Illustrative image

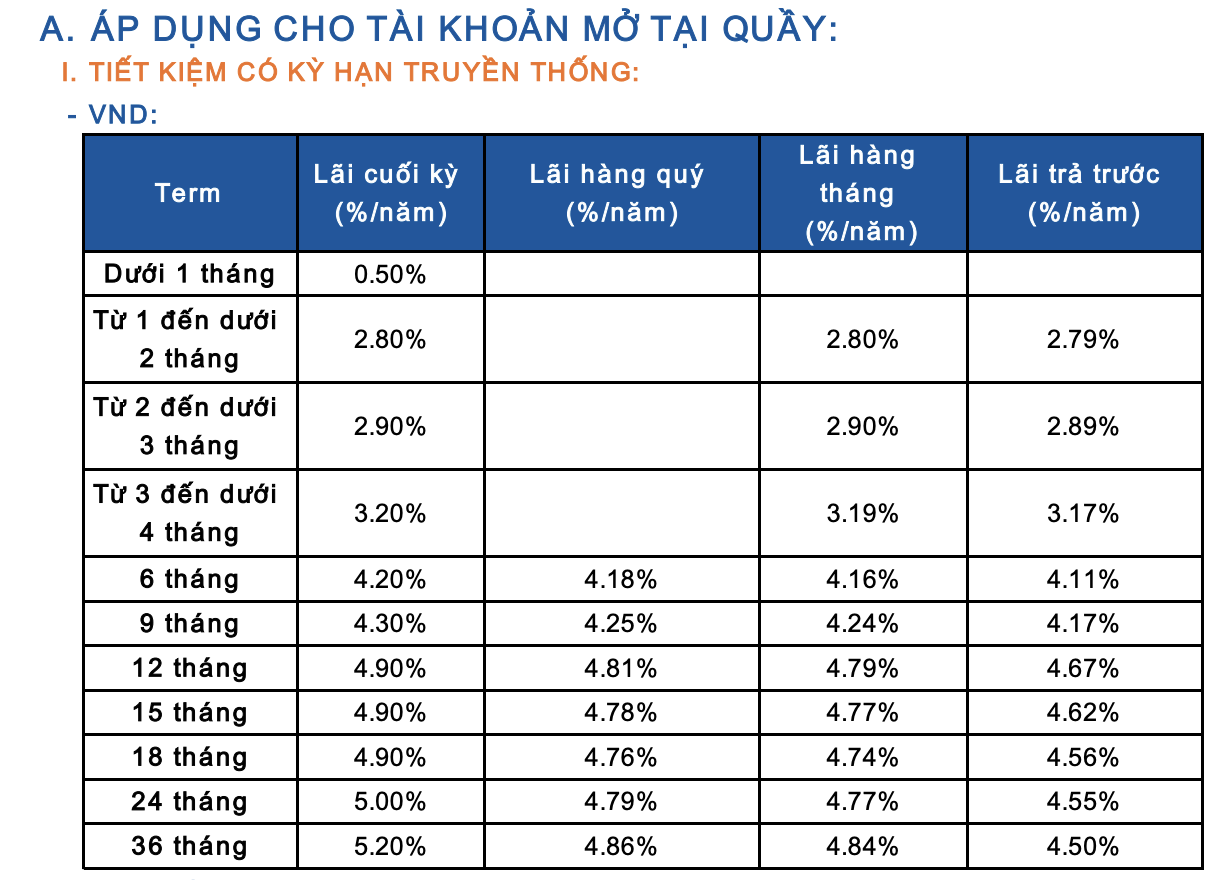

Deposit interest rates at Sacombank counter in November 2024

According to the latest survey, the savings interest rate of Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) applied to the form of depositing at the counter and receiving interest at the end of the term fluctuates in the range of 0.5 – 5.2%/year.

Specifically, the term of less than 1 month is applied with an interest rate of

0.5%/year;

the term of 1 to less than 2 months is

2.8%/year

; the term of 2 to less than 3 months is

2.9%/year

; the term of 3 to less than 4 months is

3.2%/year;

the term

6 months is

4.2%/year

; 9 months is

4.3%/year.

Sacombank lists an interest rate of 4.9%/year for the term of 12 – 18 months and 5.0%/year for the term of 24 months.

Customers depositing at Sacombank counter will receive the highest interest rate of 5.2%/year for the term of 36 months.

In addition to the end-of-term interest payment, Sacombank also offers flexible interest payment methods including quarterly interest (4.18%/year – 4.86%/year), monthly interest (2.8%/year – 4.84%/year), and advance interest (2.79%/year – 4.67%/year).

Sacombank’s deposit interest rate table at the counter in November 2024

Source: Sacombank

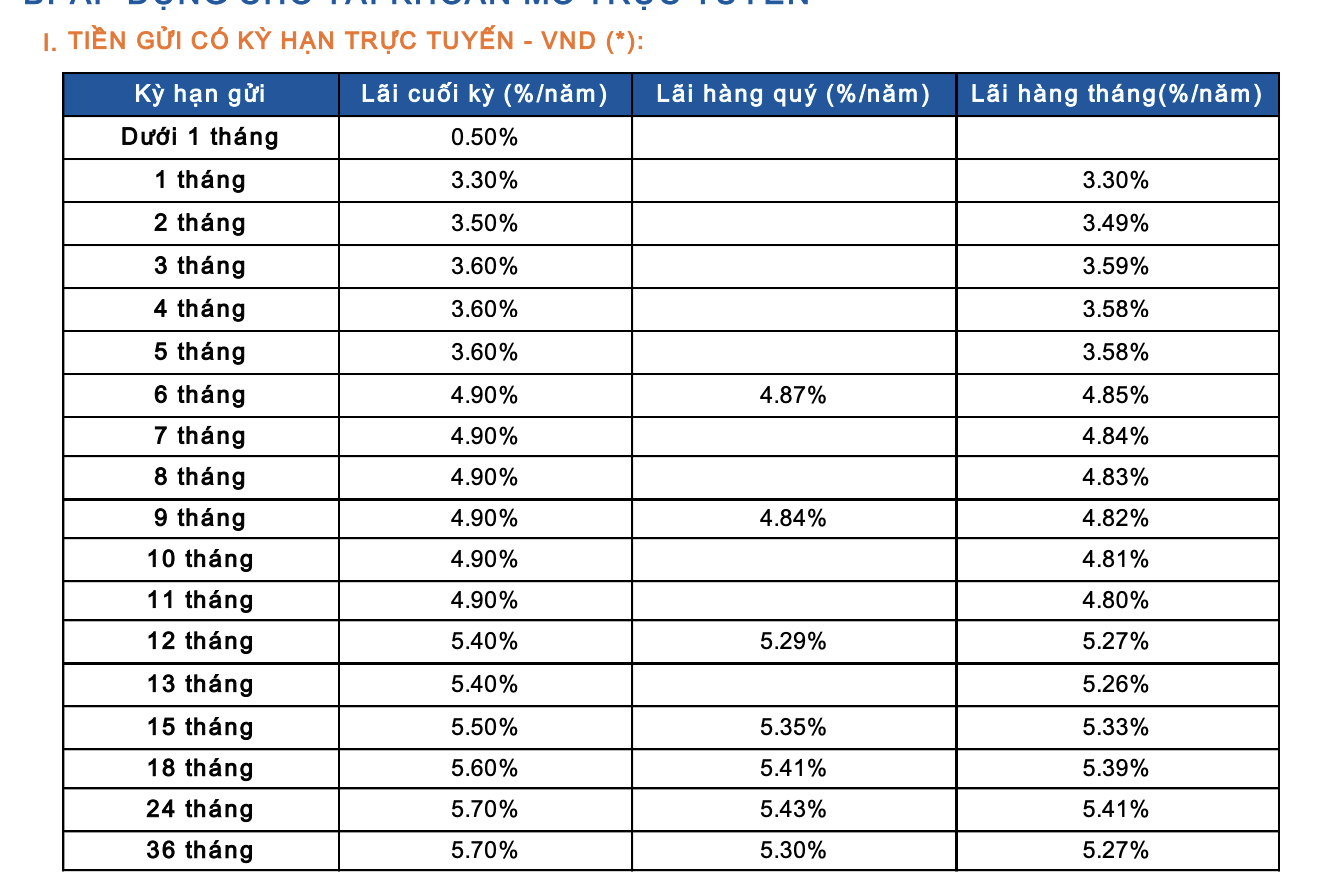

Sacombank’s online savings interest rate in November 2024

For online deposits and end-of-term interest payments, the deposit interest rate applied by Sacombank ranges from 0.5 – 5.7%/year, which is 0.4 – 0.7%/year higher than the counter deposit method.

Specifically, the online deposit term of less than 1 month has an interest rate of

0.5%/year

; the interest rate applied for the term of 1 month is

3.3%/year

; the term of 2 months is

3.5%/year

; the term of 3 – 5 months has an interest rate of

3.6%/year

;

The savings interest rate for the term of 6 – 11 months is

4.9%/year

; 12 – 13 months is

5.4%/year

; 15 months is

5.5%/year

, 18 months is

5.6%/year

;

Sacombank applies the highest savings interest rate of

5.7%/year

for the term of 24-36 months.

Sacombank’s online deposit interest rate table in November 2024

Source: Sacombank

Note that the above interest rates are for reference only and may change over time and depending on market conditions. Customers should contact the nearest Sacombank branch for detailed information.

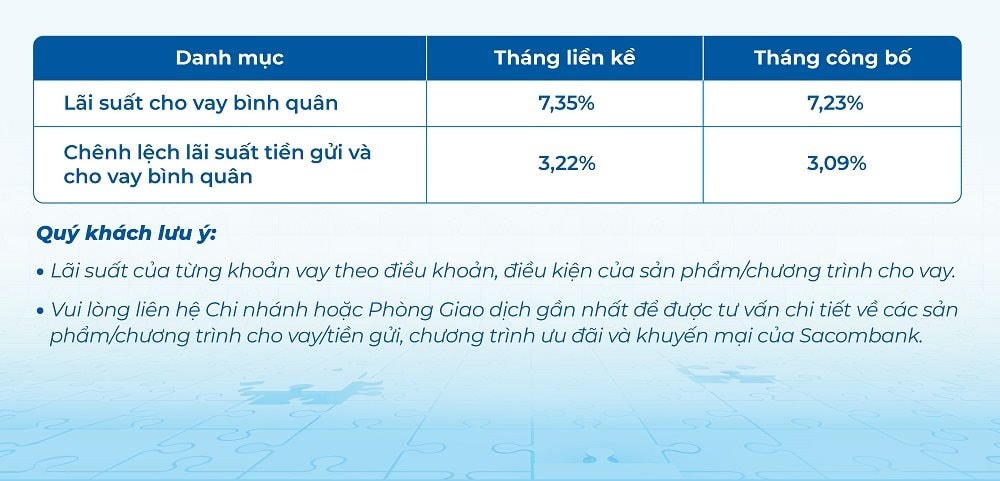

Sacombank’s latest lending interest rate

Sacombank announces the average interest rate of new loans disbursed in October 2024 at

7.23%/year

with an average interest rate differential of

3.09%/year

. Previously, the average lending interest rate at Sacombank in September 2024 was 7.35%/year and the average interest rate differential between deposits and loans was 3.22%/year.

Note that this is the bank’s average lending interest rate, not the interest rate applied to a specific loan. Customers can contact the nearest Branch or Transaction Office for advice and more detailed information about Sacombank’s credit programs and promotions.

The Year-End Interest Rate Crunch

The end of the year always brings a surge in demand for capital, especially for businesses and individuals seeking funds to expand production, stock up for the Lunar New Year, and meet festive consumer demands. In response, commercial banks have started to increase deposit interest rates to secure stable funding.

Latest Savings and Loan Interest Rates at TPBank: How High Can They Go?

With an impressive 5.7% annual interest rate, TPBank offers an attractive deal for those looking to save over a 36-month period. This rate applies to standard deposits and shines as an appealing option for those seeking steady, long-term financial growth. Additionally, TPBank has announced a base lending rate of 8.4% for personal loans with a 12-month tenure, providing customers with a competitive and accessible opportunity to borrow funds for their short-term financial needs.

The Rising Interest Rate Trend: A Boon for Depositors

Deposit interest rates have seen an upward trend across various banks, with increments ranging from 0.1% to 1.3%, depending on the tenure and the financial institution. Notably, some banks are now offering rates surpassing the 6% per annum mark, an enticing prospect for potential depositors.