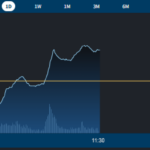

The market saw a few more minutes of price suppression at the start of the afternoon session before bottom-fishers stepped in. The breadth changed slowly, but the index rose quickly, indicating that large-cap stocks were leading the charge. As the strength spread, hundreds of stocks crossed into positive territory, and hundreds of others narrowed their losses significantly. The market had a strong signaling session around the 1200-point level.

The VN-Index’s lowest point today was 1204.6 points, corresponding to an adjustment range of about 6.8% for the current wave. The previous two corrections in April and July this year were both over 8%.

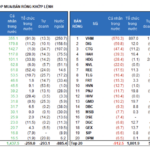

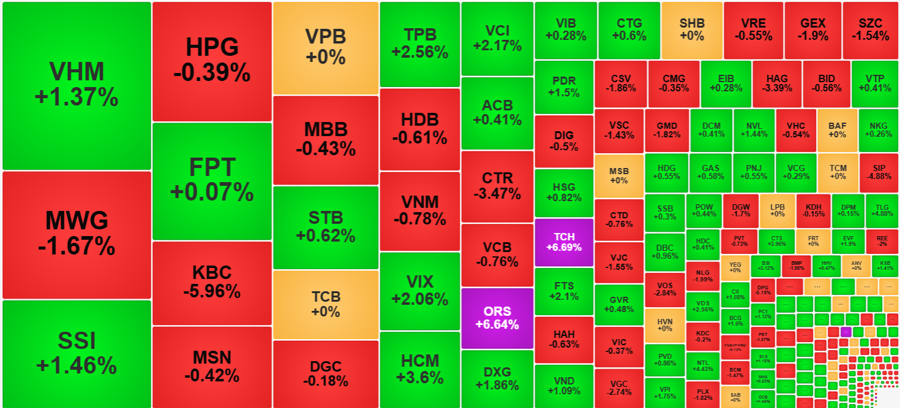

Bottom-fishing money was quite active in the afternoon session, creating a broad recovery. At its lowest point, the VN-Index had 68 stocks rising/304 falling, but by the end of the session, there were 184 gainers/181 losers. Thus, hundreds of stocks successfully reversed the downtrend.

In addition, if we look at intraday movements, although there were still hundreds of stocks in the red, their prices did not fall as deeply as in the morning or early afternoon. On the HoSE floor, only 28 stocks closed at their daily lows. Furthermore, out of the 181 stocks in the red, 76 fell by more than 1%, and only 23 of those had significant trading volume of 10 billion VND or more. The five stocks with the highest liquidity of over 100 billion VND also witnessed a strong price recovery: MWG rebounded 3.15% from its intraday low, closing down 1.67% with a turnover of 703 billion VND; KBC rebounded 1.1% and closed down 5.96%, matching 373.3 billion VND; CTR rebounded 1.22% and closed down 3.47%, with a volume of 194.8 billion VND; GEX rebounded 1.12% and closed down 1.9%, trading 124.1 billion VND; SZC rebounded 4% and closed down 1.54%, with a volume of 121.5 billion VND.

In terms of daily price recovery, the HoSE floor had 138 stocks rising by 2% or more, accounting for 37.4% of the total number of traded stocks. If we consider a recovery range of 1%, this figure rises to 63.4%.

Today’s gainers were also notable, with 76 stocks closing more than 1% higher. Securities stocks made a strong impression, with SSI up 1.46% and a turnover of 600.3 billion VND; VIX up 2.06% with 235.4 billion VND; HCM up 3.6% with 233 billion VND; VCI up 2.17% with 201.2 billion VND; OSR up 6.64% with 166 billion VND; and FTS up 2.1% with 106.4 billion VND… Only VFS, TCI, and DSE were in the red among securities stocks. Nearly two dozen stocks in this group rose more than 2%, indicating the market’s high sensitivity. If this downtrend ends, securities companies will have a great opportunity to build attractive investment portfolios for the fourth quarter.

In addition to securities stocks, many real estate stocks also showed strength. VHM staged a spectacular comeback in the afternoon session, rising more than 3% from its intraday low and ending up 1.37%. This stock also had high liquidity, with a turnover of 924.5 billion VND. DXG closed up 1.86%, PDR up 1.5%, TCH up 6.69%, and NVL up 1.44%… These stocks all recovered by 3%-7% in the afternoon.

The only regret today was that large-cap stocks failed to keep the VN-Index in the green. The index was up as much as 6.8 points at one point but ended up down 1.45 points in the ATC session. VCB fell 0.76%, and BID fell 0.56%, the two largest stocks by market cap in the index. In addition, HPG fell 0.39%, and VIC fell 0.37%. The VN30-Index also closed down 0.08%, with 12 gainers and 14 losers.

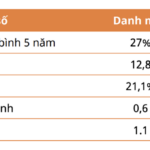

Foreign investors continued to sell heavily in the afternoon session, but this can be seen as a positive signal for domestic money. Bottom-fishing demand from domestic investors successfully pushed up prices and absorbed foreign selling. About 489.7 billion VND was withdrawn by foreign investors in the afternoon, out of a total selling value of 1,436.4 billion VND. For the whole session, foreign investors net sold 1,456 billion VND.

The bottom-fishing money from domestic investors was also the reason for the afternoon’s liquidity surge, which was 32% higher than in the morning, reaching 8,084 billion VND. Stocks that were net sold by foreign investors in the hundreds of billions, such as SSI, VHM, MWG, HDB, and VNM, also saw some recovery, with some even rising strongly.

Although the VN-Index did not fully reverse today, stocks started to recover quite impressively. This indicates that there is bottom-fishing money waiting around the 1200-point threshold of the index.

Stock Market Blog: Cash “Stalking” the Bottom

The market witnessed a strong wave of bottom-fishing this afternoon. Although it’s uncertain whether 1200 is the bottom, it’s evident that funds are “lying in wait” around this level. The current correction is similar to the previous two instances—even with a smaller amplitude—and as panic reaches its peak, that’s when money comes in for the “rescue.”

The Savvy Investors: Seizing Opportunities in a Downturn

Domestic institutional investors today bought a net 729.7 billion VND, with a net purchase of 721.5 billion VND in matched orders. Individual investors also bought a net 873.8 billion VND.

The Market’s “Rebound Rally”: Foreign Selling “Accepted”, Bottom Fishers “Strike” from 1200-Point Region, Liquidity Nearly Doubles

Yesterday’s pessimistic performance led to a negative opening for the market this morning, with the VN-Index dipping as low as 1,197.99 points and the number of declining stocks outpacing advancers fivefold. However, an unexpected turnaround occurred as strong buying power once again demonstrated its strength, driving a series of upward reversals. Turnover on the two exchanges is up nearly 90% from yesterday’s morning session, even as foreign investors continue to offload significant net sell positions.