The State Bank of Vietnam has listed the central exchange rate at VND 24,288 per USD on November 13, an increase of 21 VND from the previous day. This is the highest level in history for the central exchange rate since the State Bank of Vietnam applied this mechanism at the beginning of 2016.

Accordingly, with a 5% margin, the current USD/VND exchange rate that commercial banks are allowed to trade within the range of VND 23,074 – 25,502 per USD. The reference buying and selling rates for USD are still being maintained by the State Bank’s Trading Center at the levels of VND 23,400 – 25,450 per USD. USD/VND exchange rates at commercial banks continue to be adjusted upwards.

The selling price of USD has increased to the ceiling level. All major banks currently list the selling price of USD at VND 25,502 per USD, the highest level in history.

The selling price of USD set a new record after cooling down. |

The selling price of USD at banks has continuously been listed at the permitted ceiling level for the past 3 weeks. The buying price of USD at many commercial banks is also on an upward trend.

Specifically, this afternoon, Vietcombank bought USD at VND 25,150 per USD, up VND 60 from the previous day; BIDV also increased by VND 46, bringing the buying price to VND 25,180. VietinBank raised the buying price of USD to VND 25,163 per USD, an increase of VND 15.

In the private banking sector, Techcombank increased the buying price of USD to VND 25,165 per USD, up VND 18. Sacombank also raised the buying price of USD to VND 25,170 per USD, VND 10 higher.

Since the beginning of the year, the USD rate at banks has increased by about VND 1,100, equivalent to a 4.4% increase.

Meanwhile, in the free market, USD exchange rates are traded by foreign exchange outlets at the levels of VND 25,540-25,650 per USD (buy-sell), a decrease of about VND 70 in both buying and selling transactions compared to the previous day. Although this is not a record-breaking increase, from the beginning of the year until now, the free USD rate has increased by about VND 900, equivalent to a 3.6% increase.

The USD/VND exchange rate surged in the context of a strong appreciation of the US dollar globally.

Previously, the State Bank had issued bills and supported system liquidity through open market operations to cool down the exchange rate.

In response to a question raised at the National Assembly on November 11, Governor Nguyen Thi Hong said that since 2016, the State Bank has applied synchronous measures, including an important solution to persistently manage inflation control and stabilize the value of VND. This is accompanied by interest rate and exchange rate policies to ensure that holding VND is more attractive and beneficial, such as reducing the USD interest rate to 0%, implementing solutions to stabilize the exchange rate, and issuing circulars to restrict enterprises from buying in advance of their actual foreign currency needs.

In addition, the State Bank manages the exchange rate based on the central exchange rate, which can fluctuate up and down daily. This helps reduce speculation and hoarding of foreign currencies and reduces the dollarization of the economy. As a result, people and enterprises with USD will sell it to credit institutions.

According to the State Bank’s leadership, this policy solution is very effective and beneficial for macroeconomic stability. Evidence of this is the country’s foreign exchange reserves, which have increased to hundreds of billions of USD at times, compared to only about USD 30 billion at the end of 2015.

“If we increase the foreign currency deposit interest rate, it means that those holding foreign currency will benefit from both exchange rate fluctuations and deposit interest rates. This could create a psychological shift from VND to foreign currency, leading to potential risks,” said the Governor.

The Governor of the State Bank emphasized that Vietnam’s policy is to combat goldization and limit dollarization. Therefore, the policy of applying a 0% interest rate on foreign currency deposits will encourage enterprises and individuals with foreign currency to sell it to banks and convert it into VND for investment in production and business activities.

Ngoc Mai

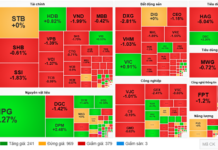

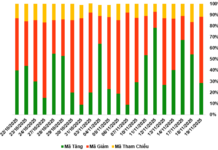

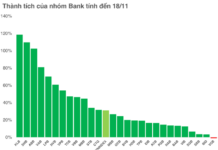

The Flow of Funds: Has the Market Reached the “Wash-Out” Phase?

The sharp declines in the last two sessions of the past week have significantly dampened market sentiment, with experts also being cautious when referring to the “bottom” of this correction phase.

The Golden Opportunity: “Rings of Fortune: A Glittering Investment”

This morning (November 17th), gold ring prices continued to surge. Many gold businesses are once again limiting the number of sales per day, and some have even sold out of gold rings entirely.