The State Bank has just issued a document requesting credit institutions and foreign bank branches to focus on implementing solutions to support businesses in overcoming difficulties and promoting production and business activities in 2024 and the following years.

Accordingly, credit institutions will continue to effectively implement solutions and tasks as directed by the State Bank in 2024 to support businesses in overcoming difficulties and promoting production and business activities.

The managing authority will continue to strongly implement solutions to reduce costs, review the fee collection situation at commercial banks to consider exempting and reducing unnecessary fees, and publicly disclose the fees charged for business activities.

Credit institutions need to simplify loan procedures and promote the application of information technology in the loan process to reduce lending interest rates, support businesses and people in production and business development, and promote economic growth.

Banks are requested to continue striving to reduce lending rates to support corporate and individual customers during the year-end period

Continue to implement solutions for safe and effective credit growth, meet the capital needs of the economy in a timely manner (especially the capital needs for production, business, and consumption during the 2025 Lunar New Year), and direct credit to production and business fields, priority fields, and growth drivers of the economy in line with the Government’s policies.

According to data from the State Bank, as of the end of October 2024, credit growth of the banking system reached over 10% compared to the end of last year.

The banking industry’s goal this year is to achieve a credit growth rate of 15%. Promoting credit growth is considered one of the key solutions to support economic growth this year.

As observed by the reporter, interest rates for credit packages remain low and preferential.

Currently, banks are deploying a series of preferential credit packages, offering low-interest loans to promote year-end credit growth.

Sacombank offers a short-term credit package of VND 15,000 billion with an interest rate of 4.5%/year for corporate customers and 5.5%/year for individual customers for production and business activities.

LPBank launched a credit promotion program with a total value of VND 3,000 billion and a lending rate of 5%/year. At Agribank, the interest rate for preferential packages is from 3%/year, with a standout package of VND 20,000 billion for businesses in the agricultural, aquatic product processing, and import of raw materials and auxiliary materials industries, with an interest rate of 2.6%/year applied for a term of less than 3 months…

What the Bad Debt Situation of Banks Reveals

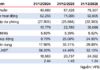

Strong credit growth, largely driven by an increase in business lending, has kept non-performing loan ratios stable in Q3 compared to the previous quarter. However, a closer look at individual bank groups reveals a different story, with underlying risks still prevalent. In particular, there are notable concerns within the smaller commercial banking groups that warrant attention.

The Year-End Interest Rate Crunch

The end of the year always brings a surge in demand for capital, especially for businesses and individuals seeking funds to expand production, stock up for the Lunar New Year, and meet festive consumer demands. In response, commercial banks have started to increase deposit interest rates to secure stable funding.

The Central Bank Governor Unveils a Special Relief Package: A VND 405 Trillion Loan Facility with Subsidized Interest Rates to Support Businesses and Individuals Affected by Natural Disasters

The Governor of the State Bank of Vietnam (SBV) has instructed credit institutions to focus on implementing solutions to support businesses and individuals affected by the recent typhoon. This includes debt restructuring and maintaining the current debt group classification as per existing regulations. The SBV has also directed credit institutions to consider reducing interest rates for those impacted by the storm, demonstrating a commitment to providing relief during challenging times.