The market witnessed a strong wave of bottom-fishing this afternoon. While it’s uncertain if 1200 is the bottom, it’s evident that funds are “lying in wait” around this level. The current corrective phase resembles the previous two instances, albeit with a milder amplitude, and when panic reaches its peak, that’s when money comes in for the “rescue.”

This bottom-fishing session significantly improves sentiment, which is more positive than focusing on how much prices or indices recover. The intense selling pressure over two and a half sessions filled with fear has forced the release of loosely held positions that were desperately “holding onto losses” over the past period. Essentially, corrective phases are similar, and they need to be pushed to a climax in the final stage.

Towards the end of today’s session, the VNI failed to maintain its position above the reference level due to some large-cap stocks remaining in negative territory or turning red during the last 15 minutes of continuous matching and unable to rebound during the ATC phase. However, the recovery amplitude in individual stocks was better, with the breadth remaining balanced and prices rebounding strongly from their lows. Overall, in sessions like today’s bottom-fishing session, the most critical factors are the recovery amplitude and volume during that period. The morning’s panic didn’t push liquidity to an extreme level, and the selling pressure in the afternoon couldn’t stop the upward momentum.

It’s highly likely that the market will experience further strong shakes to exhaust loosely held positions. However, stocks with strong fund flows will maintain a narrow amplitude and may even avoid further declines. Today’s low (in individual stocks) serves as a reference level, while indices may be influenced by large-cap stocks. After a period of patient waiting, fund flows now have a significant advantage as buying interest has increased considerably, and they need to decide on their course of action.

The market still has one more futures expiry session ahead, and there’s no new information on the horizon. However, the return to a balanced supply-demand dynamic is the best outcome at this point. When the chessboard is “reset,” a new game must commence. Any information at this stage is secondary and merely serves as an excuse to create consensus. Ultimately, the essence remains the conclusion of the expectation transfer process.

I maintain the view that this market is attractive for buying, and short-term losses are not a significant concern if well-controlled. This is a region where substantial investment can be made!

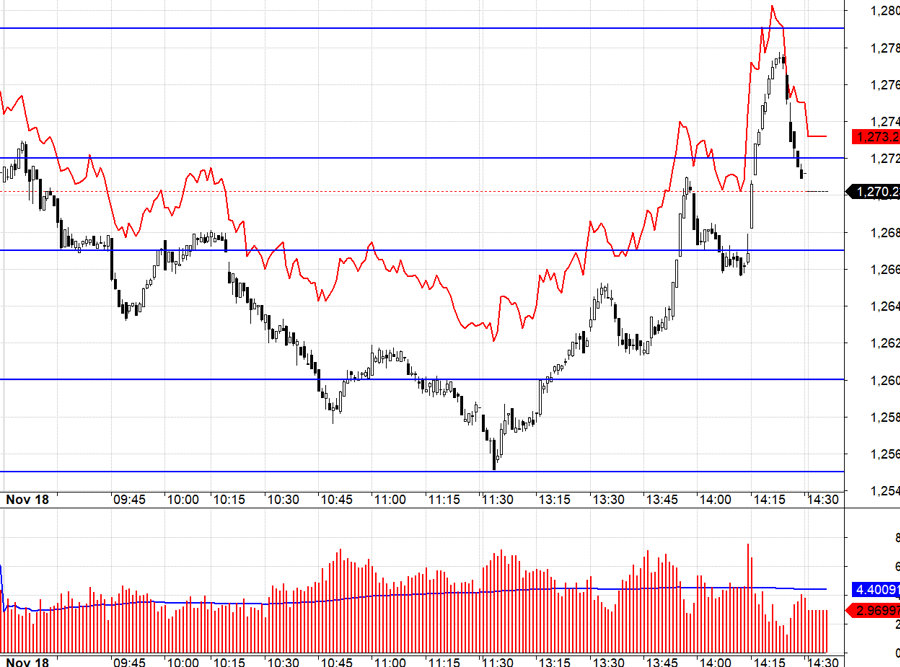

Today’s futures market, after a brief initial “fear” phase – with the basis narrowing significantly – displayed remarkable resilience. When the VN30 index breached the 1267.xx level for the second time, the difference was less than three points. However, it still presented a good short setup due to the appropriate stop-loss point, and the VN30 entered the range expansion zone with the first target at 1260.xx and the next at 1255.xx. The VN30 bounced off precisely at 1255.

The recovery phase in the afternoon was more challenging to trade due to the basis widening to nearly six points. It’s advisable to wait for the VN30 to return above 1260.xx to assess whether large-cap stocks encounter strong buying resistance. The stop-loss level, equivalent to half the basis, also needs confirmation on the VN30 index when crossing a clear level. Generally, it’s impossible to determine the recovery amplitude, so it’s best to trade in short segments.

As F1 is approaching its expiry, the basis will likely start narrowing, making it easier to trade. After today’s bottom-fishing and recovery session, sellers will likely slow down. The strategy is to look for buying opportunities in stocks and consider going long in the futures market.

The VN30 closed today at 1270.23. Tomorrow’s immediate resistance levels are 1272, 1279, 1290, 1294, and 1302. Support levels are 1268, 1260, 1255, 1249, and 1242.

Disclaimer: “Stock Market Blog” reflects the personal views of the author and does not represent the opinions of VnEconomy. The perspectives and assessments are those of the individual investor, and VnEconomy respects the author’s style and viewpoint. VnEconomy and the author are not responsible for any issues arising from the investment opinions and perspectives presented.

The Stock Market Observer: Bottom Fishers Out in Force

Today’s market showed a significant boost in positivity, not just in terms of the upward index movement but also in the balance and strength of the bottom-fishing money flow. The shift from indiscriminate selling to price-conscious selling and a tug-of-war is a notable change in psychology and risk assessment.

The Looming Threat of a Market Downturn: Navigating the Risks Ahead

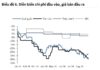

The VN-Index witnessed its fourth consecutive session of losses, dipping below the 200-day SMA. This downward trend indicates a negative shift in market sentiment. Accompanying this decline is a drop in trading volume below the 20-day average, reflecting heightened investor caution. The MACD indicator continues to plummet, reinforcing the sell signal and suggesting that the short-term outlook remains pessimistic.

“VPBank’s Strategic Director: Stocks Often Bottom Out in November, Investors Gear Up for the ‘Holiday Rally’”

With the “Tet rally” in the Vietnamese market, VPBank Securities experts have noted that, on average, the VN-Index has risen by almost 8% every year from November to April over the last six years.

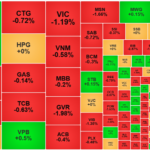

The Market Crash: Small Caps Hold Their Ground

The major stocks witnessed a sharp decline during the afternoon session, dragging down the VN-Index. Many other stocks followed suit, with the majority of the large-cap stocks exerting downward pressure on the index. Meanwhile, the mid-cap and small-cap stocks displayed a relatively strong resistance, although there weren’t many significant gainers in this group either.