Illustrative Image

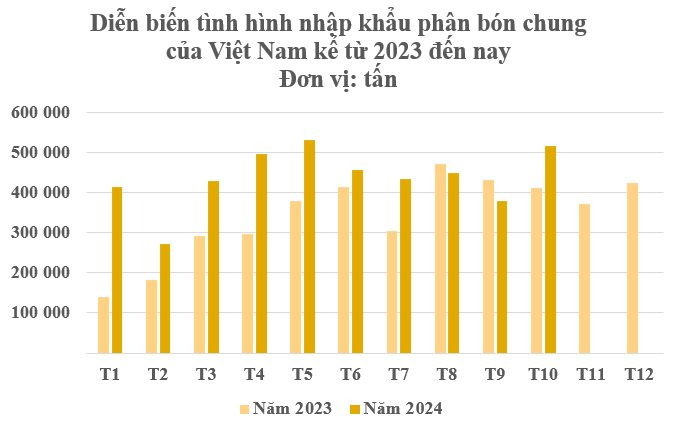

According to preliminary statistics from the General Department of Vietnam Customs, fertilizer imports to Vietnam in October reached over 515,000 tons, valued at more than $158 million, a significant increase of 36.2% in volume and 13% in value compared to the previous month. Cumulative imports in the first ten months of the year hit a remarkable milestone, surpassing 1.4 billion dollars with over 4.3 million tons, reflecting a substantial rise of 31.1% in volume and 27.1% in value compared to the same period in 2023.

The average import price stood at $329 per ton, marking a 3% decrease from the previous year.

In terms of market sources, China, Russia, and Japan emerged as the top three fertilizer suppliers to Vietnam during the first ten months. Specifically, for the largest market, China, Vietnam imported over 1.8 million tons valued at more than $588 million from its neighboring country, indicating a 13% increase in both volume and value compared to the previous year. Import prices remained stable at $318 per ton, on par with the previous year.

Russia secured the second position with over 502,000 tons, equivalent to more than $209 million, reflecting a remarkable surge of 151% in volume and 123% in value compared to the same period in 2023. The average price stood at $416 per ton, a 12% decrease.

Japan, the third-largest supplier, contributed over 329,000 tons valued at more than $30 million, witnessing a 14% increase in both volume and value. Notably, import prices from Japan were significantly lower than those from other markets, at $92 per ton.

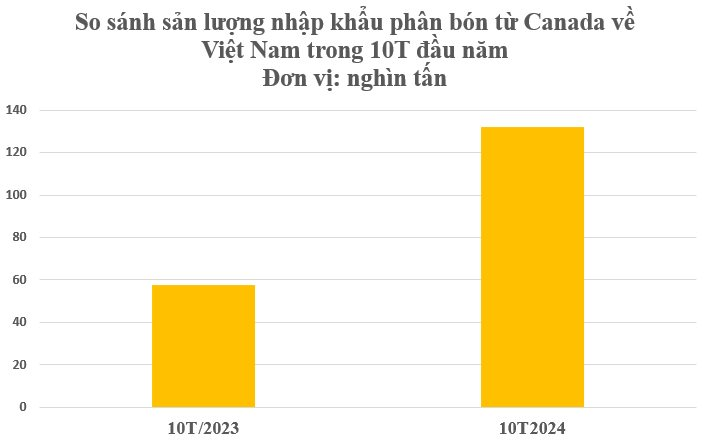

Aside from the three dominant markets mentioned above, Canada stands out as a country that has significantly increased its fertilizer exports to Vietnam. Among the leading markets, Canada ranks sixth in terms of volume and second in growth rate, with over 132,000 tons valued at more than $42 million. This represents an impressive surge of 128% in volume and 93% in value compared to the same period in 2023. The average import price from Canada was $319 per ton, a 15% decrease.

Canada boasts a robust fertilizer production industry, ranking fourth globally in terms of output. The country possesses the world’s largest potash reserves, and its potash production surpasses that of all other nations. Ontario, St. Lawrence, and the Prairie region are home to Canada’s primary fertilizer-producing centers.

In Vietnam, the total designed production capacity for fertilizer reaches approximately 20.7 million tons, including 16.1 million tons of inorganic fertilizer and 4.6 million tons of organic fertilizer. Additionally, the country imports around 3-4 million tons of fertilizer annually, while the yearly consumption demand stands at 10.4 million tons.

Currently, Vietnam is considering imposing a 5% tax on fertilizer. Specifically, the draft Law on Value Added Tax (VAT) Amendment has proposed including fertilizer as a VAT-liable commodity, with a tax rate of 5%. In contrast, the current law exempts fertilizer from VAT.

According to experts, fertilizer is an essential commodity that significantly impacts socioeconomic development, business operations, and the livelihoods of the people, especially farmers, who will be greatly affected by this proposed regulation.

The Minister of Finance has assured that the Ministry will carefully consider the diverse opinions regarding the 5% VAT imposition on fertilizer. They plan to seek further advice and conduct another impact assessment before presenting the proposal to the National Assembly in late 2024.

The Transformational Vision: Crafting a Metropolitan Masterpiece on 18ha of Redefined Land in Binh Dinh

On October 30th, the People’s Committee of Binh Dinh province approved the conversion of forest land for the An Quang Urban and Tourism project in Cat Khanh commune, Phu Cat district. The project, undertaken by An Quang Holdings JSC, encompasses a total area of 18.33 hectares, marking a significant step in the province’s development plans.

“Sumitomo Corporation and CNCTech Group Sign a Strategic Memorandum of Understanding”

On November 18, 2024, Sumitomo Corporation, a leading multinational conglomerate, and CNCTech Group, a prominent Vietnamese industrial technology and infrastructure services company, formalized their strategic partnership. This milestone signifies a pivotal juncture in their shared vision to develop sustainable and intelligent urban and industrial projects in Vietnam.