The market witnessed strong reactions around the 1200-point mark of the VN-Index. Today, there were times when the index lost this threshold, but it later reversed successfully with a booming bar. The market initially faced selling pressure due to the previous session’s inertia, falling to 1197 points in the morning, but soon after, buying interest surged, pushing the VN-Index up.

The index peaked mid-afternoon, gaining more than 17 points before closing at 11.39 points, up 1.216 points. The breadth was impressive, with 250 stocks rising over 148 falling. Large-cap stocks were led by real estate, with NVL surging 4.65% after the news that the Aqua City project had overcome planning obstacles. This pulled a series of real estate stocks out of their slump, including PDR, DIG, DXG, CEO, and DXS, with VHM also making a brilliant recovery.

Industrial real estate stocks also shone, including BCM, KBC, and SIP. Banks benefited from the real estate sector’s recovery, with positive effects on a series of bank stocks such as BID, TCB, VPB, CTG, VCB, and MBB. The rest of the sectors, including Securities, Information Technology, Materials, and Oil & Gas, were also in the green.

Stocks that pulled the VN-Index up today included VHM, FPT, CTG, TCB, BID, and MBB. Today’s strong recovery shows that whenever the VN-Index drops to the 1,200-point region, the market automatically sees significant bottom-fishing interest due to attractive valuations, with the PE ratio hovering around 12x.

Today’s trading volume on the three exchanges reached 19,000 billion VND, but buying interest weakened towards the end of the session as foreign investors continued to be net sellers, offloading 1,253.7 billion VND. In terms of matched orders, they sold a net of 1,073.7 billion VND.

Foreign investors’ net-bought matched orders were in the sectors of Personal & Household Goods, Automobiles & Components. The top net-bought stocks by foreign investors in terms of matched orders included CTG, DIG, NVL, HAH, VPB, VNM, TLG, BID, HVN, and FRT.

On the net-sold side, foreign investors’ net-sold matched orders were in the Real Estate sector. The top net-sold stocks by foreign investors in terms of matched orders included VHM, FPT, HPG, SSI, MWG, VRE, FUEVFVND, DXG, and VCB.

Individual investors were net buyers to the tune of 873.8 billion VND, of which 622.8 billion VND was in matched orders.

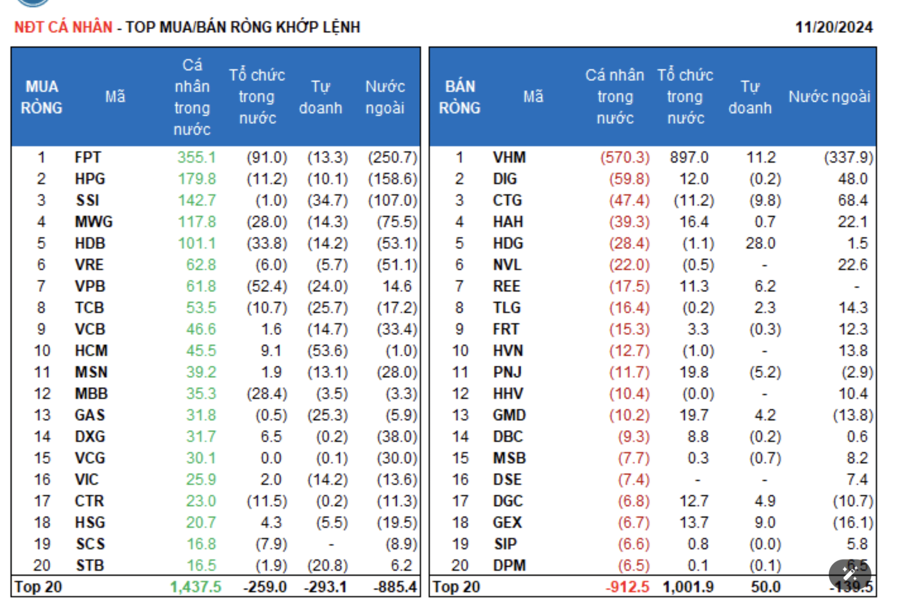

In terms of matched orders, individual investors were net buyers in 11 out of 18 sectors, mainly in the Information Technology sector. Their top buys included FPT, HPG, SSI, MWG, HDB, VRE, VPB, TCB, VCB, and HCM.

On the net-sold side, individual investors net-sold 7 out of 18 sectors, mainly in the Real Estate and Industrial Goods & Services sectors. Their top net-sold stocks included VHM, DIG, CTG, HAH, HDG, NVL, TLG, FRT, and HVN.

Proprietary trading accounted for a net sell of 385.7 billion VND, of which 270.6 billion VND was in matched orders.

In terms of matched orders, proprietary trading was net buyers in 3 out of 18 sectors. The top net-bought sectors were Industrial Goods & Services and Real Estate. The top net-bought stocks by proprietary trading today included FUEVFVND, HDG, VHM, GEX, VHC, REE, DGC, VTP, GMD, and PHR. Banking stocks were the top net-sold stocks. The top net-sold stocks included HCM, SSI, TCB, GAS, VPB, VNM, STB, VCB, MWG, and VIC.

Domestic institutional investors were net buyers to the tune of 729.7 billion VND, with net buying of 721.5 billion VND in matched orders.

In terms of matched orders, domestic institutions net-sold 10 out of 18 sectors, with the highest value in the Banking sector. Their top net-sold stocks included FPT, VPB, HDB, MBB, MWG, VTP, GVR, CTR, HPG, and CTG. The Real Estate sector saw the highest net buying. The top net-bought stocks included VHM, PNJ, GMD, HAH, GEX, DGC, DIG, REE, ACB, and TCH.

Today’s negotiated trading volume reached 2,990.5 billion VND, up 33.5% from the previous session, contributing 15.3% of the total trading value.

Individual investors continued to be active in negotiated trades in the Banking sector (MSB, EIB, LPB, SHB, VIB) and large-cap stocks (MWG, VIC, FPT).

The allocation of trading volume increased in Real Estate, Securities, Steel, and Retail but decreased in Banking, Construction, Chemicals, Food, Electrical Equipment, Software, Warehousing & Logistics, and Water Transport.

In terms of matched orders, the allocation of trading volume increased in the mid-cap sector (VNMID) but decreased in the large-cap (VN30) and small-cap (VNSML) sectors.

The Art of Strategic Trading: Navigating the Freeze on Liquidity for Derivatives Maturity

The trading market was sluggish this morning as investors awaited the derivatives expiration in the afternoon. The total matched order value on HoSE and HNX fell by 58% compared to yesterday’s morning session, reaching just over VND 3,368 billion, the lowest since April 2023. Despite this, the breadth showed a balanced differentiation.

The Sun Group’s Terraced Houses in Ha Nam Create a Buzz with Attractive Pricing and Sales Policies

With an average land price of just 25-30 million VND per square meter, the Kim Tien low-rise subdivision at Sun Urban City integrated with countless utilities has just been launched, meeting the expectations of Northern investors.

The Ultimate Guide to the Hoai Duc Land Auction: How High Will the Bidding Go?

After a lengthy 9-hour session, the final gavel fell on the auction of 32 land lots in Tien Yen, the famed ‘Land of Harmonious Melodies’, in Hoai Duc district. The top lot fetched an impressive 109 million VND per square meter, amounting to over 16 billion VND for the 148-square-meter plot. Even the lowest bid reached a respectable 79.3 million VND per square meter.

The Transformational Vision: Crafting a Metropolitan Masterpiece on 18ha of Redefined Land in Binh Dinh

On October 30th, the People’s Committee of Binh Dinh province approved the conversion of forest land for the An Quang Urban and Tourism project in Cat Khanh commune, Phu Cat district. The project, undertaken by An Quang Holdings JSC, encompasses a total area of 18.33 hectares, marking a significant step in the province’s development plans.

Unlocking Legal Hurdles for Aqua City Project: Novaland Shares Surge as Over 12 Million Units Change Hands

Novaland witnessed a trading volume of over 12 million shares, the highest in the last four sessions.