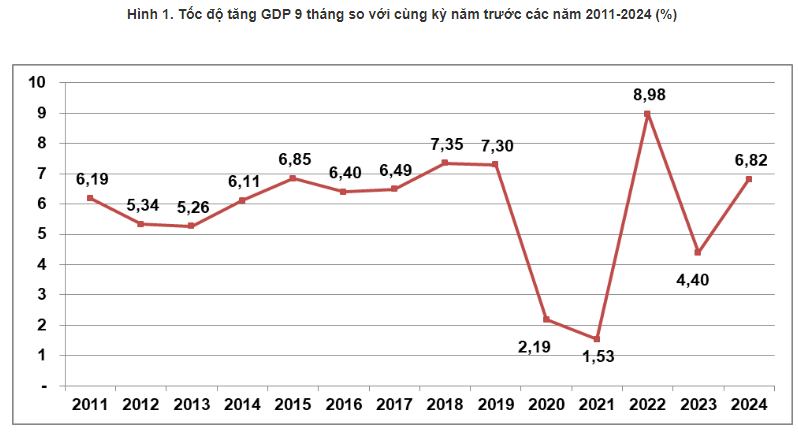

Wrapping up the third quarter, the macroeconomic picture for the first nine months of 2024 is bright and vibrant. GDP growth reached its highest compared to the same period in the last five years (except for 2022 when the economy reopened after the pandemic) – estimated at 6.82% over the same period last year. This growth was driven by the strong recovery in exports, which, in turn, boosted domestic production activities. The growth also reflects the contribution of internal factors as domestic consumption demand improved and the real estate market bounced back.

These recovery signals have also helped improve businesses’ absorption of loans. As of September 30, 2024, credit for the entire economy had increased by about 9% (a 3% increase in the third quarter of 2024), approaching the growth target of 14-15% for 2024.

Interest income boosts bank profits

Source: VietstockFinance

|

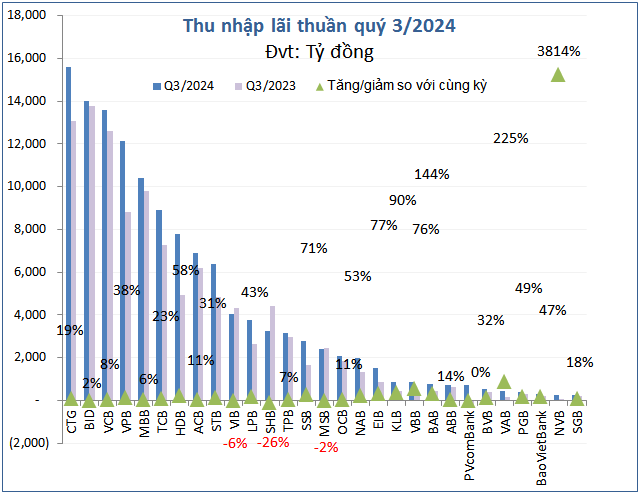

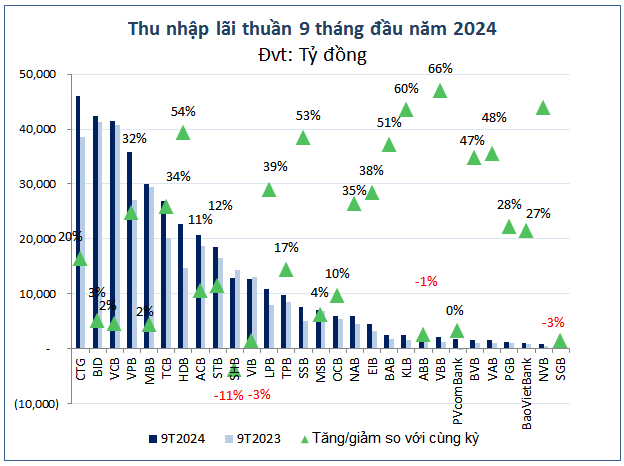

Following the credit growth trend, interest income of the banks also increased compared to the low base of the third quarter of 2023. According to VietstockFinance data, the total net interest income of 29 banks that have published their Q3/2023 financial statements reached VND126,896 billion, an increase of VND20,241 billion, or 19% compared to the same period last year.

Source: VietstockFinance

|

Source: VietstockFinance

|

Source: VietstockFinance

|

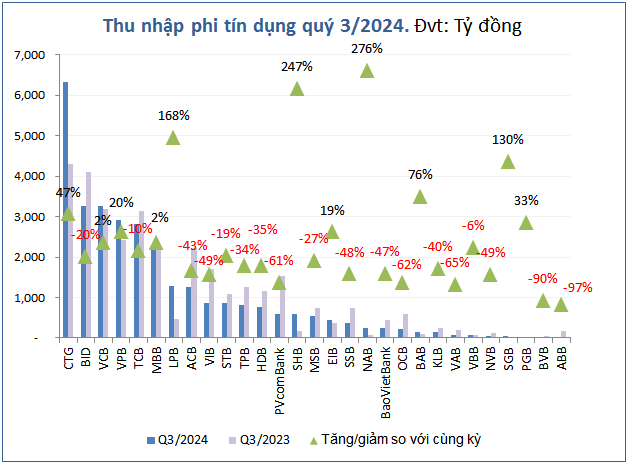

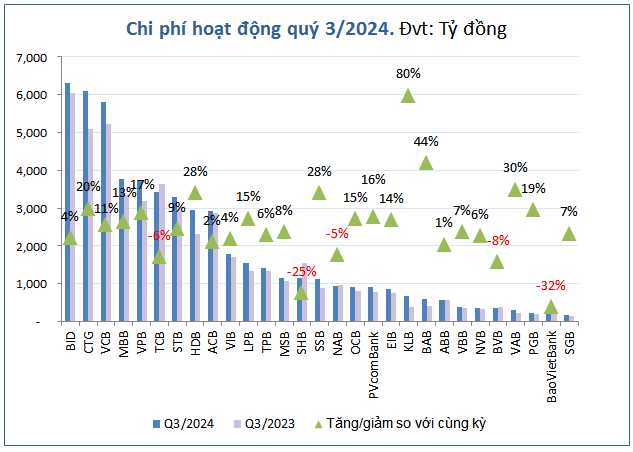

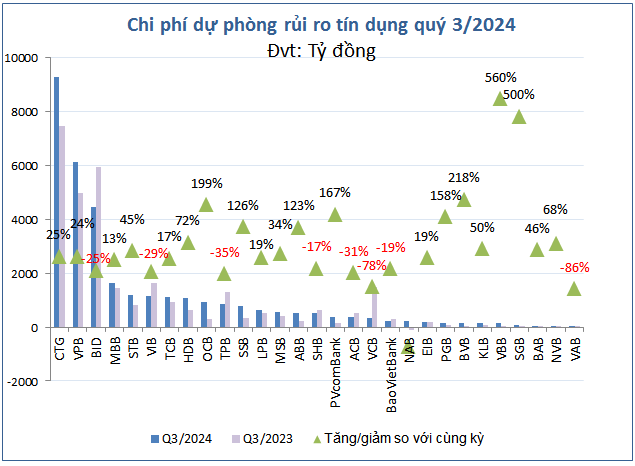

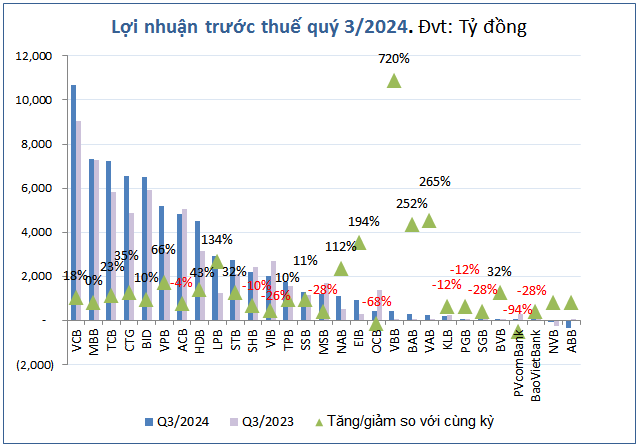

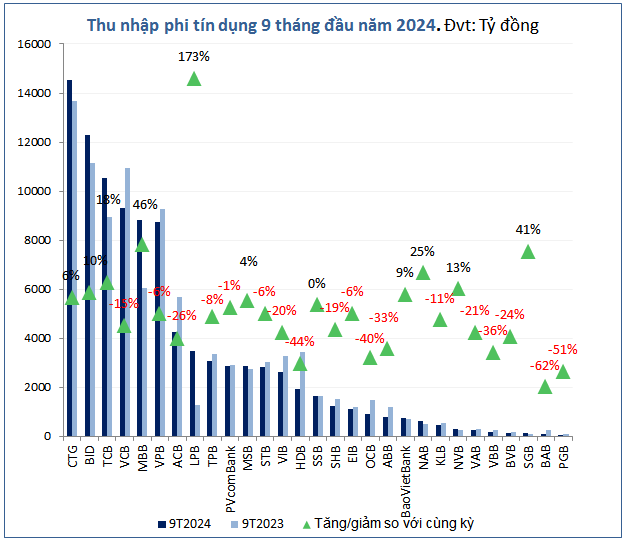

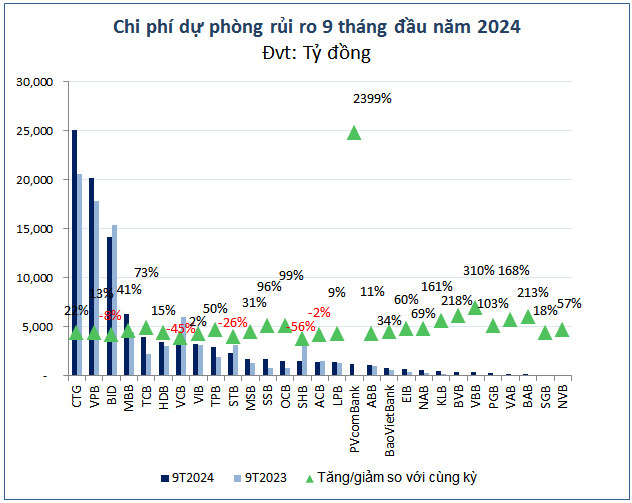

Therefore, despite a decrease of VND2,340 billion in total non-interest income, equivalent to 7% compared to the same period last year, along with the pressure from operating expenses (up 10% to VND53,955 billion) and provision for credit risks (up 9% to VND33,281 billion), the banks’ total pre-tax profit still recorded robust growth (up 17% over the same period) to VND70,170 billion.

Source: VietstockFinance

|

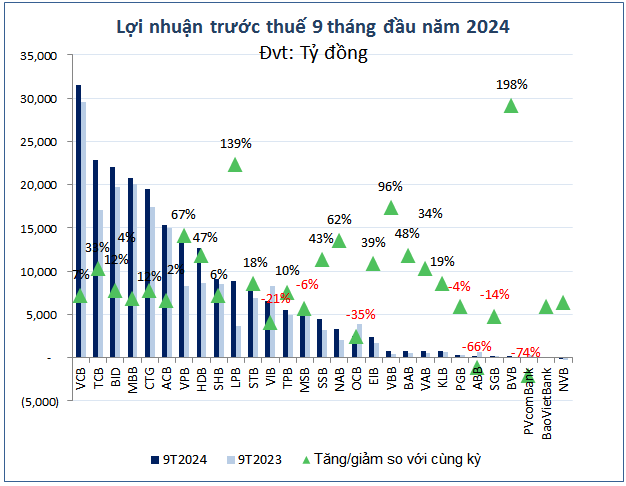

Although it was not the bank with the strongest growth in interest income like Viet A Bank (VAB), Vietbank (VBB) took the lead in pre-tax profit growth this quarter (8.2 times higher than the same period) to VND410 billion, despite having the highest increase in provision for credit risks in the banking industry (6.6 times higher than the same period last year).

While other banks were proud of their Q3 profits, ABBank (ABB) reported a significant loss of VND343 billion due to a decline in non-interest income (down 97% year-on-year) and a sharp increase in provision for credit risks (2.3 times higher than the same period last year).

Surpassing the annual profit plan “as easy as pie”

In the first nine months, the net interest income of the 29 banks reached VND379,384 billion, up 16% over the same period last year. At the same time, the banking industry’s total non-interest income also slightly increased by 1% to VND96,792 billion.

Source: VietstockFinance

|

Source: VietstockFinance

|

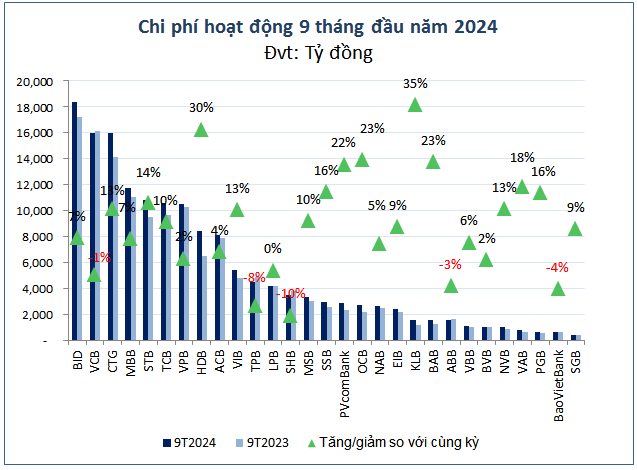

In terms of expenses, the 29 banks recorded operating expenses of VND155,879 billion and provision for credit risks of VND101,251 billion, up 8% and 12%, respectively, compared to the same period last year.

Source: VietstockFinance

|

Source: VietstockFinance

|

It can be seen that interest income has brought “sweet fruits” to the banks’ pre-tax profits, bringing in VND218,440 billion, up 16% over the same period, despite the unpromising non-interest income and persistent cost pressures.

Source: VietstockFinance

|

Thanks to the uninterrupted profit growth in the last three consecutive quarters, the two banks with the most significant profit increases in the first nine months were BVBank (nearly tripled) and LPBank (2.4 times). This result was mainly due to the contribution of interest income. LPBank also had a sudden surge in non-interest income.

Source: VietstockFinance

|

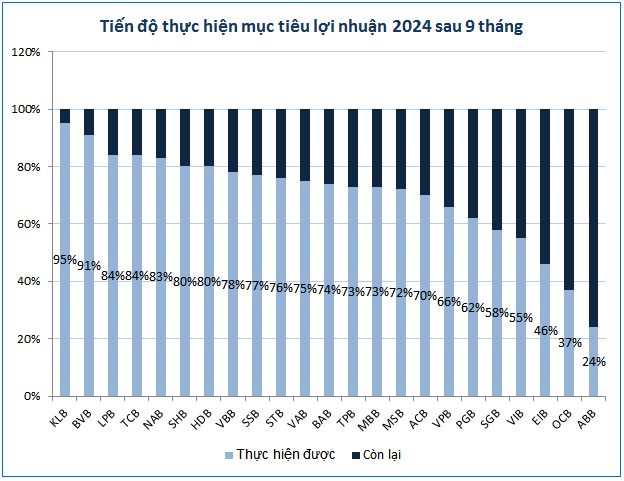

Although no bank has exceeded its plan after nine months, a few banks have achieved more than 90% of their full-year profit targets, such as KLB and BVB.

After a sluggish year, BVB stood out with a significant increase in pre-tax profit for the first nine months, the highest in the system. It is also one of the banks with a remarkably high achievement rate compared to the general level, having completed 91% of its target in just nine months, despite the ambitious profit plan with a 178% increase over the low base of 2023.

The top 3 profitable banks remain unchanged

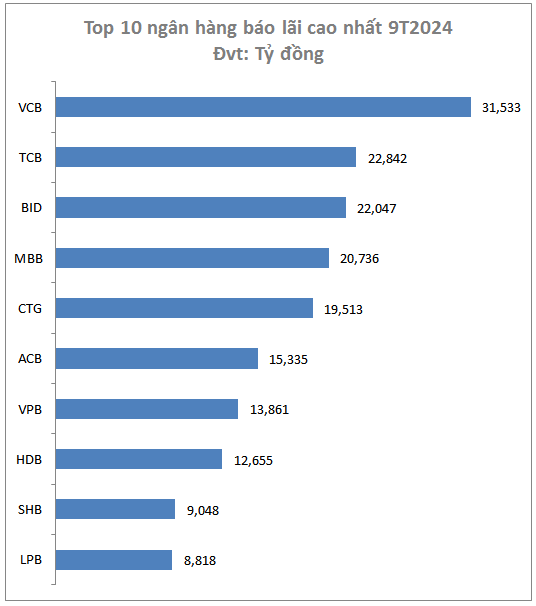

Similar to the ranking of the top 3 profitable banks in the first half of 2024, the profit ranking of the banks after the third quarter remained the same.

Vietcombank, the state-owned giant, maintained its leading position with a 7% profit increase in the first nine months, reaching VND31,533 billion.

Techcombank kept its momentum of profit growth for three consecutive quarters, firmly holding its second-place position with a profit of VND22,842 billion. Although its profit growth was slower than Techcombank, BIDV followed closely with a profit of VND22,047 billion.

Source: VietstockFinance

|

Bank profits rely on the economic recovery

KB Securities Vietnam (KBSV) believes that the economy will maintain its growth momentum in the fourth quarter of 2024, supported by various positive factors. These include robust production and business activities driven by vibrant export activities, positive FDI disbursement, and the government’s acceleration of public investment disbursement. In addition, domestic consumption is expected to recover, especially in the last months of the year, and the real estate market is also anticipated to improve with the new Land Law coming into effect, which is expected to be a new growth driver for the economy.

Sharing the same view with KBSV, Vietcombank Securities Company (VCBS) also attributes the positive outlook to thriving production and export activities, promoting public investment disbursement, especially for key projects with high spillover effects, such as infrastructure development. The recovery of the real estate market, along with increased credit growth in segments like corporate lending to the real estate and construction sectors and home loans, will further boost the overall credit growth.

“Credit demand will accelerate as the low-interest rate environment persists, stimulating borrowing needs and supporting economic recovery. Credit growth for the whole of 2024 is estimated at 12-13%. While pressure from non-performing loans remains high, it is likely to ease gradually along with the economic recovery. As a result, pre-tax profits for the entire banking industry are expected to grow by about 10% in 2024, and profit prospects among different bank groups will also vary.”, said VCBS expert.

Khang Di

The First Fiber Enterprise to Reveal 10-Month Profits

The Phu Bai Fiber Joint Stock Company (UPCoM: SPB) has announced impressive preliminary business results for the first ten months of 2024, reporting a pre-tax profit of VND 12 billion, a remarkable turnaround from the previous year’s loss of VND 43 billion during the same period.

Profitable Third Quarter for Vietnamese Giants: Vietnam Airlines Soars with Impressive Profits, While Real Estate and Textile Companies, Including Quốc Cường Gia Lai, Report Exponential Gains

Coteccons (CTD) has announced a net profit of VND 93 billion for the first quarter of the 2024-2025 fiscal year, marking a significant 39% increase from the same period last year.