Illustrative image

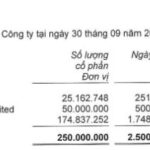

Vietnam Thuong Tin Commercial Joint Stock Bank (Vietbank – Code: VBB) announces that November 29 is the record date to exercise the right to receive dividends in shares at a rate of 25%.

Accordingly, Vietbank will issue nearly 142.8 million new shares to pay dividends to shareholders. The source of issuance comes from undistributed profit accumulated up to December 31, 2023.

After the issuance, the bank’s charter capital will increase by nearly VND 1,428 billion, to VND 7,139 billion.

According to the bank, the additional capital is expected to be used for investment in assets, supplementing capital for development and expansion of the network, ensuring compliance with safety ratios in operations and generating profits for Vietbank’s business. The expected completion time is by the end of 2024.

In terms of business results, Vietbank ended the third quarter with consolidated pre-tax profit of nearly VND 410 billion, 8.3 times higher than the same period in 2023 (VND 49.6 billion). With this result, VietBank is the bank with the highest profit growth rate in the third quarter among the 29 banks that have announced financial statements.

The most important factor contributing to Vietbank’s strong profit growth in the third quarter was net interest income. In addition to net interest income, service income also recorded a growth rate of nearly 43%, bringing in more than VND 46 billion.

For the nine months ended September 30, Vietbank’s pre-tax profit was over VND 820 billion, nearly twice as high as the same period in 2023 and reaching 78% of the yearly plan.

As of the end of September, total assets reached VND 151,957 billion, up 10% from the beginning of the year. Of which, loans to customers stood at VND 91,953 billion, up 13.9%. Customer deposits increased slightly by 1.7% to VND 91,497 billion.

At the end of the third quarter, Vietbank’s on-balance sheet bad debt was VND 3,032 billion, up 46.4% compared to the beginning of the year. In particular, substandard debt increased by 29.3% to more than VND 513 billion; doubtful debt increased by 221.7% to over VND 807 billion; and debt with potential losses increased by 20.2% to nearly VND 1,711 billion.

The rapid increase in bad debt has pushed the bad debt ratio of Vietbank from 2.56% at the beginning of the year to nearly 3.3%.

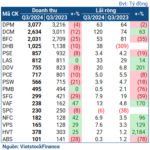

The Big Chemical Windfall: A Profitable Third Quarter

In Q3 2023, the chemical sector witnessed impressive growth across multiple entities. Conversely, the fertilizer segment, particularly businesses dealing in nitrogenous fertilizers, exhibited relative stagnation.

Is Kafei Securities Upping its Capital Raising Game to 5,000 Billion VND?

The company Kafi is seeking shareholder approval for a new proposal. From November 18 to November 28, 2024, Kafi will be soliciting written feedback from its shareholders regarding a proposed alternative to the previously approved plan. This new proposal aims to present a revised strategy that better aligns with the company’s long-term vision and goals.

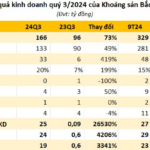

“A Company Reports a Staggering 3,300% Surge in Q3 Profits, Riding the Wave of Price Hike Frenzy”

The stock has been on a remarkable rally, with the last five trading sessions seeing gains, four of which hit the ceiling price.