This is also the highest level ever. Deposits of economic organizations have improved, reaching over VND 6,830 trillion by the end of August 2024 (over VND 6,760 trillion in July). Compared to the end of 2023, deposits of economic organizations decreased slightly by 0.05%. It can be seen that the money deposited by economic organizations is tending to return to the banking system since the second quarter of 2024. From the end of July to the end of August alone, economic organizations deposited nearly VND 70,000 billion into banks. The total amount of deposits from both households and economic organizations reached a record high of over VND 13,750 trillion by the end of August. This is the highest level ever.

Saving is still a safe investment channel

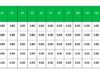

One of the main reasons why savings channels have become more attractive, and the amount of money deposited in banks has increased consecutively in the past time, is the increase in deposit interest rates. For example, Viet A Bank recently announced an increase in savings interest rates for all terms from November 13, 2024. The interest rates for terms of 1-8 months increased from 0.3-0.4% per year, ranging from 3.7% to 5.2% per year. Meanwhile, the interest rate for the 9-11-month term increased by 0.6% to 5.4% per year. MB has also officially increased deposit interest rates for many short-term deposit terms of 1-4 months, with an increase of 0.2% per year. Since the beginning of November, in addition to the two aforementioned banks, four other banks have also adjusted their savings interest rates, including VIB, Techcombank, ABBank, and VietBank. Compared to the beginning of 2024, deposit interest rates for many terms at banks have increased from 0.5% to 1% per year, making savings channels even more attractive.

In addition to attractive interest rates, another reason why savings channels are attracting customers instead of other investment channels is capital preservation. Currently, all investment channels entail certain risks. For gold, people are also very cautious after the gold price dropped sharply by almost VND 10 million per tael within a few days. The real estate market has improved, but liquidity remains low. Moreover, this investment channel requires a large amount of capital, so it is not suitable for most people.

Similarly, the stock market has not been able to break through the threshold of 1,300 points and is facing a liquidity crisis, with fluctuating scores making many investors wary. Corporate bonds have improved, but people’s faith in this investment channel remains low, so it is still gloomy. “In an uncertain economic context, with investment channels entailing risks, money will choose to return to banks to wait for better investment opportunities in the future. Especially with the increase in savings interest rates, this is a safe choice for idle money,” said an expert.

Anh Ngoc, an investor, shared that in the stock market, money is very important. When there is a significant decline in money flow, the opportunity to invest for profit is not high, while the risk is significant. Therefore, he has sold all his stocks temporarily and put the money in savings to ensure capital safety while still making a profit. He will return to investing when the stock prices are more discounted. This is a common choice of many small investors today as other investment channels still entail many risks.

With the strong fluctuations in the stock market and weak liquidity, in the opinion of Prof. Dr. Nguyen Huu Huan from Ho Chi Minh City University of Economics, it is difficult for investors to make profits, and they even face the risk of losing capital. In contrast, the increase in savings interest rates creates additional attraction, helping them feel secure in retaining their capital.

In the last months of 2024, many financial experts opined that investors should prioritize holding a high proportion of highly liquid assets such as cash and bank deposits. This is especially true given the forecasts and realities that many banks are adjusting savings interest rates for short and medium-term terms to attract capital to ensure sufficient credit supply for the production and investment activities of customers in the last months of the year, as well as to maintain stable liquidity.

According to VDSC, it is necessary to increase the input interest rates to maintain stable liquidity in the context of increasing capital demand from businesses at the end of the year. This also shows the flexibility of banks in ensuring capital sources to serve the economy while maintaining the safety and liquidity of the system.

The Year-End Interest Rate Crunch

The end of the year always brings a surge in demand for capital, especially for businesses and individuals seeking funds to expand production, stock up for the Lunar New Year, and meet festive consumer demands. In response, commercial banks have started to increase deposit interest rates to secure stable funding.

What Does the SBV’s Net Injection Move Mean?

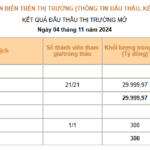

The recent net injection by the SBV on November 4th is a strong move to support liquidity, especially amidst the surging USD/VND exchange rate in both the official and free markets. The SBV’s intervention sends a clear message of their commitment to stabilizing the currency market and shielding the domestic financial sector from excessive volatility.