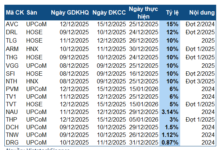

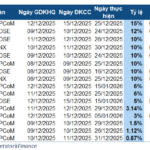

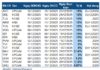

The value of derivatives contracts betting on Bitcoin surpassing $90,000 has surged to over $2.8 billion on the Deribit exchange – one of the few crypto futures trading platforms. Deribit dominates the overseas options market.

“The options market is heavily skewed towards expectations of continued upside. Call options are trading at a higher premium than puts, and open interest in call options has been increasing,” said Vetle Lunde, Head of Research at K33 Research, to CNBC.

Call options give the buyer the right to purchase the underlying asset at a specified price over a certain period. Buying a call option is a bet that the asset’s price will increase. Buying a put option, on the other hand, is a wager that the asset’s price will decrease.

The CME derivatives exchange offers Bitcoin futures contracts and is a popular avenue for institutions in the US to bet on Bitcoin’s future price. Velde told CNBC on November 8 that Bitcoin call option premiums had spiked in the past few days.

Bitcoin’s rally is supported by multiple factors. Firstly, the victory of crypto-friendly candidates in the US elections, particularly President-elect Donald Trump’s pledge to make the US the “crypto capital.”

Secondly, the Fed’s second consecutive rate cut serves as a significant catalyst. Historically, monetary policy easing has often coincided with crypto rallies as borrowing costs decrease.

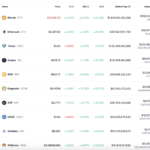

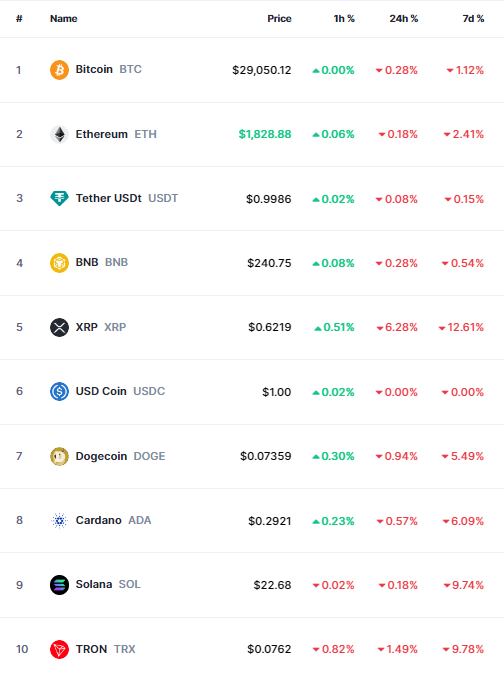

The wave of optimism swept across the crypto market. Ethereum outperformed Bitcoin, surging 30% in seven days, while Solana’s market cap surpassed $100 billion on November 10. Bitcoin spot ETFs also demonstrated strong appeal, with a total capitalization of over $80 billion. In the last three trading days alone, they attracted an additional $2.3 billion.

Shares of crypto companies also posted impressive results. Coinbase, one of the biggest corporate donors to the election campaign with over $75 million in contributions, surged 48% last week, marking its best week since January 2023. Robinhood’s stock also climbed 27%.

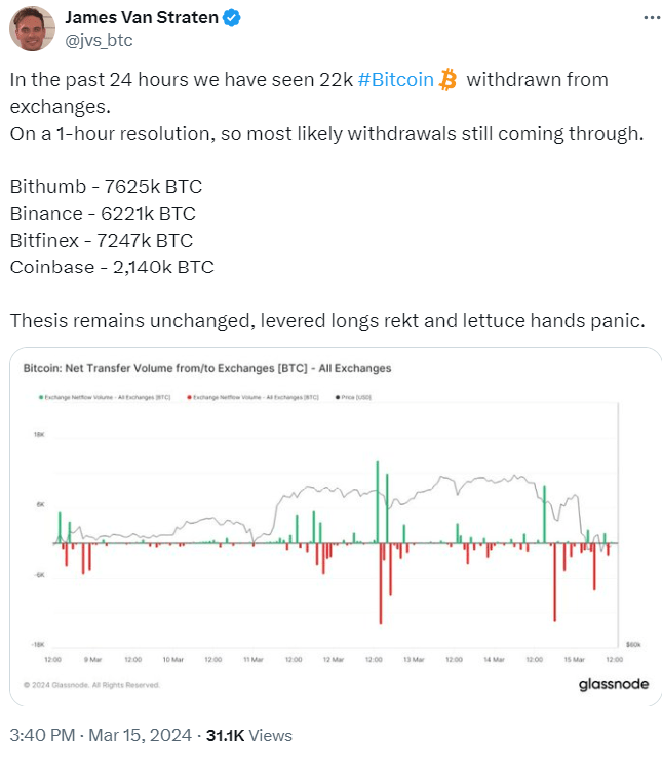

However, experts caution about the risk of heightened volatility over the weekend due to low liquidity. According to Velde, when both CME futures and ETFs are closed, price fluctuations can lead to overreactions and significant adjustments upon market reopening.

In this context, Johann Kerbrat, Vice President of Robinhood Crypto, emphasized the importance of enhancing crypto understanding. “This is a rapidly evolving and complex field. We want to help policymakers understand it and put in place appropriate consumer protections,” he said.

From a legal perspective, Trump’s pledge to fire SEC Chairman Gary Gensler could be good news for companies like Coinbase, which is battling the agency over securities violation allegations. “The night of November 5 was certainly an important night for the crypto market and crypto voters. We will have the most pro-crypto Congress we’ve ever had,” affirmed Paul Grewal, Coinbase’s legal director.

The Golden Age of Bitcoin and Cryptocurrency

The victory of Donald Trump in the US Presidential election has been hailed by the crypto community as the dawn of a “golden age”.

The Stock Market Soars to Record Highs as Trump Claims Victory

The S&P 500 futures hit record highs after Republican nominee Donald Trump claimed victory in the US presidential election.