Net Interest Margin (NIM) Decline Across the Board

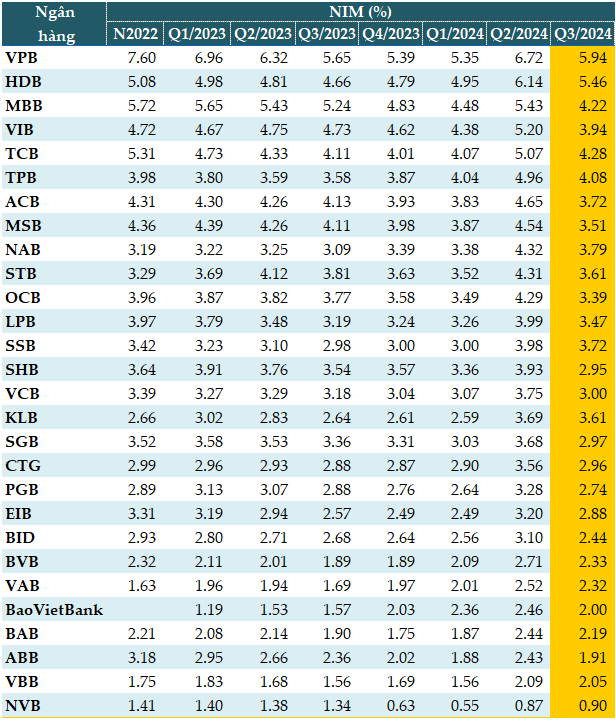

In the face of macroeconomic and financial market volatility, most banks witnessed a decline in net interest margin (NIM) in Q3 2024 compared to Q2.

Data from VietstockFinance reveals that all 28 banks experienced thinner NIMs in Q3 2024 than in the previous quarter.

VPBank led the pack with the highest NIM of 5.94%. This was closely followed by HDBank (HDB) at 5.46%, MB (MBB) with 4.22%, VIB at 3.94%, and Techcombank (TCB) coming in at 4.28%.

A crucial determinant of NIM is the cost of capital, which has been on the rise as banks aim to attract deposits amidst liquidity constraints and economic headwinds. To ensure capital stability, many institutions have had to offer higher interest rates on deposits, thereby increasing their cost of capital and putting direct pressure on NIMs.

Additionally, the CASA ratio at many banks has been on a downward trend, forcing them to rely more on long-term capital sources with higher interest rates, further exacerbating the issue.

Moreover, to support economic recovery and promote credit growth, banks have had to reduce lending rates to encourage borrowing. However, credit demand from customers has been lackluster and varied across industries. The competitive landscape has driven banks to lower lending rates while also being unable to significantly increase rates above their funding costs, resulting in a substantial decline in credit activity profit margins.

A significant contributing factor to this decline is the rising non-performing loan (NPL) ratios within the banking system. Q3 2024 financial statements indicate a substantial increase in NPLs, particularly those deemed potentially irrecoverable. This heightened risk has compelled banks to bolster their loan loss provisions, subsequently eroding profits and weakening NIMs.

|

Q3 2024 NIMs for Banks

Source: VietstockFinance

|

NIM Remains a Challenge

PGS.TS. Nguyen Huu Huan, a lecturer at the University of Economics Ho Chi Minh City (UEH), believes that NIMs will struggle to improve in the near term as capital demands intensify toward the year-end. To inject more capital into the economy, banks will likely have to increase deposit rates. However, if they are to maintain lending rates to support credit growth targets, they will inevitably face thinner NIMs. This dynamic suggests that NIMs will likely continue to decline in the coming months.

PGS.TS. Dinh Trong Thinh, an economic expert, shares a similar sentiment. He attributes the expected decline in NIMs to the increasing cost of capital coupled with stagnant or even decreasing lending rates. Consequently, NIMs are projected to remain a challenge for banks through the end of the year.

Mr. Nguyen Quang Huy, CEO of the Finance and Banking Faculty at Nguyen Trai University, highlights the growing profit disparity between large and small banks. Larger institutions, benefiting from superior capital structures, higher CASA ratios, and more effective asset management, have demonstrated better control over NPLs and maintained more stable NIMs. Conversely, small and medium-sized banks face mounting challenges in attracting quality customers in this highly competitive environment. Their asset quality tends to deteriorate, leading to higher NPL ratios and, subsequently, intensified pressure on NIMs.

To enhance NIMs in the final quarter, banks should focus on optimizing their cost of capital, tightening credit quality control, and diversifying their revenue streams through service fees. Institutions with robust risk management frameworks and effective technology utilization will be better positioned to sustain stable NIMs.

By prioritizing CASA capital mobilization through the development of payment account products and digital banking services, banks can alleviate the pressure on their cost of capital. Increasing the CASA ratio will reduce banks’ reliance on high-interest capital sources, thereby improving NIMs and enhancing their competitive edge.

Strengthened credit risk management and tighter credit quality control are crucial for mitigating the impact of NPLs on NIMs. Larger banks, benefiting from higher NPL coverage ratios and robust credit risk management processes, are better equipped to maintain stable NIMs.

To ease the pressure on credit activity profit margins, banks should explore revenue diversification through service fees and non-credit activities. Services such as insurance, investment advisory, and digital banking can provide stable revenue streams, helping banks reduce their dependence on NIMs. By investing in digital banking channels, payment services, and technology integration, banks can optimize their operational efficiency and enhance their overall performance.

In the context of intense credit competition, offering flexible interest rates to low-risk customers can optimize NIMs without burdening borrowers. Additionally, banks can restructure their income-generating assets to favor fields with higher profit margins and lower risks, thereby optimizing asset efficiency.

The Rising Tide of Bad Debt: A Major Challenge for the Banking Sector

The sharp rise in non-performing loans in Q3 2024, coupled with a decline in lending, presents a significant challenge for the banking industry. This worrying trend is a red flag, indicating that without swift and effective action, the banking system could be facing substantial financial risks in the near future.

Sure, I can assist with that.

Title: HDBank: Foremost Credit Room in the Banking Sector, Projected Profit Growth of Over 28% Annually for the Next 5 Years

In their recently published analyst report, MB Securities (MBS) has assessed HDBank’s business outlook as positive for the second half of 2024 and 2025. This optimistic forecast is attributed to the bank’s exceptional financial performance in the first half of this year, which has set a strong foundation for continued success in the upcoming periods.