|

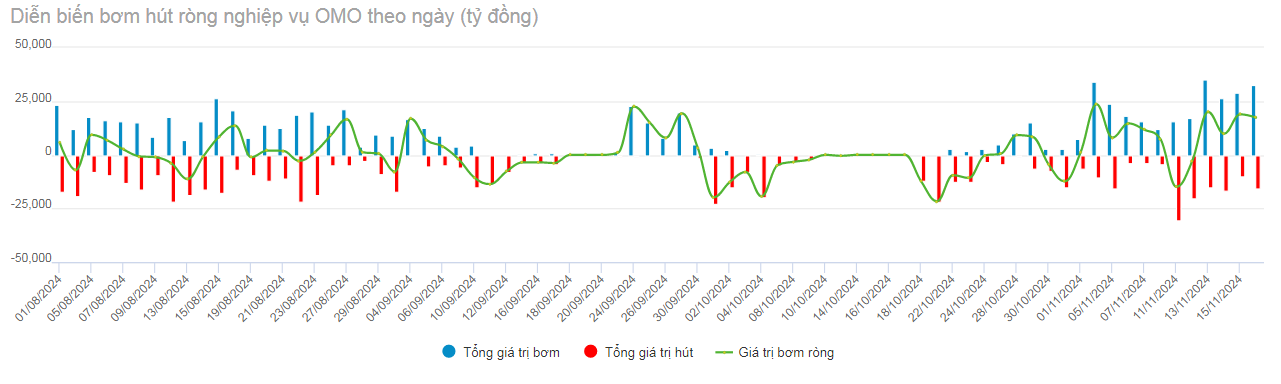

Net OMO pumping and sucking developments by day from August to November 2024. Unit: VND billion

Source: VietstockFinance

|

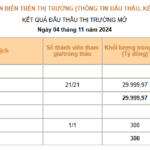

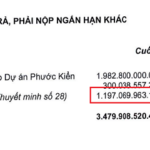

Specifically, from November 11 to 18, the SBV lent commercial banks VND 115,000 billion through the 7-day term buying channel at an interest rate of 4%/year.

In addition, the SBV still regularly called for bids on the bill channel but limited volume (VND 2,950 billion), 28-day term and winning bid interest rate reached 3.9-4%/year.

Also during this time, the pledged channel loan in the previous week (November 4-11) matured, sucking VND 105,000 billion out of the market. However, the positive point is that the system’s liquidity last week was still supported somewhat thanks to VND 41,250 billion of bills issued earlier (October 18-31) matured.

Thus, the SBV net injected VND 48,300 billion of liquidity into the system through the open market operation channel. Of which, there were VND 100,000 billion circulating in the pledge channel and VND 38,350 billion of SBV bills circulating in the market.

|

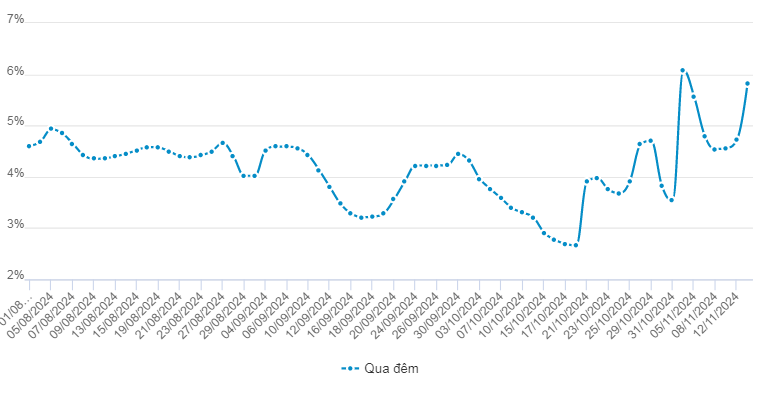

Interbank interest rates for overnight term from August to November 2024. Unit: %/year

Source: VietstockFinance

|

According to SSI Research, interbank interest rates for overnight term jumped last week and closed the week of November 15 at 5.8%, up 130 basis points from the previous week – reflecting tight liquidity. The difference between VND and USD overnight interest rates has turned positive. In addition to the maturity of up to VND 90,000 billion on the term buying channel, the end of the year is also the time when liquidity fluctuates strongly due to many factors such as credit disbursement, increased public investment,… In case liquidity does not improve this week, the SBV may consider increasing the term if necessary.

Also according to SSI Research, the market focus is on US economic data and the speech of the Fed Chairman. Accordingly, the DXY index increased by 1.3% in the past week and other major currencies all depreciated against the USD such as EUR (-1.5%), GBP (-1.3%) and JPY (-0.5%). Currencies in the Asian region fell to a lesser extent, while THB (-1.5%), MYR (-0.99%) and TWD (-0.8%) fell sharply, other currencies fell by 0.2-0.5%.

Domestically, contrary to global developments, the USD/VND interbank exchange rate fell slightly by 0.12% to 25,380, while the free market exchange rate was at 25,700 – VND 300 lower than the peak and the exchange rate quoted at commercial banks traded at the ceiling of the allowed band.

SSI Research maintains the view that there is pressure on exchange rates in the short term, however, towards the end of the year, FDI capital disbursement and remittances tend to be more positive, which will support the exchange rate.

The Dollar Dilemma: Navigating the Currency Conundrum.

The USD/VND exchange rate has been extremely volatile, causing concern for businesses that import raw materials for production.

What Does the SBV’s Net Injection Move Mean?

The recent net injection by the SBV on November 4th is a strong move to support liquidity, especially amidst the surging USD/VND exchange rate in both the official and free markets. The SBV’s intervention sends a clear message of their commitment to stabilizing the currency market and shielding the domestic financial sector from excessive volatility.

What Does the Latest Intervention in Exchange Rates by the Authorities Tell Us?

As the US dollar to VND exchange rate continues its upward trajectory, the State Bank of Vietnam has announced its decision to sell foreign currencies on the spot market to meet market demand. This proactive move by the central bank raises questions about its timing and potential impact on cooling down the market.