A unified green credit framework is essential to promote sustainable economic growth in Vietnam.

Currently, each bank uses different criteria to evaluate green projects, leading to inconsistencies and making it challenging for these projects to access preferential capital. A national green classification system will provide a consistent set of criteria for banks to assess and approve green projects, thereby reducing risks and improving access to finance for borrowers.

With a unified classification, banks can: apply common standards for credit evaluation, ensure positive environmental impact projects get preferential capital, and increase transparency and accountability.

The benefits of a national green classification system extend beyond the short term. By clearly defining “green” criteria and encouraging businesses to adopt sustainable practices, the system contributes to the country’s long-term development goals. It helps orient the economy towards environmental sustainability.

Green projects, supported by preferential credit, have the potential to create numerous jobs in renewable energy, sustainable resource management, and eco-friendly production.

As green projects thrive, greenhouse gas emissions and pollution will decrease, positively impacting global climate change mitigation efforts.

Adopting green practices enhances Vietnam’s economic competitiveness, especially as large markets like the EU enforce strict green standards on imported goods.

A draft national green catalog for banks is awaiting approval from relevant authorities. In the meantime, banks can refer to the EU’s green criteria or collaborate with international financial institutions already operating in Vietnam. This will provide temporary guidance and facilitate a smooth transition once the national catalog is implemented.

The EU’s stringent regulations on green credit offer valuable insights for Vietnamese banks to learn from and adapt to international best practices.

To optimize green credit allocation, banks should develop evaluation criteria tailored to the domestic market’s realities and needs.

Accelerating the implementation of green credit requires enhanced communication and training for businesses, households, and individuals on the green transition. Participating in programs offered by international financial institutions or ODA projects on the green transition will equip them with the knowledge and skills to meet the criteria for green projects. These programs provide the necessary financial support, expertise, and resources for a successful and sustainable start.

The national green classification system is a long-term strategy, demanding continuous collaboration between government agencies, banks, and businesses. Achieving a green future requires government commitment, international support, and heightened environmental awareness among enterprises.

The system plays a pivotal role in driving Vietnam’s sustainable economic development. By unifying criteria for green credit, green projects will have easier access to preferential capital, reducing barriers for businesses’ green transition. Effective communication, training, and guidance for businesses, households, and individuals are key to achieving this goal.

Nguyen Quang Huy – CEO of Finance and Banking, Nguyen Trai University

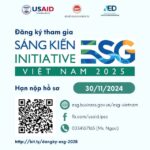

Launching the Vietnam ESG Initiative 2025

The Ministry of Planning and Investment and the United States Agency for International Development (USAID), through the Vietnam Private Sector Competitiveness Enhancement Project, have launched the Vietnam ESG Initiative 2025.

Governor: 50 Credit Institutions Offer Green Credit with Outstanding Balance of VND 650 Trillion

Governor Nguyen Thi Hong stated that, in 2017, only five credit institutions (CIs) participated in green credit. Today, we are proud to have 50 CIs with outstanding green credit balances, totaling approximately VND 650 trillion. Of this, renewable and clean energy accounts for 45%, while clean and green agriculture make up 30%.

The Textile Industry Confronts the European Green Deal

Although the EU’s green policies present significant challenges for Vietnam’s textile exports, in the long run, proactively embracing a comprehensive and synchronized green transition can unlock opportunities for businesses.