FiinRatings has just released its updated report on the corporate bond market for October and the first ten months of 2024.

TOTAL ISSUANCE VALUE FOR THE FIRST TEN MONTHS OF 2024 INCREASED BY 60% YEAR-ON-YEAR

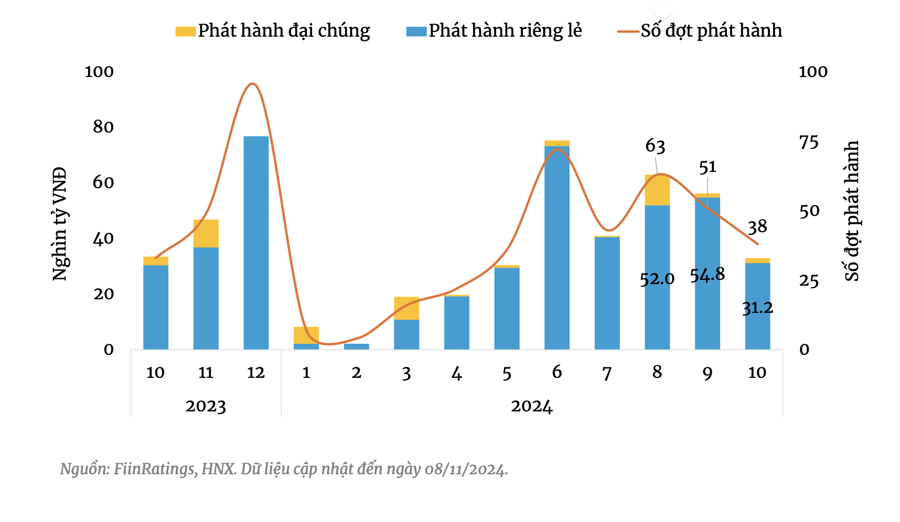

Accordingly, the primary market in October 2024 recorded a total issuance value of 33 trillion VND with 38 issuances, a decrease of 41.4% from the previous month but an increase of 1.6% from the same period last year. This was the month with the lowest issuance value since July this year, mainly due to the slowdown in the activities of the leading industry group, which is the credit institution group, after significant issuances in September to meet the State Bank’s requirements on safety ratios at the end of Q3.

In the first ten months of 2024, the total issuance value of the entire market reached nearly VND 348 trillion, an increase of nearly 60% over the same period last year. Of this, the total issuance value of green, social, and sustainable bonds reached nearly VND 6.9 trillion, accounting for about 2% of new issuances since the beginning of the year.

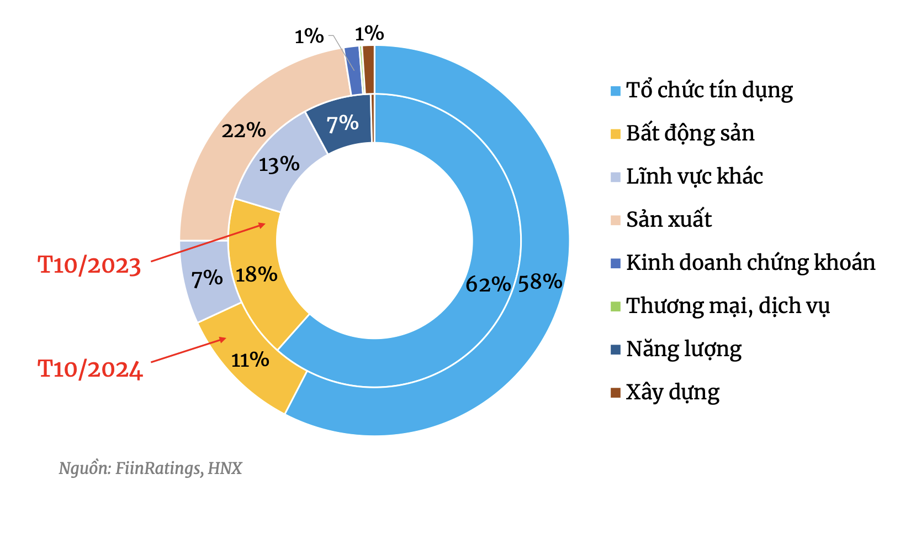

In terms of industry structure, the group of credit institutions still accounted for the highest proportion (58%) of issuance value. However, this proportion has decreased significantly compared to previous months (over 80%) due to the large-value bond issuances of many other industry groups in October 2024, resulting in a relatively diverse industry structure.

Some notable non-bank enterprises that issued large amounts of bonds in October include Vinfast (VND 6,000 billion), Vinhomes (VND 2,000 billion), and Vietjet (VND 2,000 billion).

Notably, in October, there was a VND 1,000 billion bond lot issued by I.D.I Multinational Investment and Development JSC (in the seafood industry) and guaranteed by GuarantCo. This was also the first green bond issuance by a non-financial enterprise this year.

ABOUT 10,000 BILLION DONG OF BOND PRINCIPAL IS AT RISK OF DELAY IN THE LAST TWO MONTHS OF THE YEAR

The corporate bond repurchase activities in October 2024 reached nearly VND 17.5 trillion (-14.5% compared to September), bringing the total repurchase value in the first ten months of 2024 to VND 146.3 trillion (-16.3% over the same period last year).

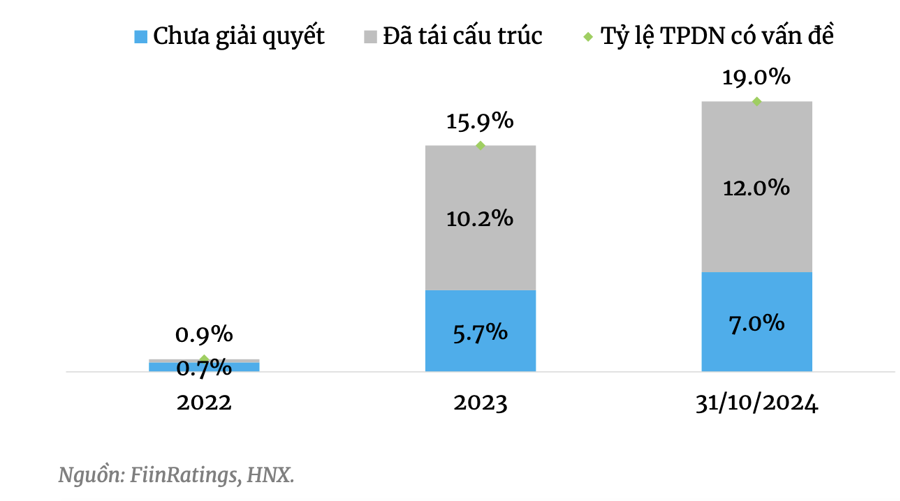

The pressure of bond maturities in the last months of 2024 is VND 54.4 trillion, especially in December, with more than VND 43 trillion, mainly concentrated in the non-financial enterprise group, specifically in the real estate and manufacturing industries (mainly in the industrial production and automobile sectors).

“Of this, we estimate that about VND 10 trillion of bond principal is at risk of delayed repayment by year-end from a few real estate enterprises with poor financial health,” said FiinRatings in its report.

In October 2024, the total trading value of corporate bonds (both publicly issued and privately placed) in the secondary market exceeded VND 117 trillion.

The average daily liquidity in October reached nearly VND 5.1 trillion, up 4% from the previous month. Specifically, the average daily trading volume of publicly issued and privately placed bonds increased by 13% and 3%, respectively, compared to September. The trading value through the agreement method (all of which were privately placed bonds) increased by 49.3% compared to September and accounted for 0.13% of the market’s liquidity.

The banking and real estate sectors still accounted for the majority of the trading value in October, with a proportion of 45.9% and 29.3%, respectively. The trading value of bank bonds increased compared to September by 33%. Meanwhile, the trading value of real estate bonds increased slightly by 1%. At the same time, the tourism and entertainment sector and other industry groups became more active, with a significant increase in trading values.

The Central Bank Governor Unveils a Special Relief Package: A VND 405 Trillion Loan Facility with Subsidized Interest Rates to Support Businesses and Individuals Affected by Natural Disasters

The Governor of the State Bank of Vietnam (SBV) has instructed credit institutions to focus on implementing solutions to support businesses and individuals affected by the recent typhoon. This includes debt restructuring and maintaining the current debt group classification as per existing regulations. The SBV has also directed credit institutions to consider reducing interest rates for those impacted by the storm, demonstrating a commitment to providing relief during challenging times.

“HCM City Credit Up 6.87% in October 2024”

As of late October 2024, Ho Chi Minh City’s total outstanding credit reached an impressive VND 3,785 trillion, reflecting a steady growth of 0.98% from the previous month and a significant 6.87% increase compared to the end of 2023. This indicates a consistent expansion in the city’s credit activities over the past few months.

VN-Index Retreat: Strategizing for the Savvy Investor

I hope this title suggestion captures the essence of your prompt. Let me know if you would like me to tweak it or provide other variations.

With an air of cautious optimism, most securities companies are advising investors to approach the upcoming trading session with prudence. While the market sentiment is generally positive, it’s important to remain vigilant and make well-informed decisions.