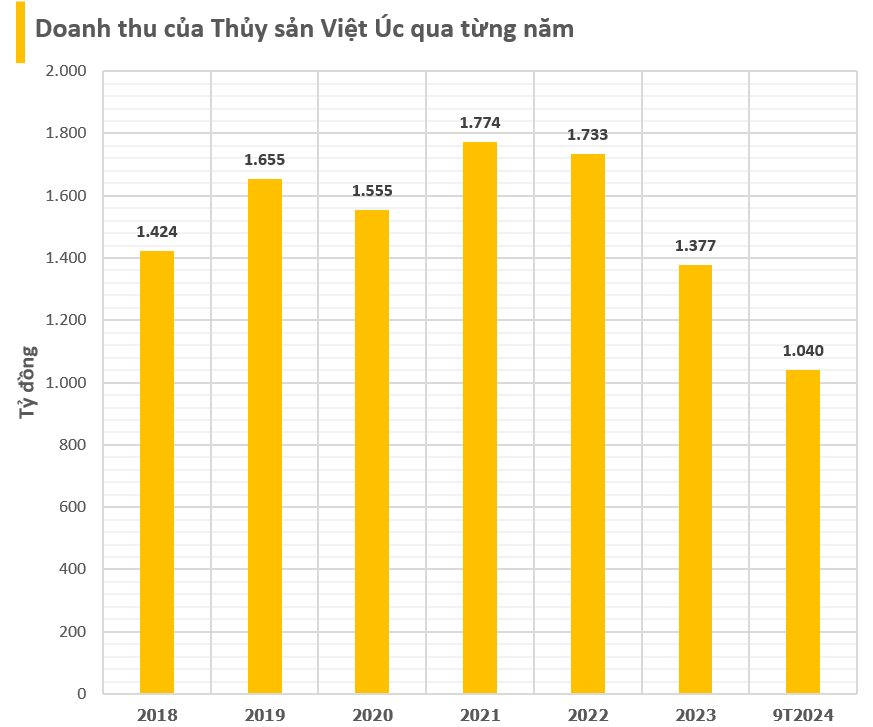

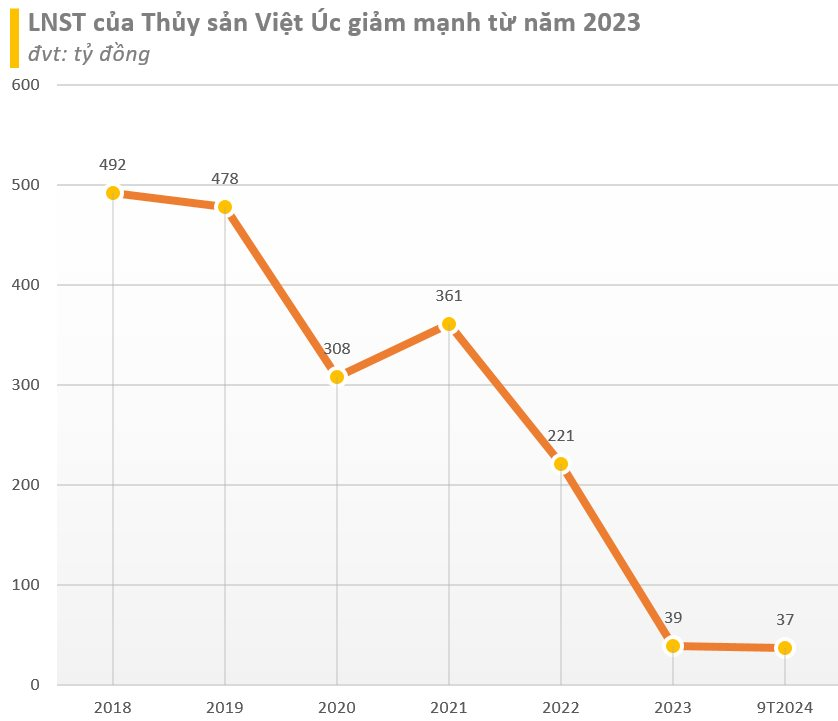

Vietnam-Australia Seafood Corporation has announced its Q3 2024 financial statement, with a revenue of 1,040 billion VND, unchanged from the same period last year. Due to increased cost of sales and selling expenses, the company’s net profit decreased by 52%, to nearly 37 billion VND.

In fact, Vietnam-Australia Seafood’s profit has been declining for the past two years. While the company consistently made profits in the hundreds of billions each year between 2017 and 2022, its profit plummeted to just a few dozen billion in 2023. The company’s revenue decline, coupled with unchanged expenses, is the main reason for the significant drop in profit in the past two years.

The decline in Vietnam-Australia Seafood’s profit coincides with the company’s announcement of its plan to list its shares on the UPCoM exchange. In mid-June 2023, the “king of shrimp breeding” was in the process of finalizing its shareholder list to initiate securities depositary and trading of its shares on the UPCoM. However, this plan has not been completed yet.

In 2022, Vietnam-Australia Seafood’s shareholders approved a plan to offer shares to the public to increase its charter capital and list its shares on the Ho Chi Minh City Stock Exchange (HOSE). However, this plan was ultimately unsuccessful.

Vietnam-Australia Seafood is the market leader in shrimp breeding in Vietnam

Vietnam-Australia Seafood, formerly known as Vietnam-Australia Co., Ltd., was established in July 2001 in Binh Thuan province. The company is founded and chaired by Mr. Luong Thanh Van, who also serves as its CEO. Its main business is aquaculture.

In May 2015, the company officially transitioned to a joint-stock company and became a public company in March 2019. Vietnam-Australia Seafood is known as the “king of shrimp breeding” in Vietnam, with a market share of over 30% and a production capacity of 50 billion shrimp fry per year, meeting 25% of the domestic market demand.

In the past, Vietnam-Australia Seafood also impressed with its remarkable returns on capital. In 2020, the company achieved a basic earnings per share (EPS) of nearly 30,000 VND. This figure was even higher in 2019, reaching nearly 48,000 VND. The reason for this high EPS was the company’s modest charter capital of just over 103 billion VND, equivalent to 10.3 million shares.

In 2018, a group of investors from STIC (South Korea) acquired a 9.8% stake in Vietnam-Australia Seafood, paying 764,843 VND per share. This valued the “king of shrimp breeding” at approximately 7,400 billion VND. For context, the current market capitalization of Minh Phu (MPC), the leading company in the shrimp industry, is around 7,800 billion VND.

The extraordinary EPS of Vietnam-Australia Seafood ended in 2022 when the company paid a “huge” 120% stock dividend, meaning that for every share owned, shareholders received 12 stock dividends. This dividend was paid from the company’s undistributed profit after tax.

As of September 30, 2022, Vietnam-Australia Seafood’s total assets amounted to 2,280 billion VND, a decrease of 200 billion VND from the beginning of the year. More than half of this was fixed assets, valued at 1,331 billion VND. Inventories increased by 52% to 244 billion VND.

Notably, the company had only borrowed 6 billion VND as of the end of September. Owners’ equity stood at 2,105 billion VND, including 754 billion VND of retained earnings.

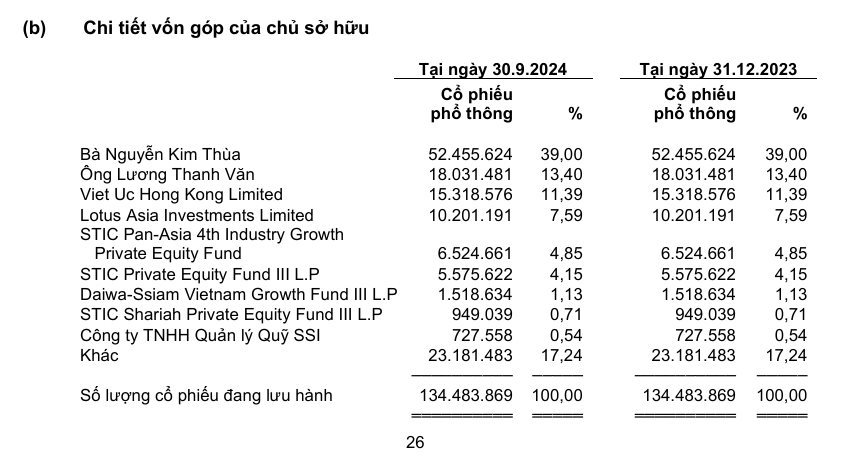

In terms of shareholder structure, Mr. Luong Thanh Van and his wife, Mrs. Nguyen Kim Thua, own 13.4% and 39% of Vietnam-Australia Seafood’s shares, respectively, according to the audited financial statements. The company’s other major shareholders are Viet Uc Hong Kong and Lotus Asia Investments, holding 11.39% and 7.59% stakes, respectively. The financial statements also show that employee ownership in Vietnam-Australia Seafood stood at 17.24% at the end of 2022.

Although not officially disclosed, the ownership percentage of Mr. Luong Thanh Van’s family in Vietnam-Australia Seafood is much higher than the reported 52.4%. In fact, Viet Uc Hong Kong is also related to his family.

In addition to the investment made by the STIC group in 2018, shareholders affiliated with SSI Securities Corporation, including Daiwa – Ssiam Vietnam Growth Fund III and SSI Asset Management Company, hold a combined 1.67% stake in Vietnam-Australia Seafood.

The Rising Exchange Rate: A Boon for Banks

The volatile exchange rates in the first half of the year have resulted in a windfall for many banks’ foreign exchange business.

The Dynamic Duo: Unveiling the Power of Nhất Việt Securities’ New Board

On November 11th, the Board of Directors of VFS Joint Stock Company (HNX: VFS) passed two resolutions to establish the Procurement and Expenses Council and the Investment and Capital Council for the term 2024-2029. Key roles within these councils are held predominantly by the newly appointed members of the Board of Directors, who joined in April 2024.

Profits Plummet: Bảo Minh Insurance Projects a 29% Drop in 2024 Profit Plans

The Board of Directors of Baominh Insurance Joint Stock Corporation (HOSE: BMI) has proposed to adjust and reduce the profit plan for 2024, following a significant drop in interest rates in the third quarter due to Storm Yagi.