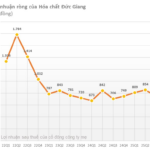

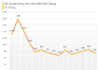

Four years after the entry into force of the Vietnam-EU Free Trade Agreement (EVFTA) in August 2020, the European Union (EU) has become Vietnam’s top trading partner, with an estimated export turnover of over $200 billion in the four years, growing from 12% to 15%. In July 2024 alone, Vietnam’s trade surplus with the EU was estimated at over $20.2 billion, a 19.4% increase compared to the same period in 2023. The EU is among the top six export and import markets for Vietnam.

A survey by the European Chamber of Commerce in Vietnam (EuroCham) revealed that the EVFTA has significantly boosted Vietnam’s exports to Europe, surging from €35 billion in 2019 to over €48 billion in 2023. This growth is evident in sectors such as electronics, textiles, footwear, agriculture, and seafood, following the tariff reduction roadmap under this FTA.

The European Union (EU) is currently Vietnam’s top trading partner.

According to Mr. Dinh Sy Minh Lang, from the Europe-America Market Department (Ministry of Industry and Trade), the EU market favors imported goods with sustainable value. Environmentally friendly products, fair trade, ethical practices, and sustainable employment in supplying businesses have gained strong support from consumers. As a result, sustainable supply chains are also attracting robust support from EU retailers.

“A survey on sustainable sourcing and products in the EU market showed that 85% of retailers stated that sales of sustainable products had increased over the past five years, and 92% expected sales of these products to grow in the next five years,” said Mr. Lang.

Similarly, in the UK market, Mr. Nguyen Canh Cuong, former Commercial Counselor of Vietnam in the UK, pointed out that there are still many opportunities for Vietnam to export goods to the country. UK consumers value quality, sustainability, and unique value propositions. They are willing to pay a premium for products that meet quality standards and demonstrate a commitment to environmental protection. However, the UK market has stringent technical standards and regulations regarding food safety and the environment, so businesses need to be well-prepared to meet these requirements and stand out in a highly competitive environment.

“The advantage of the Vietnam-UK Free Trade Agreement (UKVFTA) is opening up significant opportunities for Vietnamese businesses by eliminating tariffs on over 99% of tariff lines within six years. Industries such as seafood, textiles, footwear, wood products, and processed agricultural products have benefited considerably. For instance, the export turnover of frozen basa and shrimp to the UK in 2024 exceeded $30 million, a more than 10% increase. Textiles made from natural and sustainable fibers are attracting UK consumers. Additionally, the UK is the second-largest import market for Vietnam in Europe, with a high demand for modern wooden furniture,” said Mr. Cuong.

Recalls and Returns of Export Goods Can Be Extremely Costly

Mr. Nguyen Thanh Hung, a senior economic expert and former Deputy Head of the International Relations Department of the Government Office, shared some principles to mitigate risks in exporting formalities to the EU market. Since May 13, 2024, the EU has implemented new regulations on the import of goods from foreign countries. Accordingly, from June 3, 2024, all businesses related to exports from Vietnam to the EU must declare data before the goods arrive in the Import Control System (ICS2).

It is more cost-effective for businesses to bring back goods from the EU than to have them destroyed on the spot.

Additionally, one of the newest and most critical issues that businesses need to consider regarding exports to the EU is the Carbon Border Adjustment Mechanism (CBAM). The EU is piloting this mechanism during a transition period starting on October 1, 2024, and will fully implement it in 2026. Recently, some batches of Vietnamese rice were recalled from the market due to exceeding the allowable limit for pesticide residues. Although the excess was insignificant, the rice had to be recalled and either destroyed or returned to Vietnam. It would be more cost-effective for businesses to bring back goods from the EU than to have them destroyed on the spot.

“The recall of exported products and the subsequent widespread media coverage will significantly impact the image of Vietnamese goods, which has already struggled to establish its reputation,” warned Mr. Hung. He also noted that returning goods to the exporting country is extremely challenging. If the goods are inspected and returned at the border, the procedure is not complicated. However, if the import is recalled after a year, the re-import procedure into Vietnam is very complex. “It took more than two months for a batch of returned goods to clear customs, and the paperwork for the Vietnamese business to refund the EU business is still ongoing,” Mr. Hung worriedly shared.

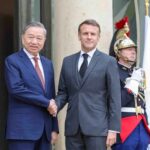

Elevating Ties: Vietnam and France Upgrade Relations to Comprehensive Strategic Partnership

With this decision, France becomes the first country in the EU to establish a Comprehensive Strategic Partnership with Vietnam.

Unlocking Opportunities: The Path to Success in the EU Market

The upcoming visit from Slovenia’s transport and logistics experts offers a strategic opportunity for Vietnamese businesses to strengthen their presence in Southern and Central Europe. This delegation visit opens doors for local enterprises to explore new avenues of collaboration, particularly in terms of accessing fresh routes for the efficient transportation of goods into the heart of the EU market.