Vietnam’s Top 15 Banks: A Snapshot of the Country’s Most Trusted and Best-Performing Financial Institutions

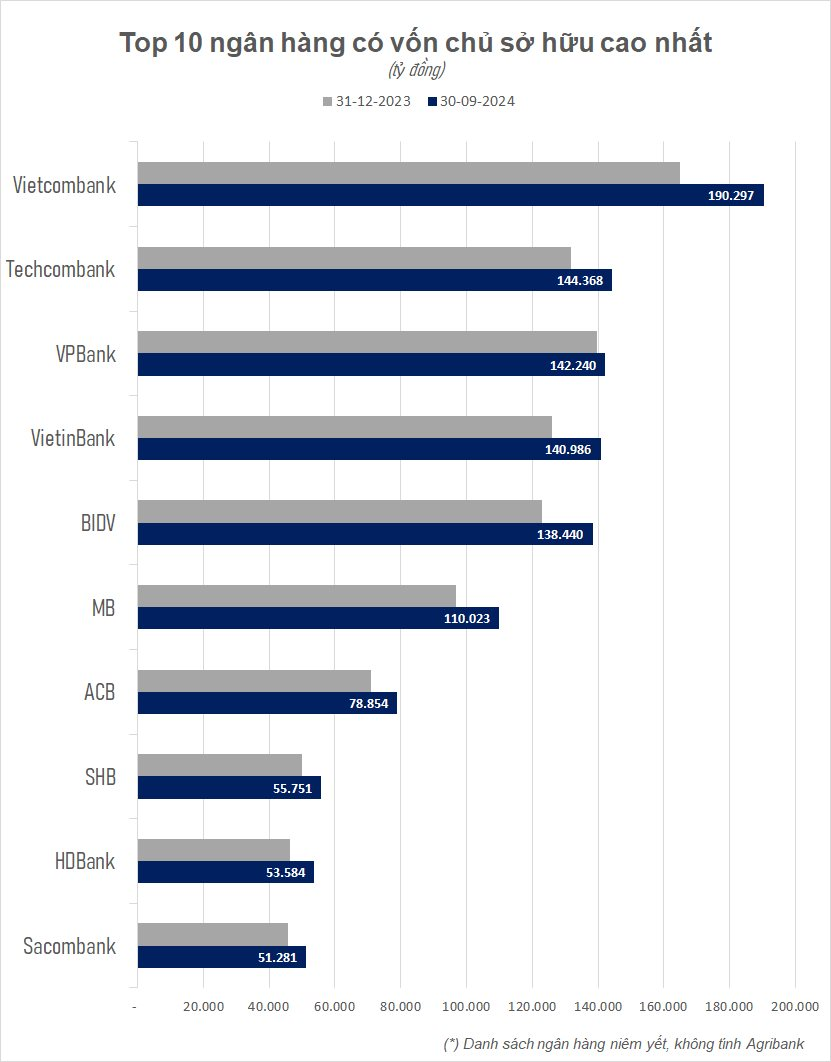

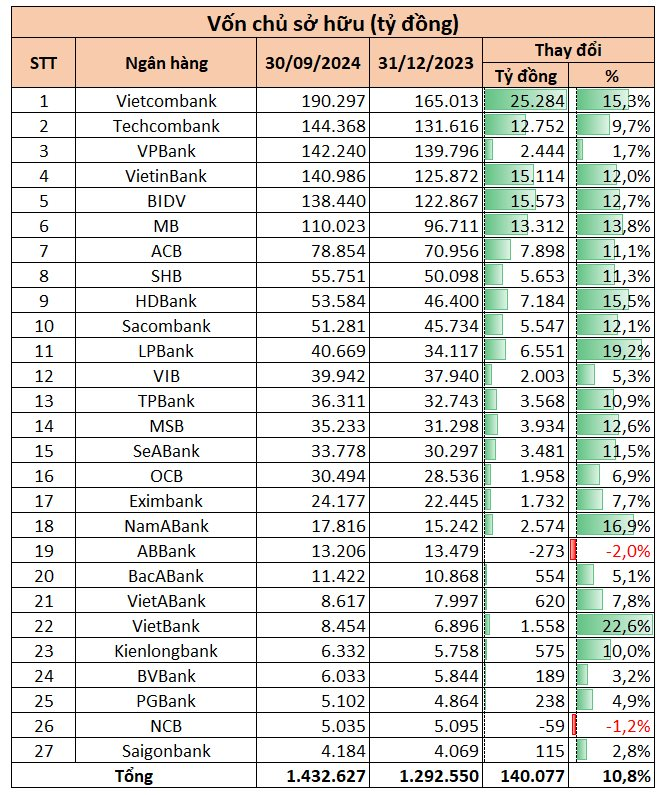

As per the consolidated financial report for Q3 2024, the combined owner’s equity of 27 banks listed on the stock exchange reached nearly VND 1,433 million billion by the end of September, marking an increase of over VND 140,000 billion, or 10.8%, compared to the end of 2023. Among these institutions, almost all witnessed a surge in owner’s equity during the first nine months of 2024.

Leading the pack is Vietcombank, boasting an owner’s equity of VND 190,297 billion, reflecting a notable surge of VND 25,284 billion from the previous year. Vietcombank’s robust expansion in owner’s equity can be attributed to its top position in the industry in terms of profitability. The bank reported an after-tax profit of VND 25,283 billion, indicating a 7% year-over-year increase. Specifically, in Q3 alone, Vietcombank’s after-tax profit neared VND 8,600 billion, marking a rise of nearly 18%.

Vietcombank consistently maintains its leading position in the industry in terms of owner’s equity, which can be ascribed to its exceptional profitability. Additionally, the bank has refrained from distributing cash dividends in recent years, opting instead to reinvest profits to bolster its capital foundation and support its business operations.

With an after-tax profit of approximately VND 9,000 billion per quarter and a strategy of not paying cash dividends, Vietcombank is on track to reach the milestone of VND 200,000 billion in owner’s equity by the end of 2024 or early 2025.

Techcombank assumes the second position in the industry with an owner’s equity of VND 144,368 billion as of September 30, 2024, reflecting a substantial increase of VND 12,752 billion compared to the previous year. Following closely behind Vietcombank, Techcombank stands as the second most profitable bank in the industry and the frontrunner among private banks.

It is worth noting that Techcombank has consistently retained its entire profits since its listing on the stock exchange, only commencing cash dividend payments in 2024. This strategic decision has resulted in the continuous expansion of the bank’s owner’s equity over the years, surpassing even the state-owned giants VietinBank and BIDV.

VPBank currently occupies the third position, with an owner’s equity of VND 142,240 billion. In 2024, the bank distributed over VND 7,900 billion in cash dividends to its shareholders, causing a noticeable slowdown in the growth of its owner’s equity.

This marks the second consecutive year that VPBank has opted for cash dividend payments, having already accomplished its capital augmentation plans and fortified its financial foundation to facilitate future development. During last year’s annual general meeting of shareholders, the Chairman of VPBank’s Board of Directors, Mr. Ngo Chi Dung, pledged that the bank would continue distributing cash dividends for the next five years.

During the first nine months of the year, VietinBank witnessed a substantial increase in its owner’s equity, climbing from VND 125,872 billion to VND 140,986 billion. This impressive growth can be attributed to the bank’s after-tax profit of VND 15,114 billion. Similar to Vietcombank, VietinBank currently has no plans to distribute cash dividends, choosing instead to retain its profits. As a result, the bank’s owner’s equity is expected to continue its upward trajectory in the foreseeable future.

Another prominent bank that secured a spot in the top five banks with the largest owner’s equity on the stock exchange is BIDV. As of September 30, BIDV’s owner’s equity stood at VND 138,440 billion, reflecting a significant increase of VND 15,573 billion compared to the end of 2023.

BIDV is one of the cornerstone banks in Vietnam’s financial system, boasting the largest asset size in the industry. The bank focuses on financing large-scale projects, particularly in the energy and transportation sectors, which provides a stable and long-term source of revenue, thereby sustaining its profit growth.

Furthermore, BIDV has no immediate plans to distribute cash dividends and has proposed retaining all profits to augment its charter capital. Should this proposal receive approval from the relevant authorities, the bank’s owner’s equity is poised for a substantial boost in the upcoming period, effectively catering to the capital requirements for its business operations.

As of the end of Q3, MB‘s owner’s equity reached VND 110,023 billion, marking a considerable increase from the VND 96,711 billion recorded at the end of 2023. Notably, MB’s owner’s equity surpassed the VND 100,000 billion threshold in Q2, despite distributing over VND 2,600 billion in cash dividends at a rate of 5%.

Source: Consolidated Financial Statements for Q3 of the Banks

Rounding out the top ten banks with the largest owner’s equity on the stock exchange are familiar names such as ACB (VND 78,854 billion), SHB (VND 55,751 billion), HDBank (VND 53,584 billion), and Sacombank (VND 51,281 billion).

Notably, HDBank stands out as the bank with the fastest growth rate in owner’s equity within the top ten, achieving an impressive 15.5% increase, equivalent to nearly VND 7,184 billion. This expansion is even more remarkable considering that HDBank distributed over VND 2,900 billion in cash dividends to its shareholders. The bank’s outstanding performance can be attributed to its profit growth of nearly 47% during the first nine months of the year, amounting to VND 12,655 billion.

On the opposite end of the spectrum, the banks with the lowest owner’s equity in the industry at present are PGBank (VND 5,102 billion), NCB (VND 5,035 billion), and Saigonbank (VND 4,184 billion). These institutions also possess the smallest asset sizes in the industry.

When examining the growth rate of owner’s equity, VietBank, LPBank, and Nam A Bank emerge as the frontrunners during the first nine months of the year. This trio of banks also recorded the most substantial profit growth in the industry within the same period. Conversely, ABBank and NCB were the only banks that experienced a decline in owner’s equity compared to the previous year.

Owner’s equity not only serves as a barometer of financial health but also sheds light on the dividend distribution strategies employed by banks. Overall, the steady expansion of owner’s equity across the industry underscores the concerted efforts of banks to bolster their financial foundations and enhance their resilience in the face of economic fluctuations. These robust fundamentals position Vietnam’s banking sector for sustained growth and resilience in the years ahead.

VietinBank: Leading the Pack in Operational Income

As per the Q3 2024 financial statements, VietinBank has emerged as a leader in Vietnam’s banking industry, boasting top-tier figures in terms of operating income and pre-provision profit from business operations. This remarkable performance underscores the bank’s adeptness in leveraging its earning assets to generate robust revenue and profits.

The Power of Compounding: Maximizing Your BIDV Savings Account Interest in November 2024

In November, BIDV offered an impressive 4.9% annual interest rate on online deposits for personal customers with a tenure of 24 to 36 months. This highly competitive rate showcases BIDV’s commitment to rewarding its customers with attractive returns on their savings. With this offer, customers can rest assured that their money is not only secure but also growing at a remarkable rate during this period.