On November 16th, Hanoi Radio and Television hosted a forum titled “Restoring the Real Estate Market to Health and Development.” The forum was attended by representatives from the Ministry of Natural Resources and Environment, the Ministry of Construction, Hanoi’s leadership, and leading experts in economics and real estate.

During the forum, Dr. Can Van Luc shared his insights on the prospects of the Vietnamese real estate market in the new context. He identified six factors that influence the real estate market: macroeconomic conditions; information, data, and transparency; legal framework and regulatory oversight; supply, demand, and pricing dynamics, including confidence levels; urban planning and infrastructure development; and finance (taxes and fees, capital sources, and financial capacity).

Dr. Can Van Luc, Member of the Monetary and Financial Policy Advisory Council and BIDV’s Chief Economist, presents his paper.

Therefore, the market’s recovery will depend on multiple factors. Firstly, the primary boost will come from economic growth. The global economy is expected to stagnate or experience a mild recovery in 2024-2025, with a more noticeable improvement from 2026 onwards. Additionally, institutional and legal issues have been gradually addressed and improved, setting the foundation for entering a new phase.

However, the market also faces four significant risks and challenges in 2024-2025: complex geopolitical conflicts; inflation and interest rates, which are decreasing but remain high; high public and private debt risks; slow recovery in some countries (such as Japan, the UK, and China); and persistent energy and food security risks, along with unpredictable climate change impacts.

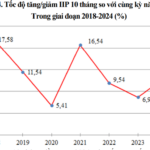

Turning to the Vietnamese economy in 2024-2025, it will also confront similar risks and challenges. External risks include slow global economic growth, with export and investment recovery lagging pre-COVID-19 levels. Public investment disbursement remains slow, lacking breakthroughs and uneven across sectors. Businesses continue to face difficulties, and the corporate bond market is struggling. The real estate market is recovering slowly, with high land prices and rapid increases in apartment and land plot prices in certain areas.

Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association.

Acknowledging the positive shifts in the real estate market, Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association (HoREA), noted that although the recovery is gradual, it demonstrates the effectiveness of the government’s policies and timely interventions.

Looking ahead, there are expectations for improvements in the legal framework, with the National Assembly presenting the Government with a draft resolution on pilot implementation of commercial housing through land-use agreements. If approved, this will unblock projects and alleviate difficulties for businesses in accessing land.

However, a pressing issue in the real estate market is the imbalance in the housing product structure, with a lack of affordable and reasonably priced options. In Ho Chi Minh City, for instance, there has been an absence of properties priced below VND 3 billion in the market since 2021. Additionally, 70% of apartments available are in the luxury and ultra-luxury segments, while only around 12,000 social housing units have been made available.

“These figures are alarming and indicate an uneven and unstable real estate market. Evidently, the housing market is in a state of reverse pyramid, requiring a strong force to bring it back into alignment,” emphasized Mr. Chau.

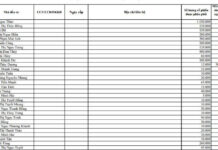

The HoREA Chairman commended the government’s efforts in establishing two task forces to address challenges in the real estate market. These task forces have made progress in resolving issues for many projects, especially in Ho Chi Minh City, where eight projects have been completely resolved and 22 projects are under review. More recently, the Prime Minister formed a steering committee to tackle ongoing difficulties and obstacles.

To promote healthy market development, the state regulates the market through policies and laws. The most practical tool is taxation, which has a direct impact. Currently, there is a 3% value-added tax applied specifically to social housing projects for sale or rent. Additionally, there is a proposed tax for owners of multiple properties, aimed at curbing speculation and stabilizing the market during periods of overheating or stagnation.

The second tool is credit policy. While the Law on Housing stipulates preferential interest rates for social housing buyers, the current rates are still high. We recommend lowering these preferential rates to around 4.8% – 5% to provide meaningful support for those purchasing social housing.

“Banks Reap the Benefits as Savings Account Interest Rates Rise”

With an increasing number of banks offering attractive interest rates on savings accounts, the battle for idle funds is heating up. In today’s market, which banks are offering interest rates above 6% per annum on deposits? It’s time to explore the options and make your money work harder.

“The Nation’s Pride”: Businesses Honored as National Brands Contribute Hundreds of Billions to the State Coffers.

“The ‘National Brand’ enterprises have collectively achieved an impressive revenue of 2.4 quadrillion VND in 2023, with approximately 150,000 billion VND contributed to the state budget. These businesses provide employment for over 600,000 people and actively engage in social welfare activities, fostering Vietnam’s rapid and sustainable development. This was emphasized by Prime Minister Pham Minh Chinh at the ceremony announcing the ‘Vietnam National Brand’ awardees for the 9th time in 2024.”