“Gen Z’s purchasing decisions go beyond simply acquiring a product; they view shopping as a means of self-expression and connecting with like-minded individuals. It’s common to see young people gathering to discuss unique finds or boasting about their midnight sale hauls,” shared Mai Cam Linh, Business Director of YouNet Media, at a press conference on November 14th regarding the future of e-commerce in Vietnam.

Since mid-2023, the advent of TikTok Shop and the rise of Shoppertainment have significantly altered the shopping habits and e-commerce spending of consumers, with Gen Z (those born between 1997 and 2012) being particularly influenced, as this generation seeks fun, trendy, and personality-reflecting experiences.

The Rise of Chinese Domestic Cosmetics

From January 2023 to August 2024, YouNet Media’s social listening tool captured approximately 600,000 discussions and over 21 million interactions related to the top 5 Chinese domestic cosmetics brands: Focallure, Colorkey, Judydoll, Perfect Diary, and Zeesea.

Notably, demographic data revealed that over 50% of the participants discussing these cosmetic lines were Gen Z individuals.

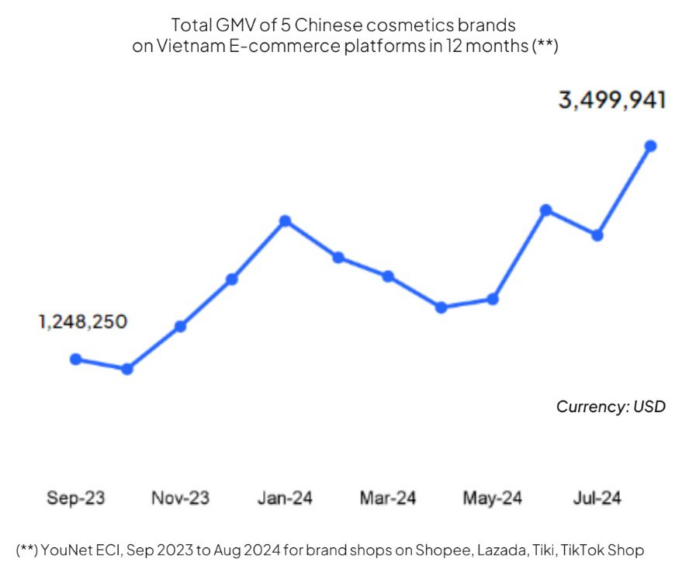

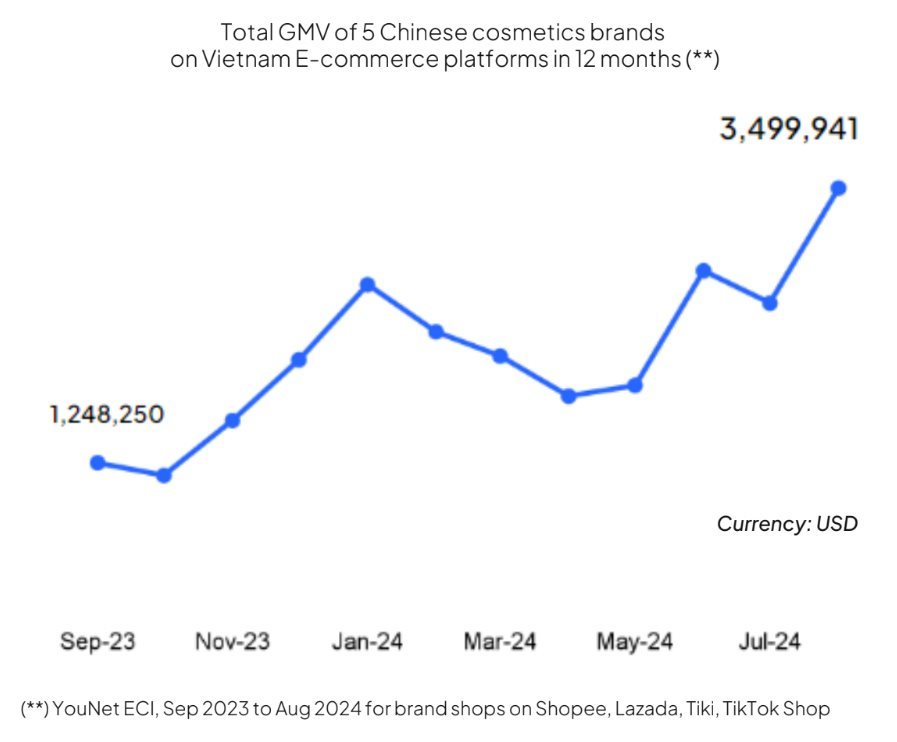

Accompanying the high level of social media engagement is impressive revenue performance. YouNet ECI data from four platforms: Shopee, Lazada, TikTok Shop, and Tiki, showed that the aforementioned five brands collectively generated 26 million USD (over 660 billion VND) in sales within a 12-month period (from September 2023 to August 2024).

In August 2024 alone, the total transaction value of the top 5 Chinese domestic cosmetic brands reached 3.5 million USD (nearly 89 billion VND), reflecting a remarkable 180% growth compared to September 2023. Mai Cam Linh predicted that this growth trajectory will continue to ascend.

Total transaction value of the top 5 Chinese domestic cosmetic brands on Vietnamese e-commerce platforms. Source: YouNet ECI.

“This exceptional growth showcases the profound impact of social media trends on brand sales, especially through the purchasing power of Gen Z. In the era of Shoppertainment, social media trends will not only aid in brand recognition but also have the potential to translate into tangible economic outcomes,”

assessed the Business Director of YouNet Media.

Understanding the “Free-Spending, Fickle” Gen Z

Delving deeper into the profile of Gen Z consumers, Mai Cam Linh pointed out that they have come of age in the digital era, where access to a plethora of information, trends, and lifestyles is effortless. Consequently, they are heavily influenced by social media, technology, and, most notably, global connectivity.

“One of the key factors contributing to Gen Z’s allure is community—a sense of belonging and connection can be fostered even among strangers who share common interests and values. A prime example is the community of K-pop enthusiasts or, more recently, fans of the show ‘Anh trai vượt ngàn chông gai’

,” illustrated Linh.

As Gen Z individuals scroll through social media daily, they are readily immersed in the world of their idols or favored content creators, who promote an array of captivating products, exclusive vouchers, and enticing deals on e-commerce platforms. This leads to impulsive purchases and a “free-spending” attitude that previous generations might find astonishing.

This analysis also sheds light on another characteristic of Gen Z consumers: their relatively low brand loyalty.

According to a YouNet Media survey, 54% of Gen Z consumers admitted to frequently switching brands based on the latest trends and promotions. Only 11% consistently purchase from their favorite brands, regardless of price and trends. This presents both a challenge and an opportunity for businesses.

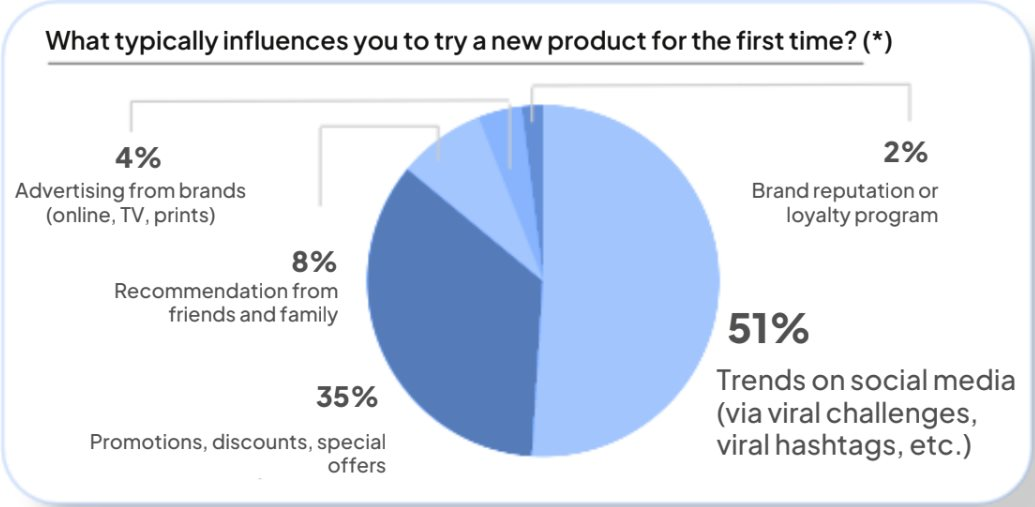

When asked about their motivations for trying new products, 51% of Gen Z consumers cited social media trends as a key influence, while 35% were drawn in by promotions and discounts.

Factors influencing Gen Z’s decision to try new products, with 51% influenced by social media trends. Source: YouNet Media.

Gen Z in Vietnam is currently shopping online an average of 1-3 times per week, with transaction values ranging from 100,000 to 500,000 VND per purchase. The primary product categories are fashion, beauty, and personal care, reflecting their focus on self-care and their pursuit of products that align with their modern lifestyles.

Given the increasing income of Gen Z and the rapid growth of e-commerce, YouNet ECI projects that by 2028, the average basket size of Gen Z for the fashion, beauty, and personal care categories could potentially increase by 2.3 times compared to 2023, reaching 28.8 USD per basket (approximately 730,000 VND). Consequently, Gen Z’s total e-commerce spending is expected to surge from 4 billion USD in 2023 to 20.3 billion USD in 2028.

To effectively reach Gen Z, YouNet recommends that businesses collaborate with influencers to host interactive livestream sessions and offer exclusive perks to create captivating experiences.

Engaging with micro-influencers (those with 10,000 to 100,000 followers) who embody a similar lifestyle is another promising approach to attract and connect with Gen Z.

“Jollibee Captivates 1.5 Million Students with its “Fun Learning Class” Event”

With a mobile playground right at their doorstep, Jollibee successfully captivated 1.5 million students by bringing the fun to their school grounds. “Jollibee Happy Class” was more than just a marketing campaign; it was a testament to the brand’s connection with the youth, especially Gen Z.

“Vietnam’s Low Milk Consumption: A Cause for Concern, Says CEO Mai Kiều Liên”

Sharing at the recent Vinamilk’s meeting with investors on the financial results for the third quarter of 2024, the company’s executives unveiled impressive figures, showcasing the dairy giant’s resilience and robust performance amidst market challenges.