The sharp declines in the last two sessions of the past week have significantly dampened market sentiment, and experts are also very cautious when mentioning the “bottom” of this correction phase.

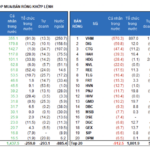

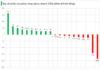

The VN-Index evaporated nearly 34 points, equivalent to a 2.7% drop last week, the sharpest fall in the last five months. Most of the decline occurred in the last two days (-27.5 points) combined with high liquidity, confirming that selling activities have intensified.

Experts believe that the market is entering a “washout” phase, although we need to wait for a few more sessions to see higher liquidity. On the other hand, although liquidity has slightly improved in the sharp falling sessions of the past week, the buying force to catch the bottom has not been effective, and even weakened quickly after that.

Regarding the factors that influenced the market, exchange rates remain the main story. Experts believe that the current exchange rate fluctuations are different from the second quarter of 2024 when the market was concerned about a change in the Fed’s interest rate reduction trend. The variables in policies during President Donald Trump’s term are reflecting on the upward trend of the US dollar and bond yields. However, there are still opinions that exchange rate pressure will cool down towards the end of the year.

Experts are still very cautious when assessing the bottom of this correction phase. After the VN-Index broke through the 1220-point threshold, lower thresholds such as 1200 points and 1180 points are being considered. This caution has caused bottom-fishing transactions not to be executed yet.

The current situation is different from the April period, as the swap rate has turned positive, which is one of the factors supporting the USD/VND exchange rate. In addition, the “inflow” source is also quite good, enough to compensate for the demand of the Treasury, so the market does not need the intervention of the State Bank in this period.

Nguyen Thi My Lien

Nguyen Hoang – VnEconomy

The two extremely “mentally torturous” sessions at the end of last week pushed the VN-Index down below the 1220-point mark. The threshold you expected during this decline seems to be becoming a reality. The inflow of money to catch the bottom created good liquidity, but the effect on prices was limited. Has the market entered a “wash-out” state?

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

The market witnessed a negative decline last week, especially a sharp drop in the last two sessions, breaking through the bottom of 1240 and falling to the next support zone at 1185-1220. Although the last session was accompanied by high trading volume, indicating the possibility of money coming in to support the market, the price action has not reflected this clearly. I think we need to wait a little longer. If the market continues to fall sharply with higher trading volume and we see more panic selling during the session and the emergence of a “pullback” candle (or a quick recovery in the next session), it will support the possibility of a “washout”, and then we may soon see a short-term recovery.

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

In my observation, there is still a risk of a “washout” session with high liquidity. Although there are bottom-fishing activities, the buying force shows weaker momentum compared to the selling side during the tug-of-war, thus losing control. With the current downward momentum, the index is likely to retreat to a threshold that could trigger more “margin calls”, further driving the panic selling trend.

Le Duc Khanh – Analysis Director, VPS Securities

I assess that the area below the 1240-point threshold is a strong support zone on the December chart at 1215-1220 points. The “washout” state may occur next week, and the bottom-fishing force may increase again.

Le Minh Nguyen – Senior Director of Individual Customers, Rong Viet Securities

With the inflow of money increasing when the market fell below the 1220-point threshold, it shows that investors are monitoring the market and are ready to allocate capital when the price reaches the expected zone. However, the money flow seems to be waiting for the market to fall further before allocating more capital instead of buying and holding, waiting for the opportunity for prices to increase.

The fact that the VN-Index has not fluctuated much in the context of low liquidity recently may have discouraged investors. In addition, strong net selling by foreign investors in the two “mentally torturous” sessions has caused investors to start feeling the “heat”. When the holders leave the market and wait for better opportunities, the observing money flow starts to come in, but it seems that the buying side’s expectation is not at the current point but at a lower level. I think in the new trading week, the market is likely to enter a clear “washout” state.

Nguyen Hoang – VnEconomy

Last week, the key phrase that caused investors’ concern was “exchange rate”, as the central exchange rate was raised to the highest level of the year, surpassing the peak in April and June this year, and the Fed’s unexpected message made the chance of a December rate cut very dim. In the previous week, you also discussed the exchange rate risk, but is this the reason for the market’s strong correction, or is it just an excuse? Is this rate hike any different from the second quarter of 2024?

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

In the context of a lack of supportive information, just one negative factor appearing will be very sensitive to the general psychology of the market, especially when many macroeconomic data are not very favorable and are causing mixed expectations at the moment, and exchange rate pressure is also one of the issues.

Unlike the second quarter of 2024, the market’s reaction to the exchange rate story at the moment, in my opinion, may reflect longer-term concerns about the impact of President Donald Trump’s policies. In this scenario, the DXY index is likely to continue to hover at high levels, and the Fed’s interest rate reduction process will slow down due to the possibility of inflation returning. As a result, not only will there be a continued shift of capital out of emerging and developing markets like Vietnam, but capital market management policies will also face corresponding pressure.

Le Minh Nguyen – Senior Director of Individual Customers, Rong Viet Securities

In the second quarter, the main reason for the exchange rate increase was related to cyclical factors and adjustments after the loose policy stage. Currently, the main factor causing pressure is the message from the US Federal Reserve (Fed), as the possibility of a December rate cut has become more distant. This has increased the attractiveness of the US dollar and put pressure on the VND. US bond yields are still maintaining at high levels, leading to the outflow of foreign capital from emerging markets, including Vietnam.

Therefore, exchange rate risk is a factor affecting the market, but it can also become an “excuse” for strong adjustments when the market is in a sensitive state and lacks growth momentum.

The scenario of the VN-Index falling below the 1200-point threshold is possible if the pessimistic sentiment persists and macroeconomic factors are not well controlled. However, for the index to drop further to the 1170-point zone, a series of negative factors need to occur simultaneously. Conversely, if positive supportive signals appear, the market may find a balance at the 1200-point zone and gradually recover from there.

Le Minh Nguyen

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

I think that the State Bank’s adjustment of the central exchange rate to the highest level in history is appropriate given the developments in the world market, as the DXY index rebounded strongly to a one-year high after Mr. Trump won the US presidential election and the Fed gave a vague signal about the possibility of a rate cut in the near future.

The strong increase in the DXY index is also an important factor affecting the psychology of the domestic foreign exchange market. In addition, the high demand for foreign currency by the Treasury in this period, around 2 billion USD from September to now, has also put pressure on the exchange rate. However, I think the current situation is different from the April period, as the swap rate has turned positive, which is one of the factors supporting the USD/VND exchange rate. In addition, the “inflow” source is also quite good, enough to compensate for the demand of the Treasury, so the market does not need the intervention of the State Bank in this period. We still maintain the view that the pressure will soon subside, and the exchange rate will stabilize again by the end of the year.

Le Duc Khanh – Analysis Director, VPS Securities

Exchange rate fluctuations are event-driven and time-bound, especially after the US presidential election and the strong increase in the DXY index. The Fed still has reasons to cut rates as October inflation data rose in line with experts’ forecasts. The year-end period also coincides with the period when the State Bank absorbs foreign currency, and remittances show signs of increasing compared to other periods of the year. At this time, it is clear that the State Bank is also carefully monitoring the actions of central banks, especially the policies of the Fed, and prioritizing controlling the exchange rate through open market operations and bills. I think the end of November and December will be “easier” – the market psychology will stabilize again.

Nguyen Hoang – VnEconomy

The adjustment trend since the beginning of October has not been as strong as the two previous corrections in April and July. However, the market sentiment seems to be much more pessimistic, and there are even concerns that the VN-Index will fall below the 1200-point threshold or worse, to the 2024 bottom of around 1170 points. What is your assessment of this scenario? Is there anything “bad enough” in the market for this selling pressure to occur?

With the current downward momentum, the index is likely to retreat to a threshold that could trigger more “margin calls”, further driving the panic selling trend.

Nghiem Sy Tien

Le Minh Nguyen – Senior Director of Individual Customers, Rong Viet Securities

The market has witnessed positive third-quarter business results, but the lack of active participation from cash flow has made the general sentiment more pessimistic, and investors are waiting for the fourth-quarter results before making allocation decisions. The market is still in a state of lacking supportive information, but with sharp declines, it will be a “test” for supply and demand forces and create a new price foundation for investors to participate more in the market.

The scenario of the VN-Index falling below the 1200-point threshold is possible if the pessimistic sentiment persists and macroeconomic factors are not well controlled. However, for the index to drop further to the 1170-point zone, a series of negative factors need to occur simultaneously. Conversely, if positive supportive signals appear, the market may find a balance at the 1200-point zone and gradually recover from there.

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

In my opinion, the VN-Index will have a probability of a technical rebound when it retreats to the 1200-point psychological threshold. However, with the current downward momentum and the short-term adjustment trend dominating, the market risks facing selling pressure again when the supply at the upper resistance zones is relatively large. In that case, the mid-term support threshold at around 1180 will be more likely to provide clear support.

Le Duc Khanh – Analysis Director, VPS Securities

Investors generally do not like and are somewhat disappointed that the VN-Index has fallen below the MA200-day indicator. Looking at the broader picture on the weekly and monthly charts, the 1200-1215-1220 point zone is a strong support zone, and the story of errors and discrepancies of 5-15 points is not the goal, and we are not ambitious about making accurate predictions. The market falling into the “oversold” zone will trigger strong rebound sessions with high liquidity. In my opinion, investors should not worry too much about the general trend but pay attention to individual stocks.

Nguyen Thi My Lien – Head of Analysis, Phu Hung Securities Joint Stock Company

In my observation, the market sentiment has become more pessimistic, mainly because the VN-Index has lost the MA200 line, while in the two previous corrections, it still maintained this level, which has made investors worry that the current downward trend may continue.

A scenario of the 2024 bottom of around 1170 points can also be considered, not that it is impossible, because this is also the lower boundary of the 1180-1300 sideway channel. This scenario will be further supported if there are unfavorable developments in the foreign exchange market or the emergence of other unfavorable information.

Nguyen Hoang – VnEconomy

Your view of preserving resources in previous weeks has been effective, as stock prices have fallen significantly. Have you started to allocate capital strongly again? What is the appropriate equity ratio at this time?

The market falling into the “oversold” zone will trigger strong rebound sessions with high liquidity. In my opinion, investors should not worry too much about the general trend but pay attention to individual stocks.

Le Duc Khanh

Nghiem Sy Tien – Investment Strategy Specialist, KBSV Securities

I observe that the current supply-demand relationship in the market is relatively unfavorable, and the trend of active selling is still dominating most trading sessions. Therefore, I have not reopened buying positions yet and will take advantage of the rebound sessions to restructure my portfolio to a safer level.

Ng

The Proactive Investor: Navigating the Stock Market

The market is experiencing significant volatility around the 1200 mark for the VNI, indicating that this area is a key supply-demand battleground. Today’s bottom-fishing efforts were more effective than those on November 18th, with a notable improvement in buying power.

The Market’s “Rebound Rally”: Foreign Selling “Accepted”, Bottom Fishers “Strike” from 1200-Point Region, Liquidity Nearly Doubles

Yesterday’s pessimistic performance led to a negative opening for the market this morning, with the VN-Index dipping as low as 1,197.99 points and the number of declining stocks outpacing advancers fivefold. However, an unexpected turnaround occurred as strong buying power once again demonstrated its strength, driving a series of upward reversals. Turnover on the two exchanges is up nearly 90% from yesterday’s morning session, even as foreign investors continue to offload significant net sell positions.

The Market Dip: Exploring Stocks with Potential for Profitable Gains

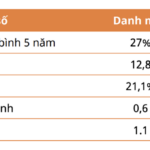

The banking sector stocks form a significant part of the portfolio, thanks to their ability to generate stable profits. Alongside this, the real estate, transportation, and retail sectors present potential for mid- to long-term growth.