I. MARKET ANALYSIS OF NOVEMBER 5, 2024

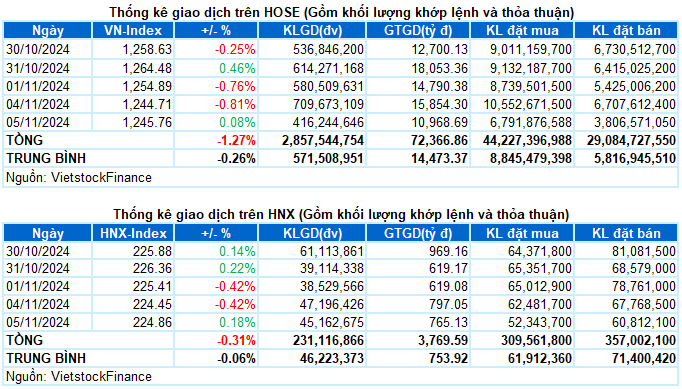

– The main indices edged higher on November 5. The VN-Index closed up 0.08% at 1,245.76; HNX-Index reached 224.86, up 0.18% from the previous session.

– Matching volume on the HOSE reached nearly 333 million units, down 43.5% compared to the previous session. Matching volume on the HNX decreased by 26.2%, reaching nearly 27 million units.

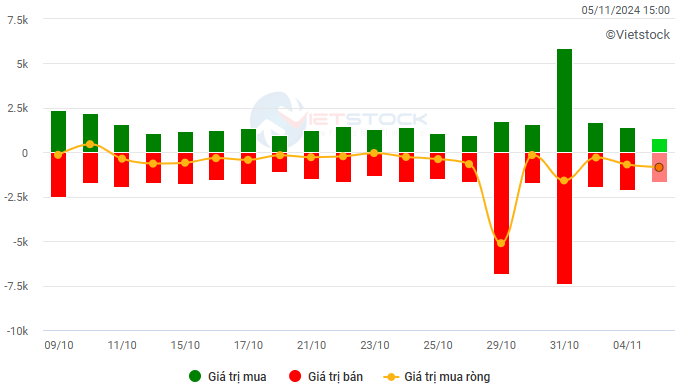

– Foreign investors net sold on the HOSE with a value of nearly VND 833 billion and net sold more than VND 17 billion on the HNX.

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

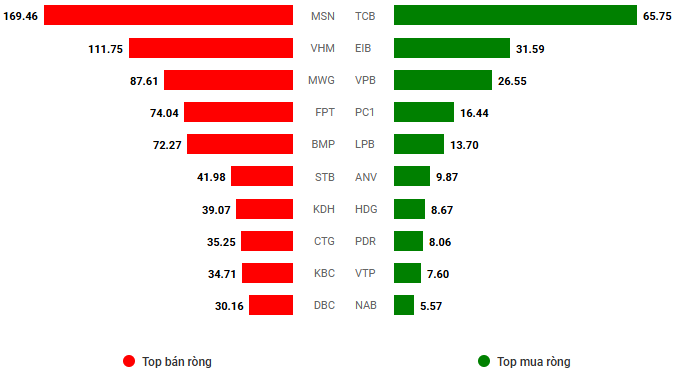

Net trading value by stock code. Unit: VND billion

– The two recent sharp declines have raised caution, and market liquidity was very subdued on November 5. Although the index fell to the old bottom, buyers still did not show any significant moves, and the VN-Index fluctuated within a narrow range throughout the morning session. In the afternoon session, a few pillar stocks unexpectedly surged, helping the index quickly gain more than 4 points. However, this positive momentum was not sustained, and sellers once again pulled the index back to a stalemate around the reference level. At the close, the VN-Index edged up more than 1 point, or 0.08%, to 1,245.76 points.

– In terms of impact, HVN, GVR, and HPG were the stocks that had the most positive impact on the VN-Index today, helping the index gain more than 1.5 points. On the contrary, CTG, BID, and GAS exerted the most significant pressure, taking away nearly 1.5 points from the VN-Index.

– The VN30-Index closed up 0.05% at 1,313.35. The basket had a balanced breadth with 11 gainers, 9 losers, and 10 stocks closing unchanged. Among them, GVR led with a standout gain of 1.7%, while CTG was the most dominated by selling pressure, finishing at the bottom with a 1.8% decline. The remaining stocks fluctuated slightly around the reference level.

In terms of sectors, on the upside, telecoms continued to shine, surging nearly 3% led by VGI (+4.01%), FOX (+1.13%), and CTR (+0.4%). This was followed by materials and industrials, which also attracted positive buying interest. Bright green colors were visible in GVR (+1.74%), HPG (+0.76%), NTP (+1.07%); VEA (+1.8%), HVN (+5.56%), VTP (+4.47%), TMS (+1.82%), HAH (+0.92%), and SGP (+2.18%).

On the flip side, IT, utilities, financials, and healthcare were dominated by red colors, but the declines were not significant. In the financial group, the stocks that recorded notable declines were CTG (-1.82%), OCB (-1.38%), VIX (-1.4%), TVS (-2.76%), BIC (-1.82%), and APS (-1.49%). On the other hand, no fewer stocks still posted positive gains, such as EIB (+3.21%), PGI (+3.22%), TVB (+2.69%), CSI (+2.25%), PTI (+1.69%), etc.

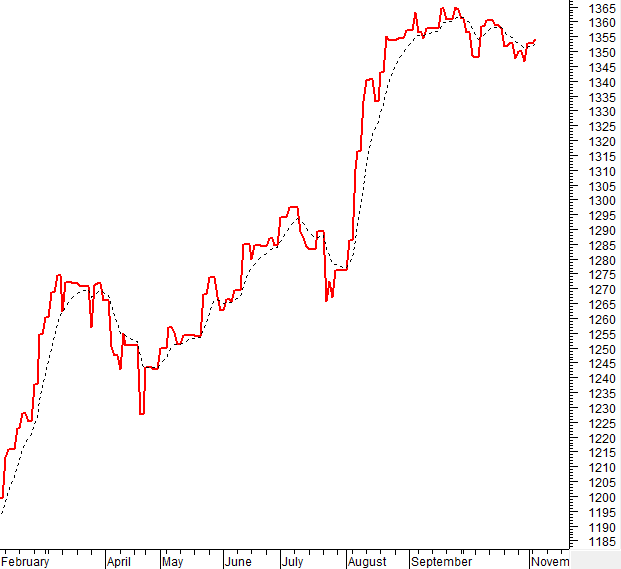

The VN-Index rebounded with a slight gain, coupled with a sharp drop in trading volume below the 20-day average. This indicates that investor sentiment remains cautious after the recent declines. Currently, the Stochastic Oscillator and MACD indicators continue to decline after giving sell signals. This suggests that the short-term outlook remains uncertain.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Stochastic Oscillator and MACD indicators continue to give sell signals

The VN-Index rebounded with a slight gain, coupled with a sharp drop in trading volume below the 20-day average. This indicates that investor sentiment remains cautious after the recent declines.

Currently, the Stochastic Oscillator and MACD indicators continue to decline after giving sell signals. This suggests that the short-term outlook remains uncertain.

HNX-Index – Trading volume remains below the 20-day average

The HNX-Index advanced amid trading volume continuing to stay below the 20-day average. In the coming sessions, liquidity needs to improve for the index to sustain its upward momentum.

At present, the Stochastic Oscillator indicator has given a buy signal after exiting the oversold zone. If the MACD indicator also gives a similar signal in the coming sessions, the short-term outlook will be less pessimistic.

Analysis of Capital Flows

Changes in Smart Money Flows: The Negative Volume Index indicator of the VN-Index cut up above the EMA 20-day moving average. If this state continues in the next session, the risk of a sudden drop (thrust down) will be limited.

Changes in Foreign Capital Flows: Foreign investors continued to net sell in the November 5 session. If foreign investors maintain this action in the coming sessions, the situation will become more pessimistic.

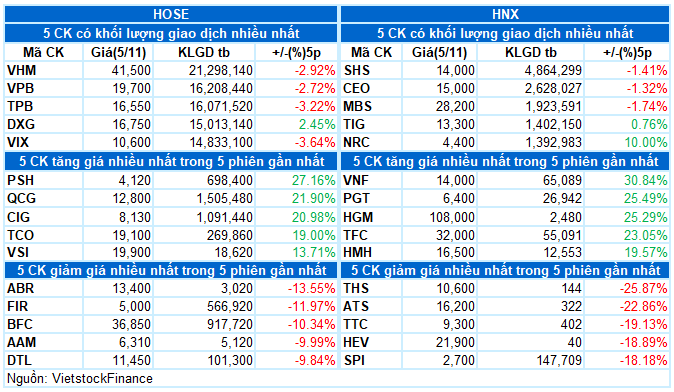

III. MARKET STATISTICS FOR NOVEMBER 5, 2024

Economic and Market Strategy Division, Vietstock Consulting

The Vietstock Daily: Navigating a Sea of Negative Signals

The VN-Index witnessed a significant decline, forming a bearish Black Marubozu candlestick pattern, while trading volume surpassed the 20-session average, indicating a prevailing pessimistic sentiment among investors.

The Gloomy Sentiment Subsides

The VN-Index edged higher and rebounded after a recent streak of losses. Accompanying this rebound was a trading volume that surpassed the 20-day average, reflecting a relatively optimistic sentiment among investors. However, the Stochastic Oscillator has signaled a resumption of selling, and the MACD indicator is conveying a similar message. This suggests that the short-term outlook remains pessimistic.

The Beat of the Market: Investors Sell-Off with a Wave of Pessimism

The market closed with the VN-Index down 13.32 points (1.08%), settling at 1,218.57; the HNX-Index also ended below the reference level at 221.53 points. The market breadth tilted towards sellers, with 546 declining stocks against 193 advancing ones. The VN30-Index basket was mostly red, recording 26 losses, 3 gains, and 1 stock referencing.

The Market Beat: Green Wave Extends, VN-Index Recovers Over 15 Points

The market closed with strong gains, seeing the VN-Index surge by 1.25% to 1,261.28; a substantial increase of 15.52 points. Meanwhile, the HNX-Index also witnessed a healthy boost, rising by 1.29% to 227.76, an increase of 2.9 points. The market breadth tilted heavily in favor of bulls, with 536 tickers advancing against 147 declining names. The large-cap basket, VN30, painted a similar picture, with 29 constituents climbing and only 1 remaining unchanged.