Understanding market sentiment has never been easy. But sometimes, the best explanation is to keep asking questions: Why should the market rise now? What’s driving it?

These new questions seem more challenging than the initial conundrum.

The shift in monetary policy direction by the US Federal Reserve (Fed), with a significant inflection point being the decision to cut interest rates after the September meeting, almost confirms the removal of a significant risk to the stock market: exchange rate pressure.

The global financial community had, in fact, foreseen (through assessing gradually released economic data) and acted beforehand, as reflected in the decline of US Treasury bond yields and the US Dollar Index (DXY) since May-June, even before the Fed meeting took place.

The drop in the domestic currency’s value no longer batters the psyche of Vietnam’s business and investment community. However, emerging from this instability gives rise to a new head-scratcher for market participants: a major concern has been resolved, but why haven’t stocks taken off?

|

Unit: VND/USD

Data as of the morning of September 26, 2024 – Source: tradingeconomics.com

|

The first thing to remember: exchange rates are not the sole factor influencing market shifts. In fact, for most of history, it hasn’t been the decisive factor in stock price increases. The impact of exchange rates is only more significant during periods of sharp fluctuations, usually in a negative direction, as witnessed in the last three years.

The exchange rate issue can be likened to a ceiling barrier for the market (if it’s not resolved, there won’t be a conducive environment for growth), whereas, for stock prices to rise, we must rely on the value and prospects of businesses.

Maintaining the stock price increase is challenging nowadays, as the market has gone through a re-rating phase – shifting stock prices from the context of the crisis at the end of 2022 to recovery and normalization.

From 2023 to September 25, 2024, the VN-Index rose 27.8%, thus indicating a bull market. The market prices of stocks with solid fundamentals have mostly returned to the high price region of early 2022, before the bond crisis occurred.

This means the market will struggle to continue its upward trajectory unless there’s further significant progress in fundamentals, specifically corporate profits, beyond mere recovery.

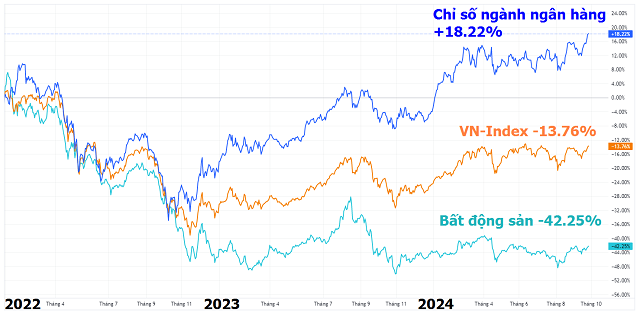

A significant barrier for the market in returning to the 1,500-point mark – “getting back what was lost,” as investors often say – is the sluggishness of real estate stocks.

Legal bottlenecks and the real estate debt crisis have yet to find a clear solution. Although there were signs of improvement in 2024, the real estate industry couldn’t get back on its feet, and the product supply remained meager compared to the past; real estate market liquidity has only improved somewhat.

Well-known stocks in this sector, such as NVL, HPX, HTN, DXS, SCR, and CRE… are currently trading at prices 70-80% lower than at the beginning of 2022; PDR is down 63%, while the VIC, VHM, and VRE group is down 37-55%, according to data as of 10:42 am, September 26, 2024.

Reports from HOSE show that the real estate sector once accounted for 22.5% of the total market capitalization of the VNAllshare index at the beginning of 2022 but had dropped to less than 12% by the end of August 2024.

While still leaving room for monetary policy to continue to orient low-interest rates, the relief in exchange rates can’t do much more for real estate tycoons.

Both the stock market and the real economy are awaiting positive developments in the real estate market. This is almost the crux of all current issues.

The gloominess of the real estate industry not only directly restrains the VN-Index but also makes investors anxious about its connection with other sectors such as construction, materials, and especially banking. With more than 20% of the total system’s outstanding loans going to real estate lending, concerns about bad debt, hidden debt, and credit growth potential are worrying banking industry observers.

The low valuations of bank stocks compared to non-financial stocks reflect a significant wariness. The close link between banks and real estate may explain why the market is not yet ready to accept higher prices for bank stocks, even though the profit trend in this sector has been more robust than non-financial corporations in recent years.

Positive progress in the real estate market will bring a more optimistic outlook to related fields. Real estate is not only a value retention channel but also the primary collateral in the banking system. Improved real estate liquidity will support the bad debt handling process and contribute to credit growth.

Meanwhile, restarting projects will create a more favorable environment for construction and material businesses. Consequently, better incomes and the wealth effect from asset prices will stimulate consumer psychology in the economy.

|

Turning Point

Bank stocks recover and continue to grow while real estate stocks remain at the bottom Considering capitalization on the three exchanges (HOSE, HNX, and UPCoM), the weight of the banking sector (30.5%) is currently more than double that of real estate (12.6%), although it was equivalent two years ago. Data as of 10:00 am, September 26, 2024 – Source: VietstockFinance

|

The Real Estate Market’s ‘Upside-Down’ Pyramid: A City’s Story of Missing Affordable Homes.

Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association (HoREA), offers an intriguing perspective on the current state of the real estate market. He analogizes the market to an “inverted pyramid,” alluding to a unique situation where positive signals exist, yet the market remains uneven and unstable in its development.

The Upcoming US Election: What’s in Store for the Vietnamese Stock Market?

The Vietnamese stock market has historically shown a positive correlation with the US stock market. With a correlation of 27% in the last month and 76% in the last quarter between the S&P 500 and the VN-Index, the movements in the US stock market are expected to significantly influence the short-term trends of the VN-Index.

The Stock Market Observer: Bottom Fishers Out in Force

Today’s market showed a significant boost in positivity, not just in terms of the upward index movement but also in the balance and strength of the bottom-fishing money flow. The shift from indiscriminate selling to price-conscious selling and a tug-of-war is a notable change in psychology and risk assessment.

The Central Bank Governor: We Will Intervene in the Foreign Exchange Market During Times of Significant Volatility

Governor Nguyen Thi Hong affirmed that the State Bank of Vietnam (SBV) remains steadfast in its commitment to flexible exchange rate management, adapting to market fluctuations. The exchange rate is currently allowed to fluctuate within a band of +/- 5%. “In the event of significant market volatility, the State Bank will consider selling foreign currencies to stabilize and meet the needs of the people,” she added.

Why is there an Idle Budget of 800,000 Billion Dong Deposited at the State Bank?

The Governor of the State Bank of Vietnam revealed that funds deposited with the State Treasury, when not in use, are primarily held in large commercial banks. More recently, these funds have been transferred to the State Bank. Approximately 80% of the VND 1 quadrillion is now deposited with the State Bank.