The government has recently issued Decree No. 144/2024/ND-CP, amending and supplementing a number of articles of Decree No. 26/2023/ND-CP dated May 31, 2023, on the Export Tax Schedule, Import Tax Schedule preferential (MFN), List of Goods and Absolute Tax Rates, Mixed Taxes outside Tariff Quotas. This decree takes effect from December 16, 2024.

The decree is issued to timely support and resolve difficulties in production and business for enterprises, contributing to macroeconomic stability.

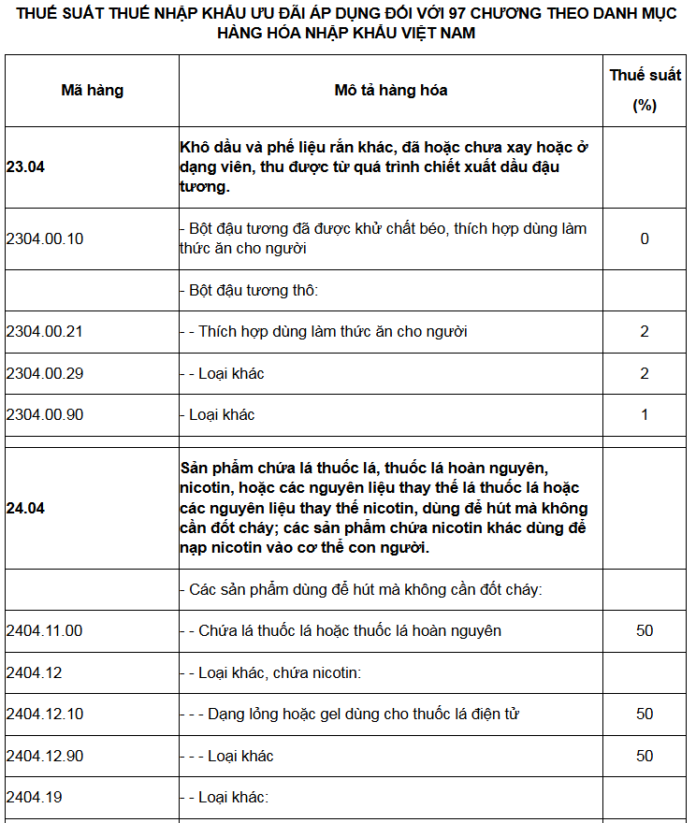

“The decree adjusts the import tax rate for soybean oil dregs used as animal feed, classified under HS code 2304.00.90, from 2% to 1% to reduce input costs for the livestock industry”.

(Ministry of Finance)

The first commodity, which has a significant impact on domestic production, to benefit from this policy is soybean oil dregs. This product, derived from the soybean oil pressing process, is an important component in the production of domestic animal feed.

According to updated data from the Ministry of Agriculture and Rural Development, as of the end of 2023, Vietnam can only produce about 20% of the total demand, and soybeans used for oil pressing are mainly imported as Vietnam does not have a comparative advantage in soybean production.

The Ministry of Finance believes that reducing the import tax rate will enable domestic soybean oil dregs producers to enhance their competitiveness while contributing to lowering raw material costs for the livestock industry, and businesses can also be more proactive in terms of supply sources. At the same time, reducing the MFN tax rate to 1% still leaves room for negotiation for future FTAs that Vietnam will sign, ensuring compliance with the principles of issuing Tax Schedules and tax rates stipulated in the Law on Export and Import Taxes.

Next, the decree adjusts the import tax rate for electronic equipment used for electronic cigarettes and similar personal electro-vaporizers (HS code 8543.40.00) to the same level as for other types of cigarettes, at 50%.

Tobacco products are highly sensitive and subject to specialized management. Since joining the World Trade Organization (WTO) and throughout the negotiation process of FTAs, Vietnam has consistently maintained the maximum tax commitment, not reducing import tax rates or, if necessary, prolonging the reduction period as long as possible. This is also a commodity that affects human health, so its use should be restricted.

Unifying the MFN tax rate at 50% is necessary to ensure similar management as for traditional tobacco products, while also limiting the negative impacts when this product is granted circulation by the competent authority in Vietnam.

For ammonium nitrate with an NH4NO3 content of ≥98.5% (HS 3102.30.00.10), which is a precursor to explosives, a specific tax rate of 0% is applied.

In addition, to simplify the tax schedule and reduce administrative procedures due to the lack of clear distinguishing criteria, the Ministry of Finance has merged the lines of unwrought zinc and tin in the Export Tax Schedule.

Currently, unwrought zinc (group 79.01) and unwrought tin (group 80.01) are detailed into two 10-digit codes, distinguished by ingots or other forms, with the same tax rate of 10% for these forms.

“Due to the lack of specific criteria for ingots in terms of shape, such as square or rectangular, or size and weight, customs authorities face difficulties in classifying goods into the ingot group or the other forms group,” the Ministry of Finance stated the problem.

Therefore, the Ministry of Finance proposed to the Government to merge the lines of 10-digit codes with the same tax rates for the above-mentioned goods to facilitate customs authorities in checking the goods’ name, code, and tax rate declared by enterprises. This line merging does not change the export tax rates for the above goods but only aims to facilitate declaration and reduce administrative procedures.

Similarly, the tax rate for hand-held soil tillers (HS code 8701.10.11) with an MFN import tax rate of 20% and single-axle tractors for agriculture (HS code 8432.29.00) with an MFN import tax rate of 30% has been adjusted to the same rate of 20%.

This creates favorable conditions for customs authorities in terms of classification and code application, reduces costs for enterprises, and ensures compliance with the principle of issuing Tax Schedules and tax rates stipulated in Article 10, paragraph 5 of the Law on Export and Import Taxes, which is to apply a uniform tax rate to goods of the same nature, composition, and technical characteristics.