The third quarter saw a slew of positive news for the economy, including the easing of global monetary policies after the Fed’s first 0.5% rate cut; promising macro signals with Q3 GDP growth at 7.4% year-on-year and credit growth accelerating to 9% compared to the beginning of the year; and the issuance of Circular 68, allowing foreign institutional investors to buy stocks without full payment upon order placement.

However, the VN-Index experienced mixed performance in Q3, consistently facing challenges and failing to conquer the 1,300-point mark.

Specifically, the VN-Index rose 3.4% in Q3 to 1,287 points, up 13.7% year-to-date. The average trading volume in Q3/2024 reached 646 million shares, a decrease of over 24% compared to Q2/2024. The average trading value in Q3/2024 exceeded VND16.5 trillion, a decline of more than 25% compared to the previous quarter.

Foreign investors continued to net sell over VND14.1 trillion in Q3/2024, but the selling pressure eased significantly compared to VND38.1 trillion in Q2/2024.

In Q3, the group of stocks influencing the market was polarized, and the group with a less positive impact on the market experienced significant fluctuations. Telecommunications led the decline with a drop of over 35%, followed by Travel & Entertainment and Goods & Industrial Services, which fell 16% and 11.6%, respectively. In contrast, the Banking and Financial Services groups topped the gainers, rising 10.4% and 9.1%, respectively.

The market’s P/E ratio is at a low level since 2023. Compared to other stock markets in the region, the VN-Index has a relatively attractive P/E ratio.

Notably, after a sharp decline lasting from last week to this week, the VN-Index again retreated towards the 1,200-point mark, with the PE ratio hovering around 12 times. According to statistics, 20-30% of stocks are trading below the RSI 30 threshold. The RSI (Relative Strength Index) is an indicator that measures price volatility, reflecting the relative strength or weakness of an index/stock compared to its own history. The indicator ranges from 0 to 100. When RSI falls below 30, it indicates that the price is oversold, and when RSI rises above 70, it suggests overbought conditions.

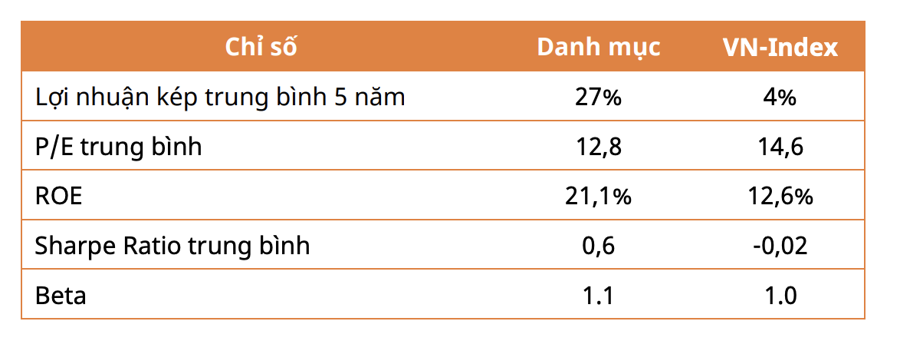

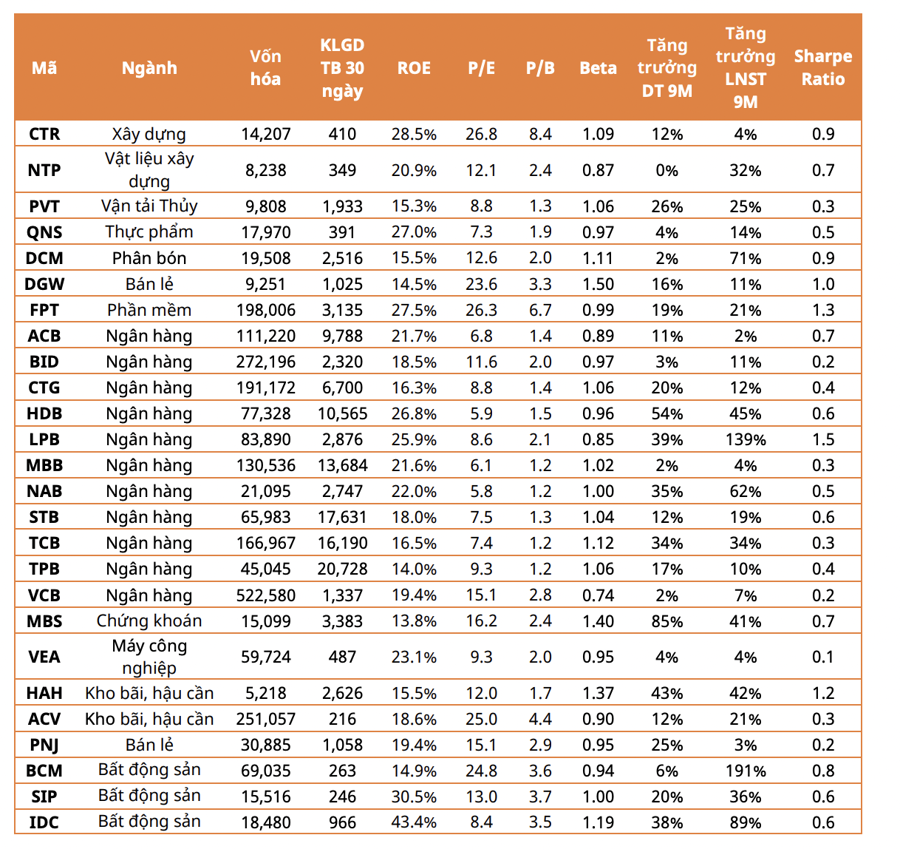

After the recent developments, Mirae Asset Securities has constructed an investment portfolio for the coming period. This portfolio is based on the financial results of the first nine months of 2024, focusing on companies with solid financial foundations and sustainable growth potential.

The stocks in this portfolio were selected based on the following criteria: market capitalization above VND5,000 billion; average trading volume higher than 100,000 shares to ensure liquidity; return on equity (ROE) higher than that of the VN-Index, indicating high profitability and efficient business operations.

The companies’ revenue and profit for the first nine months of 2024 must show positive growth, ensuring stability and good financial health.

The Sharpe Ratio of the portfolio must be positive, reflecting a favorable risk-adjusted return. The Sharpe Ratio assesses risk-adjusted performance, helping investors consider not only profits but also the associated risks. It is calculated based on the difference between the expected return of the portfolio and the risk-free interest rate, divided by the standard deviation of the return. A positive Sharpe Ratio (>0) is desirable, indicating efficient performance, while a negative value may suggest excessive risk.

Through rigorous screening, the portfolio is predominantly comprised of banking stocks due to their stable profit-generating ability. Additionally, the real estate, transportation, and retail sectors are identified as having growth potential in the medium to long term.

The stocks that meet the above criteria include ACB, BID, CTG, HDB, LPB, MBB, NAB, STB, TCB, TPB, VCB, and MBS from the financial and banking sector. The non-financial sector is represented by CTR, NTP, PVT, QNS, DCM, DGW, FPt, VEA, HAH, BCM, SIP, ACV, PNJ, and IDC.

With positive macro conditions, recovering corporate profits, and attractive market valuations, Mirae Asset believes that these factors will drive the market forward in the coming period.

“The Art of the Written Word: Mastering the Craft of Compelling Content”

The VN-Index surged, slicing through the 200-day SMA resistance. For the bullish momentum to be sustainably reinforced, trading volume needs to surpass the 20-day average. The Stochastic Oscillator has already signaled a buy in oversold territory. If the MACD indicator follows suit in upcoming sessions, the short-term outlook will turn even more optimistic.

The Cautious Sentiment Rises

The VN-Index staged a mild recovery, with a slight uptick in the session, but this was accompanied by a significant plunge in trading volume, falling below the 20-day average. This indicates that investor sentiment remains cautious following the recent downturn. The Stochastic Oscillator and MACD indicators continue to trend downward after issuing sell signals, suggesting that the short-term outlook remains bearish.

The Gloomy Sentiment Subsides

The VN-Index edged higher and rebounded after a recent streak of losses. Accompanying this rebound was a trading volume that surpassed the 20-day average, reflecting a relatively optimistic sentiment among investors. However, the Stochastic Oscillator has signaled a resumption of selling, and the MACD indicator is conveying a similar message. This suggests that the short-term outlook remains pessimistic.