Illustrative image

The State Bank of Vietnam (SBV) has recently requested credit institutions and foreign bank branches (CIs) to focus on implementing solutions to support businesses in overcoming difficulties and promoting production and business activities in 2024 and the following years.

Accordingly, the SBV requires CIs to continue to effectively implement solutions and tasks under the direction of the SBV in 2024 to support businesses in overcoming difficulties and promoting production and business activities…

Closely following the Government’s and SBV’s directions and policies, CIs are requested to vigorously implement solutions to reduce costs, review the situation of applicable fees at CIs to consider waiving unnecessary fees, and publicly disclose the fees charged for CIs’ business activities. Simplify loan procedures and strengthen the application of information technology in the loan process to reduce lending interest rates and support businesses and people in production and business development and promote economic growth.

The SBV also requires CIs to continue implementing solutions for safe and effective credit growth, meeting the capital needs of the economy (especially the capital needs for production and business and consumption during the 2025 Lunar New Year), and directing credit to production and business fields, priority fields, and the economy’s growth drivers in line with the Government’s policies.

Continue to promote the implementation of credit programs and policies under the direction of the Government, the Prime Minister, and the SBV, such as the social housing and worker housing loan program, the project to renovate and rebuild old apartment buildings; the VND 60,000 billion credit program for the forestry and aquatic sectors; the linked production, processing, and consumption loan program for high-quality and low-emission rice in the Mekong Delta…

Diversify credit and banking products and services suitable for each customer segment and proactively communicate the interest rate policies of CIs’ credit programs and products to customers to understand and access the policies.

Implement solutions of the banking industry to support people and businesses affected by Storm No. 3 to restore and promote production and business and economic growth; continue to effectively deploy the Bank-Enterprise Connection Program…

An Essential Circular on the Classification and Retention of Loan Groups in the Banking Sector is Nearing its Expiry

The Circular 02 issued by the State Bank of Vietnam (SBV), which provides guidelines on debt restructuring and allows for the retention of the original debt classification, will expire on December 31, 2024.

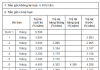

A Positive Signal from the Corporate Bond Market’s Manufacturing Sector in the First Ten Months

Although corporate bond issuance value plummeted in October, a positive sign emerged with a relatively diverse sectoral issuance structure. Notably, significant value increases were observed in the manufacturing, trading, and services sectors.