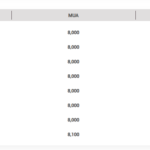

According to statistics, 12 out of 29 banks reported an increase in total net foreign exchange profits in the first nine months. The total net profit from foreign exchange operations of the 29 banks that have published financial statements amounted to VND 19,621 billion, up 7% over the same period.

After nine months, BIDV maintained its leading position in the rankings, surpassing Vietcombank in Q1/2024 with a net profit of VND 3,923 billion, up 25% over the same period.

Agribank has not yet published its Q3 financial report. However, in the first half of the year, Agribank recorded a net profit of VND 2,029 billion from foreign exchange operations, a growth of 60%.

Among the joint-stock banks, MB took the lead with a net profit of VND 1,516 billion from foreign exchange operations, achieving a growth rate of 65%; Techcombank’s profit was VND 1,017 billion.

Many banks reported double-digit growth in net profits from foreign exchange operations.

In terms of growth rate, VietABank continues to be the bank with the highest industry-wide growth rate in net profit from foreign exchange operations, up 290% over the same period, earning VND 12 billion. This was followed by HDBank, which made VND 609 billion from foreign exchange operations.

Many banks also achieved double-digit growth in net profits from foreign exchange operations, including BVBank (82%), SeABank (57%), and VIB (49%).

This afternoon (November 14), the State Bank of Vietnam set the daily reference exchange rate at 24,290 VND/USD, up 2 VND from the previous day. The exchange rates of commercial banks were also adjusted upwards and continued to be maintained at the ceiling level. Specifically, Vietcombank’s buying rate was 25,184 VND and the selling rate was 25,504 VND; Vietinbank’s buying rate was 25,190 VND, and the selling rate was 25,504 VND.

Since the beginning of the year, the USD price at banks has increased by about 1,100 VND, or 4.4%.

In the context of the selling price touching the allowed limit, some banks have increased the buying price more than the selling price. Typically, when the exchange rate increases, the buying-selling spread also increases to compensate for risks. Reducing the buying-selling spread will expose banks to more risks and indicates that exchange rate pressure remains intense.

Nevertheless, the buying-selling spread at banks remains at 300-360 VND, much higher than that of foreign currency exchange shops in the free market (only about 100 VND).

In the current context, the State Bank of Vietnam continues to flexibly manage the open market to stabilize the exchange rate while ensuring liquidity for the system.

The Dynamic Duo: Unveiling the Power of Nhất Việt Securities’ New Board

On November 11th, the Board of Directors of VFS Joint Stock Company (HNX: VFS) passed two resolutions to establish the Procurement and Expenses Council and the Investment and Capital Council for the term 2024-2029. Key roles within these councils are held predominantly by the newly appointed members of the Board of Directors, who joined in April 2024.

The Master Dealer’s New “Game”: Taking the MG Car-Selling Subsidiary Public

PTM is currently the distributor of MG motor vehicles for Haxaco, with a nationwide network of 7 dealerships.

Who is the Woman Behind the 6-Month-Old Enterprise That Just Invested 300 Billion VND in VIB?

Quang Kim Investment and Development JSC, established on May 23, 2024, purchased 17.2 million VIB shares during the November 11 trading session. This substantial acquisition elevated the company’s holdings, along with those of its affiliated shareholder group, to a notable 9.836% stake in the bank’s capital. The legal representative of Quang Kim Investment and Development JSC is Ms. Do Xuan Ha, the sister of Mr. Do Xuan Hoang, who serves as a member of the board of directors of VIB Bank.

The Year-End Interest Rate Crunch

The end of the year always brings a surge in demand for capital, especially for businesses and individuals seeking funds to expand production, stock up for the Lunar New Year, and meet festive consumer demands. In response, commercial banks have started to increase deposit interest rates to secure stable funding.