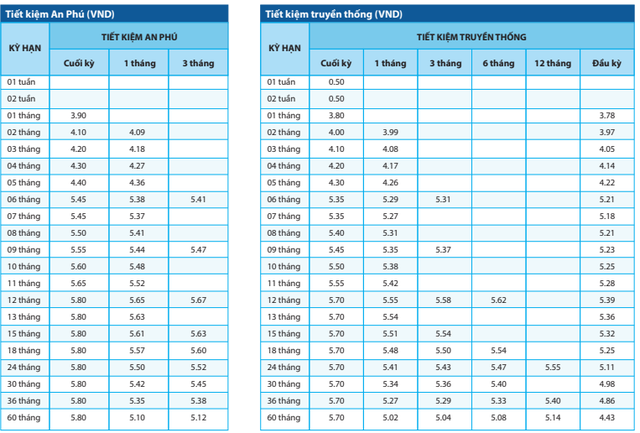

In a recent move, NCB has reduced its interest rates by an average of 0.1 percentage points for the An Phu savings scheme, applicable for tenures ranging from 6 to 11 months.

Specifically, the interest rate for savings accounts with a 6 to 7-month tenure has been lowered to 5.45% per annum, while the rate for 8 to 9-month tenures stands at 5.5% per annum. The bank is offering an interest rate of 5.6% per annum for 10-month tenures and 5.65% per annum for 11-month tenures.

The interest rates for other tenures remain unchanged. The 1-month tenure attracts an interest rate of 3.9% per annum, while the 2-month and 3-month tenures offer 4.1% and 4.2% per annum, respectively. For tenures of 4, 5, and 12 to 60 months, the interest rates are 4.3%, 4.4%, and 5.8% per annum, respectively.

NCB’s latest savings interest rates.

Traditional savings interest rates have also been adjusted downward by 0.1 percentage points for tenures ranging from 6 to 11 months. Following this change, the savings interest rates now fluctuate between 3.8% and 5.7% per annum for tenures ranging from 1 to 12 months.

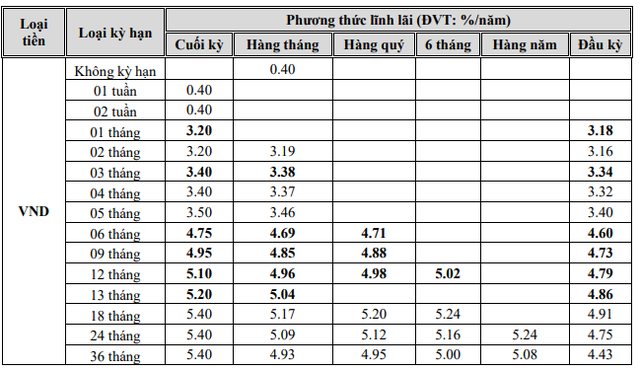

Interest rates for business customers.

NCB has not made any changes to the interest rates for business savings accounts.

According to statistics, since the beginning of November, 14 banks have adjusted their deposit interest rates, including BaoViet Bank, HDBank, GPBank, LPBank, Nam A Bank, IVB, Viet A Bank, VIB, MB, Agribank, Techcombank, ABBank, VietBank, and NCB.

Duc Anh

Today’s Interest Rates 22-11: How Much Interest Will You Earn on a 1 Billion VND Time Deposit?

The recent uptick in deposit rates has pushed long-term interest rates at many commercial banks beyond the 6% per annum mark.

“Interest Rates: Sustaining Stability to Support Economic Growth”

The macroeconomic stability and consistent results, coupled with the growth in deposits and credit expansion, attest to the effectiveness of the State Bank’s monetary and credit policy framework and its implementation. This solid performance is a testament to the State Bank’s successful navigation of the economic landscape, fostering an environment conducive to business growth and financial stability.

“Banks Reap the Benefits as Savings Account Interest Rates Rise”

With an increasing number of banks offering attractive interest rates on savings accounts, the battle for idle funds is heating up. In today’s market, which banks are offering interest rates above 6% per annum on deposits? It’s time to explore the options and make your money work harder.