VIB Earns $6.6 Trillion in Profits in the First Nine Months

Vietnam International Commercial Joint Stock Bank (VIB) has announced its business results, with pre-tax profits of $6.6 trillion in the first nine months, a 21% decrease compared to the same period last year. The return on equity (ROE) reached approximately 19%.

Estimated pre-tax profits for the third quarter of VIB reached $199.7 billion, a 26% decrease compared to the same period in 2023.

In the first nine months, VIB’s total revenue was $15.3 trillion, with net interest income decreasing by 9% year-on-year.

In addition to lending activities, VIB’s non-interest income for the first nine months reached $350 billion, a 5% increase, contributing to 23% of the bank’s total revenue. Notably, income from written-off debt recovery exceeded $750 billion, more than doubling compared to the same period last year; foreign exchange activities also contributed over $450 billion in income, a 49% increase. Fee income reached $2.1 trillion, with credit cards and insurance as the main products.

The bank’s operating expenses increased by 13% year-on-year due to investments in human resources, branch expansion, technology, digital banking, and marketing. The cost-to-income ratio (CIR) temporarily rose to 36%.

In the first nine months, VIB set aside $3.23 trillion in provisions, a 2% increase. With improving asset quality, provisions in the third quarter decreased by more than 25% compared to the same period last year. As of September 30, 2024, VIB’s non-performing loan ratio was 2.67%.

As of September 30, 2024, VIB’s total assets exceeded $44.5 trillion, a 9% increase from the beginning of the year. Credit balance exceeded $29.8 trillion, a nearly 12% increase from the beginning of the year, higher than the industry average of 9%. Notably, in the third quarter alone, VIB’s credit growth reached nearly 7%, and it was one of the best-performing retail banks in terms of credit growth. Capital mobilization increased by 8%.

SeABank’s Nine-Month Profit Grows by 43%

The Southeast Asia Commercial Joint Stock Bank (SeABank) has announced its nine-month business results, with pre-tax profits of $4.508 trillion, an increase of $1.352 trillion, or 43%, compared to the same period in 2023. Total gross income (TOI) reached $9.19 trillion, a 39.56% increase year-on-year; net operating income outside interest (NOII) reached $1.65 trillion; net interest income (NII) accounted for the majority, reaching $7.541 trillion. The NIM ratio remained stable and increased slightly to 3.94%, a nearly 1% increase compared to the same period last year, despite a decrease in average lending rates, which have only recently started to rise since the end of July 2024.

At the end of the nine-month period, SeABank’s total outstanding loans to customers reached $19.689 trillion; total assets increased by $22.396 trillion compared to 2023, reaching $28.8518 trillion.

As of September 30, 2024, SeABank’s total mobilizations from domestic and international organizations and individuals reached $17.8666 trillion, a nearly 2% increase compared to 2023. Current and savings accounts (CASA) reached $2.0677 trillion, a 24% increase compared to December 31, 2023, and accounted for 13.46% of customer deposits.

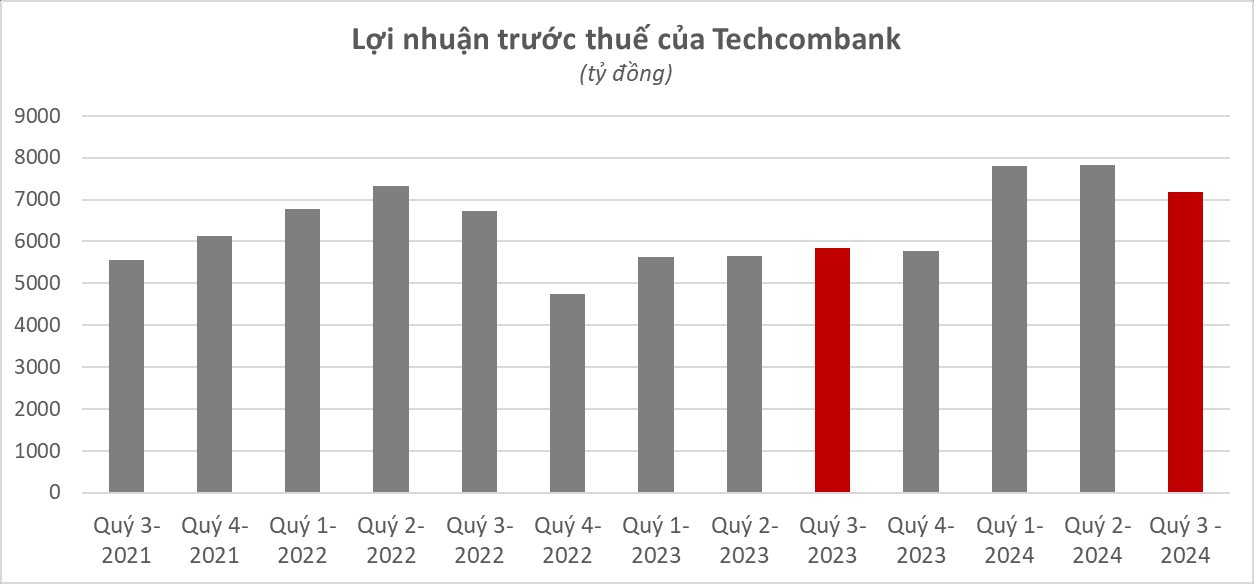

Techcombank: Pre-Tax Profit of $22.8 Trillion in the First Nine Months

Techcombank reported pre-tax profits of $22.8 trillion in the first nine months of 2024, a 33% increase compared to the same period in 2023.

As of the end of September 2024, Techcombank’s total assets reached $92.71 trillion, a 9.1% increase from the beginning of the year and an 18.7% increase year-on-year. On a consolidated basis, personal credit was the main driver of growth in the third quarter. Customer loans increased by 6.0% from the previous quarter, twice the increase in corporate loans (including corporate loans & bonds).

Techcombank’s CASA balance (including “automatic earnings”) reached a record high of $20.03 trillion, contributing to a CASA ratio of 40.5%. Total customer deposits reached $49.5 trillion, an 8.9% increase from the beginning of the year and a 21.0% increase year-on-year.

Eximbank: Estimated Pre-Tax Profit of Over $1.9 Trillion in the First Nine Months

In a recent announcement, Eximbank also released preliminary information about its third-quarter business results. Specifically, pre-tax profits for the third quarter increased by 39% year-on-year; total assets as of the end of September increased by 11% from the beginning of the year and 16.9% year-on-year; total mobilizations increased by 9.1% from the beginning of the year and 12.2% year-on-year; loans increased by 15.1% from the beginning of the year and 18.9% year-on-year; the capital adequacy ratio (CAR) remained at a healthy 12-14% (above the 8% requirement set by the State Bank of Vietnam).

LPBank’s Third-Quarter Pre-Tax Profit Reaches $2.899 Trillion

LPBank’s pre-tax profit for the third quarter of 2024 was $2.899 trillion, a 133.7% increase compared to the same period last year. Cumulative pre-tax profit for the first nine months reached $8.818 trillion, a 139% increase year-on-year.

As of September 30, LPBank’s total assets were nearly $44.6 trillion, a 16.4% increase from the end of 2023. Customer loans increased by 16.1%, reaching $31.977 trillion. Customer deposits at LPBank also increased by 14.3%, reaching nearly $27.1303 trillion.

In the first nine months, LPBank’s non-performing loan balance increased by 70%, from $3.689 trillion to $6.272 trillion, pushing the non-performing loan ratio to 1.96%.

Kienlongbank: Nine-Month Pre-Tax Profit of Over $760 Billion

According to the recently published consolidated financial statements, Kienlongbank’s pre-tax profit for the third quarter of 2024 was nearly $209 billion. Cumulative pre-tax profit for the first nine months exceeded $760 billion, a 19% increase year-on-year.

PGBank’s Third-Quarter Profit Grows by 36%

The bank’s pre-tax profit for the third quarter of 2024 was $7.7 billion, a 36% increase compared to the same period in 2023. However, the nine-month cumulative pre-tax profit decreased by 4.4% year-on-year to $34.4 billion.

Saigonbank’s Nine-Month Profit Declines

Saigon Commercial Joint Stock Bank (SaigonBank) announced that its pre-tax profit for the first nine months of the year is estimated to be over $20 billion, achieving approximately 55% of its 2024 plan. In the same period last year, SaigonBank’s profit reached over $24.8 billion.

Previously, the bank recorded pre-tax profit of over $16.6 billion in the first half of the year. Thus, Saigonbank’s estimated pre-tax profit for the third quarter is $3.4 billion, a nearly 50% decrease compared to the same period in 2023.

BaoViet Bank: Nine-Month Pre-Tax Profit of Over $3.2 Billion

In the first nine months of 2024, the bank increased its provisions by 35% compared to the previous year. Pre-tax profit exceeded $3.2 billion.

The Race to Reach a Capital Ownership Milestone: Vietnam’s Next Trillion-Dong Bank

As of the end of September, six Vietnamese banks boasted equity capital of over VND 100,000 billion: Vietcombank, Techcombank, VPBank, VietinBank, BIDV, and MB. These financial powerhouses have solidified their standing as the country’s preeminent lenders, each with a formidable war chest that underscores their dominance in the industry.

“SeABank: A Renowned National Brand and Leading Vietnamese Powerhouse”

For the third consecutive year, SeABank (HOSE: SSB) has been recognized as a National Brand of Vietnam by the Ministry of Industry and Trade. This prestigious accolade, received by the bank for three consecutive years, solidifies its position as a leading financial institution in the country. In addition, for 16 consecutive years, SeABank has been honored as a Vietnam Strong Brand, a testament to its unwavering commitment to excellence and the trust bestowed upon it by its valued customers. This recognition underscores SeABank’s market prominence and reinforces its reputation as a trusted financial partner in Vietnam.

“VIB Bank Contributes Over $129,000 in Taxes for 2023, Finalizing an Additional $383,000 Payment for 2022-2023”

As per the Large Enterprise Tax Department’s document dated November 11, 2024, Vietnam International Commercial Joint Stock Bank (HOSE: VIB) has completed paying additional taxes of 8.5 billion VND for the years 2022 and 2023, bringing the total tax payment for 2023 to 3,102 billion VND.