Circular 02/2023/TT-NHNN, issued by the State Bank of Vietnam in late April 2023, provides guidelines for credit institutions and foreign bank branches to restructure repayment periods and maintain debt groups to support customers facing difficulties. The beneficiaries of these measures are those who encounter challenges in their production, business, or consumption loan repayments.

In practice, Circular 02 has offered a lifeline to businesses struggling with cash flow, income, and revenue declines stemming from market forces and consumption patterns. By granting debt extensions and moratoriums without changing debt groups, financial institutions have eased the repayment burden and maintained access to new capital, enabling businesses to weather challenges, sustain operations, and pursue recovery and growth.

Initially, Circular 02 was set to be effective until June 30, 2024. However, given the slow recovery and persistent challenges, the State Bank issued Circular 06 on June 18, 2024, extending the implementation period of Circular 02 until December 31, 2024.

After more than a year and a half in effect, Circular 02/2023/TT-NHNN (Circular 02), as amended by Circular 06/2024/TT/NHNN, has provided some relief in addressing non-performing loans for credit institutions while alleviating repayment pressure and facilitating new loan access for individuals and businesses.

According to the State Bank’s data, as of the end of 2023, nearly 188,000 customers had their debt restructured under Circular 02, totaling over VND 183.5 trillion in principal and interest. As of June 30, 2024, analysts estimate that the total restructured principal and interest had increased by 25.5% compared to the end of 2023, reaching VND 230,400 billion, while the number of beneficiaries surged from 188,000 to 282,000.

With just over a month left in its validity period, there has been no official word from the State Bank regarding a possible extension of Circular 02.

However, experts believe that the expiration of Circular 02 at the end of this year will not significantly impact the provisioningsection of risk provisions by banks. Per Circular 02, credit institutions are required to determine the specific amount of provisions to be set aside for the entire customer debt balance as if the debt group maintenance provision was not applied, and they must make the necessary supplementary provisions by December 31, 2024.

Consequently, by the end of 2024, credit institutions will have the financial wherewithal to handle risks as if they had performed debt classification and risk provisioning under the current regulations (Circular 11/2021/TT-NHNN).

On the other hand, the expiration of Circular 02 will lead to an increase in on-balance-sheet non-performing loans for credit institutions. Nonetheless, banks have proactively accounted for debt in accordance with its true nature, and the sharp rise in non-performing loans during the first nine months of the year reflects their preparedness for this eventuality.

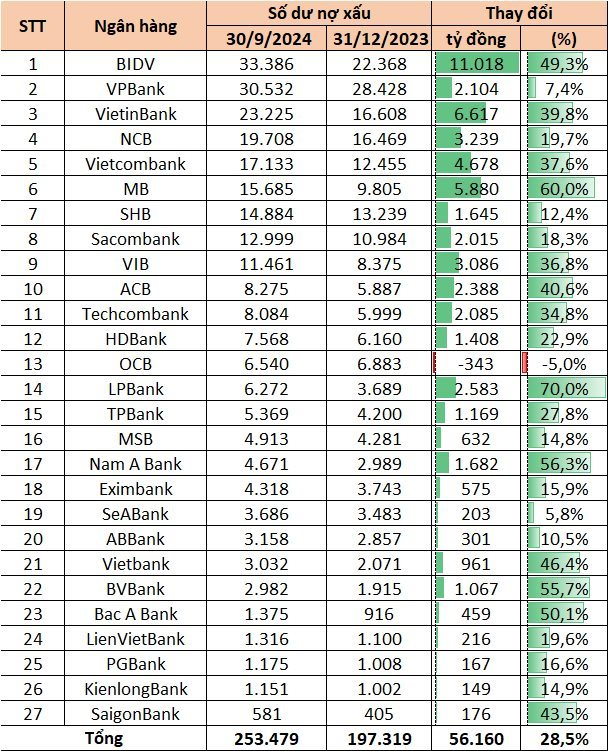

Consolidated financial statements for the third quarter of 2024 reveal that the total non-performing loans (categories 3-5) of 27 banks listed on Vietnam’s stock exchange stood at VND 253,479 billion as of the end of September, representing a VND 56,160 billion increase compared to the end of 2023 (a 28.5% surge). This non-performing loan balance accounts for 2.3% of the total loan balance to customers for these 27 banks.

Specifically, in the third quarter, non-performing loans among these banks increased by VND 13,479 billion, equivalent to a 5.6% rise.

Posco Pursues $2.15 Billion LNG-to-Power Project Investment in Nghe An

Previously, in late October, the People’s Committee of Nghe An province directed relevant departments to coordinate and expedite procedures for investment approval and selection of investors for the project.