Illustrative Image

In today’s trading session (November 15), the State Bank of Vietnam (SBV) increased the central exchange rate by 8 VND to a new high of 24,298 VND/USD. This is the fourth consecutive increase, with a total rise of 35 VND since the beginning of the week.

With a 5% margin, the permitted trading range for commercial banks is now between 23,083 and 25,513 VND/USD.

Meanwhile, the SBV’s Trading Center kept the buying and selling rates unchanged at 23,400 and 25,450 VND/USD, respectively.

On the interbank market, the exchange rate closed at 25,400 VND/USD on November 14, a 57 VND increase from the previous session, bringing the year-to-date rise to over 4.7%. As a result, the interbank USD rate is only 50 VND lower than the SBV’s intervention selling rate. Typically, when the interbank rate surpasses the intervention selling rate, banks begin purchasing USD from the regulator.

Previously, from the afternoon of October 24, the SBV raised the intervention selling rate at the Trading Center to 25,450 VND/USD. Simultaneously, according to market sources, the regulator notified banks of the resumption of spot foreign currency intervention sales at the rate of 25,450 VND/USD – the same rate announced by the SBV in April 2024.

At a recent National Assembly questioning session, Governor of the State Bank of Vietnam Nguyen Thi Hong acknowledged the complexities of the international money market. The US dollar has been particularly volatile, experiencing sharp declines earlier in the year before rebounding in the third quarter and currently fluctuating at high levels.

These developments, according to Ms. Hong, have influenced the domestic foreign exchange market. “Maintaining exchange rate stability is challenging because it depends on the actual supply and demand in the market, namely the amount of foreign currency injected into the economy and the sources of revenue available,” she explained.

Additionally, the foreign exchange market faces dollarization, making it susceptible to psychological expectations. In other words, organizations and enterprises with foreign currency holdings refrain from selling, and even purchase more when they don’t have an immediate need for it. This poses a challenge for regulators. Nonetheless, Ms. Hong affirmed the SBV’s commitment to a flexible and appropriate exchange rate management strategy. Currently, the exchange rate is allowed to fluctuate by +/- 5%.

“When the market experiences significant fluctuations, the State Bank will consider selling foreign currency to stabilize the market and meet the needs of the people,” the Governor assured.

On the bank-people market, commercial banks continued to push USD/VND rates closer to the ceiling in today’s morning session. As of 10:00 am, all major banks were offering selling rates of 25,512 VND/USD, just 1 VND below the permitted trading limit and the highest level in history.

USD/VND rates at banks have consistently been at or near the ceiling for over three weeks. Since the beginning of the year, the USD rate at banks has increased by approximately 1,100 VND, equivalent to a 4.4% rise. Specifically, in October and November alone, the VND has depreciated by more than 3% against the USD.

The official USD/VND exchange rate remains at a record high as the US Dollar Index (DXY), which measures the strength of the greenback against other major currencies, surged to nearly 107 points – the highest level since October 2023.

The US dollar has been on a continuous upward trajectory following Donald Trump’s decisive victory in the US presidential election, along with the Republican Party’s majority win in both the Senate and the House of Representatives.

Trump’s policies on immigration restrictions and new tariffs are expected to boost growth and inflation, reducing the likelihood of Fed interest rate cuts and strengthening the US dollar. Moreover, with Republican control of both chambers of Congress, Trump can more easily advance his agenda.

As the USD/VND exchange rate faces significant pressure from international markets and rising domestic foreign currency demand, the SBV is employing both tools – issuing bills and selling foreign currency – to curb the rate’s rise, similar to the approach taken in the second quarter and early third quarter of this year. The SBV’s interventions are expected to help rein in the rapid appreciation of the exchange rate, but they may also impact VND liquidity in the interbank market.

The Dollar Dilemma: Navigating the Currency Conundrum.

The USD/VND exchange rate has been extremely volatile, causing concern for businesses that import raw materials for production.

What Does the SBV’s Net Injection Move Mean?

The recent net injection by the SBV on November 4th is a strong move to support liquidity, especially amidst the surging USD/VND exchange rate in both the official and free markets. The SBV’s intervention sends a clear message of their commitment to stabilizing the currency market and shielding the domestic financial sector from excessive volatility.

What Does the Latest Intervention in Exchange Rates by the Authorities Tell Us?

As the US dollar to VND exchange rate continues its upward trajectory, the State Bank of Vietnam has announced its decision to sell foreign currencies on the spot market to meet market demand. This proactive move by the central bank raises questions about its timing and potential impact on cooling down the market.

“Interbank Overnight Rates Plummet as Liquidity Pressure Eases”

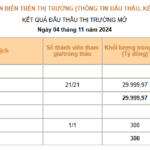

Through open market operations (OMO), the State Bank of Vietnam (SBV) injected a net amount of VND 50.55 trillion into the system last week (November 4-11, 2024), swiftly stabilizing the overnight interbank interest rate.