At the talk show “Owning Social Housing from Dream to Reality” hosted by Hoang Quan Group, Dr. Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokers Association, shared that compared to the past, investment procedures for social housing have been greatly streamlined. In addition to removing barriers for investors, commercial banks have also joined with a preferential credit package of VND 120,000 billion.

In the long run, the state still needs to play a dominant role in developing social housing, from land allocation, loan sources to simplifying procedures for buyers. In that case, enterprises will only act as “contractors” hired to develop this type of housing.

To successfully implement the project “Investing in the construction of at least 1 million social housing units for low-income people and industrial park workers in the period of 2021-2030”, according to economic expert Can Van Luc, it requires the joint effort of four stakeholders: the state, banks, investors, and households.

Specifically, the state needs to concretize planning, allocate land, complete social infrastructure, and accurately determine the demand for social housing in each area. Banks should provide preferential capital. Investors need to prepare capital and ecosystems to optimize investment processes and control the quality of projects. Buyers should save money and apply appropriate financial leverage.

Experts and enterprises discuss the project of 1 million social housing units.

Mr. Ha Quang Hung, Deputy Director of the Housing and Real Estate Market Management Department (Ministry of Construction), shared that the social housing policy for low-income earners is supported by the state indirectly through investors and directly to buyers. The current social housing development policies have addressed bottlenecks compared to the past, such as expanding the beneficiary group and relaxing residency and income conditions.

At the event, Dr. Truong Anh Tuan, Chairman of the Board of Hoang Quan Group, a company with over 20 years of experience in developing social housing, shared that there are three factors for people to be able to buy social housing: mechanisms and policies, capital sources, and monthly savings. According to Mr. Tuan, social housing has never been better supported by the state than it is now. Social housing prices are only 20% of commercial housing prices. Currently, buyers can borrow at a preferential interest rate of 6.6%/year.

At the event, Hoang Quan Group also introduced Hoang Quan Land, the main distributor of diverse real estate projects, including social housing, commercial housing, and industrial parks. Hoang Quan Land aims to help realize the dream of social housing ownership for millions of Vietnamese people.

Hoang Quan Land not only undertakes the distribution of Hoang Quan Group’s social housing projects in Ho Chi Minh City, such as HQC Plaza, HQC Binh Trung Dong, HOF-HQC Ho Hoc Lam, and HQC Hoc Mon, but also collaborates with other enterprises by signing cooperation agreements with partners to provide a quality supply of social housing projects.

Sharing insights on the VND 120,000 billion preferential credit package for social housing, Mr. Tran Hoang Nam, Head of Real Estate at the University of Economics and Finance in Ho Chi Minh City, said that the package has now increased to VND 145,000 billion with the participation of nine banks. From July 1 to the end of this year, the interest rate for social housing buyers under this credit package is 6.5%/year. According to Mr. Nam, this interest rate is still quite high. However, in addition to this credit package, buyers can also access capital from the lending program of the Social Policy Bank.

Regarding the interest rate for social housing loans through the Social Policy Bank, Mr. Luc said that the rate used to be 4.8%/year and is now 6.5%/year. In contrast, the interest rate for lending to poor households has been 6.6%/year since 2015. To reduce the interest rate for social housing borrowers, Mr. Luc suggested that the government and the State Bank review and consider reducing the interest rate for poor households first, which would be more reasonable.

The Forex Floor: A Buzzing Hub of Trading Action

The volatile gold prices and the lackluster stock market have prompted a shift in investment strategies. Many are now turning to international gold and forex markets, seeking new opportunities to deploy their capital.

“Lucrative Seafood Enterprise: A Tasty Dividend Treat”

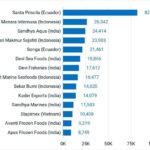

As the largest and most profitable shrimp company in the industry, it is also the only Vietnamese representative in the Top 15 shrimp suppliers in the US for 2023.