The financial reports for Q3 show a more promising picture regarding non-performing loan (NPL) ratios for listed banks, with signs of stabilization. This can be considered a “bright spot” in the current complex financial landscape, as credit management measures have taken effect, contributing to market stability. However, close monitoring of NPL risks remains crucial as Circular 06 will expire by the end of this year, and the impact of nearly two years of robust credit growth for businesses could bring about more unpredictable consequences.

With consumer demand remaining subdued, as evident in the outstanding economic growth in Q3, largely driven by robust industrial production, the decline in NPLs in this context warrants careful scrutiny to thoroughly assess the significance of the current NPL figures.

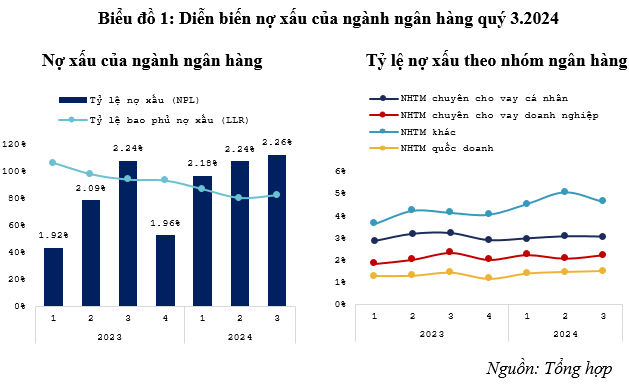

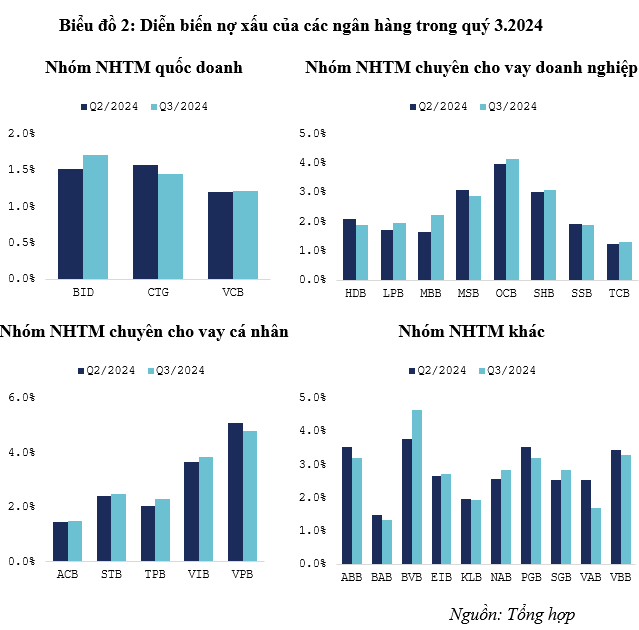

Trends in NPL ratios for Q3

Following concerns about the pressure on on-balance sheet NPL ratios, the Q3/2024 financial reports of 27 listed banks portray a more positive scenario. During Q3/2024, the banking system’s NPLs did not surge as significantly as in previous quarters, with the NPL ratio holding steady at 2.26%, compared to 2.24% in the previous quarter. This reflects the effectiveness of policies aimed at unblocking credit, restructuring repayment terms, and maintaining debt groups, which helped curb the rise in NPLs. Nonetheless, this level is still considerably higher than the 1.6% average observed between 2017 and 2022.

Apart from the NPL ratio, the loan loss reserve (LLR) ratio, which indicates the coverage of NPLs, exhibited a downward trend since the beginning of 2023. The LLR ratio for the entire banking sector witnessed a substantial drop from 86.9% in Q1 to 80.4% in Q2/2024. In Q3/2024, as banks increased their provisioning expenses for the quarter by 9% year-over-year, coupled with a slight increase in the NPL ratio, the LLR ratio improved to 82.5%. However, compared to previous periods, the quality of NPL coverage remains on a downward trajectory. Consequently, this will exert pressure on credit risk provisioning costs and bank profits in the upcoming quarters to further enhance coverage.

State-owned commercial banks continued to maintain the lowest NPL ratio in the industry, sustaining it below 1.5% over the last two years. Meanwhile, the NPL ratio for the group of commercial banks specializing in personal lending remained stable, fluctuating between 2-3%. Although the group of commercial banks lending to businesses managed to keep their NPL ratio low, it experienced fluctuations, reaching 2.2% in Q3/2024. Notably, the “other” group of commercial banks had the highest NPL ratio, witnessing a decrease from 5% in Q2/2024 to 4.62% in Q3/2024. This volatility is surprising, given that, within just one quarter, the “other” group, which typically has a riskier loan portfolio compared to the other groups, experienced such a significant shift.

On another note, since the beginning of 2024, credit growth has been robust, particularly for businesses. Preferential credit packages have been implemented to provide timely liquidity to enterprises, alleviating their repayment pressures for maturing debts. This could be a contributing factor to the notable improvement in the NPL ratio for the “other” group of commercial banks. Businesses benefiting from refinancing are likely to restructure their debts and settle existing obligations.

Some noteworthy points about NPLs

Overall, the NPL ratio trends in the banking industry no longer exhibit sudden surges as witnessed at the beginning of the year, and the differentiation in NPL ratios highlights the unique challenges faced by individual banks. Within the state-owned group, VCB sustained the lowest NPL ratio, while CTG maintained a stable level, and BID experienced a significant increase of around 0.2% compared to the previous quarter. The group of banks specializing in personal lending kept their NPL ratios relatively steady. The two banks with the most significant increases in NPLs were VIB and TPB, both of which aggressively pushed credit growth in the last quarter, focusing on the corporate segment to compensate for the sluggish credit growth earlier in the year. These banks expanded their credit portfolios substantially, ranging from 6% to 10% compared to the previous quarter. ACB, STB, and VPB, which adopted a more cautious approach to credit growth in Q3, maintained their NPL ratios without significant changes.

The group of commercial banks specializing in lending to businesses displayed a clear divergence in NPL ratios. Notably, the substantial increase in MBB‘s NPL ratio within just one quarter, rising to 2.23% from 1.63% in the previous quarter, equivalent to a VND 15,685 billion NPL size, represents a nearly 50% jump compared to both the previous quarter and the same period last year. Particularly in Q2, MBB had shown improvement, achieving an NPL ratio of 1.6% after a sharp increase to 2.5% in Q1 compared to the end of last year. The recent volatility in MBB’s NPL ratio reflects the challenges in controlling cross-debt-related NPLs and the complexities of debt group migration. However, MBB’s situation also underscores another risk: the increased concentration of loans due to more substantial lending to businesses, resulting in more pronounced and far-reaching NPL fluctuations.

Compared to the larger banks, the “other” group of commercial banks presents a concerning picture, with NPL ratios fluctuating between 1.5% and 4.6%. Some banks, like BVB, continued to witness a sharp rise in their NPL ratios, with an increase of nearly 0.9% in just one quarter, translating to an additional NPL size of over VND 730 billion, especially with the size of Group 4 NPLs doubling compared to the previous quarter. Furthermore, when considering NVB, seven out of eleven banks in this group experienced over 20% growth in their NPL sizes compared to the same period last year.

Based on the developments in Q3, NPLs in the banking sector might witness a slight decrease in Q4, as credit disbursements continue to be robust, and businesses can still restructure their debts. However, NPLs are only temporarily being held at bay. Once Circular 06 expires by the end of this year, if economic conditions remain challenging, the latent NPLs and those arising from new credit disbursements during the year could bring about unpredictable risks. Moreover, the increased credit extended to large enterprises brings short-term benefits but will undoubtedly have a more significant impact on NPLs.

The Q3/2024 NPL dynamics paint a complex financial picture, with both positive signals and underlying challenges. While the NPL ratio has shown signs of stabilization, the lingering risks are substantial, especially with increased corporate lending and a stagnant consumer market. Without supportive mechanisms, many banks may face the challenge of having to make substantial provisions for NPLs. To safeguard the financial system’s stability, banks must continue implementing risk management measures while also diversifying their loan portfolios to include the retail sector.

Lê Hoài Ân, CFA – Nguyễn Thị Ngọc An – HUB

The Year-End Interest Rate Crunch

The end of the year always brings a surge in demand for capital, especially for businesses and individuals seeking funds to expand production, stock up for the Lunar New Year, and meet festive consumer demands. In response, commercial banks have started to increase deposit interest rates to secure stable funding.

“HCM City Credit Up 6.87% in October 2024”

As of late October 2024, Ho Chi Minh City’s total outstanding credit reached an impressive VND 3,785 trillion, reflecting a steady growth of 0.98% from the previous month and a significant 6.87% increase compared to the end of 2023. This indicates a consistent expansion in the city’s credit activities over the past few months.

The Financial Currency Market: A Stable Investment Haven

According to a report by the Ministry of Planning and Investment, despite facing challenges and difficulties, the economy in October and the ten-month period showed a strong recovery. Economic and social activities rebounded quickly after natural disasters and floods. In October, several international organizations upgraded their growth forecasts for Vietnam in 2024, predicting it could be the highest among ASEAN+3.

A Year-End Monetary Policy: Striking a Balance Between Economic Support and Exchange Rate Stability

Although the State Bank of Vietnam is absorbing excess liquidity, Rong Viet Securities assesses that the monetary policy stance remains accommodative to economic growth, alongside managing short-term volatilities such as exchange rate pressures.

The New Interest: “The Coming Year’s Slashed Interest Rates”

With the Fed and many central banks entering a cycle of cutting interest rates, Vietnam will continue to maintain its accommodative stance to support economic growth. Interest rates are expected to drop by 0.7% in the coming year, providing a boost to the economy and potentially spurring investment and consumption.