ABBank has made a move to increase interest rates for online savings accounts with terms ranging from 3 to 5 months. This is the first time in 11 years that ABBank has adjusted its savings rates.

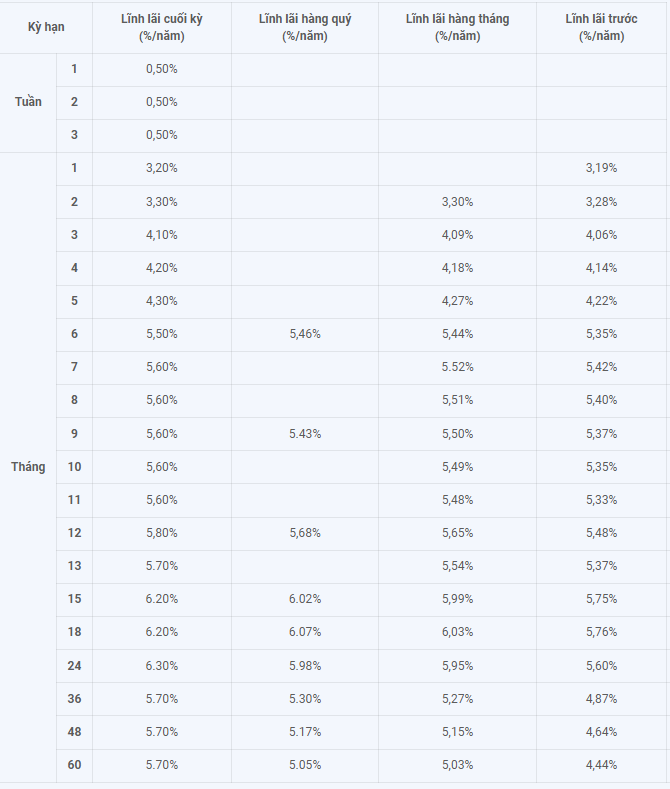

Specifically, the 3-month savings rate has increased by 0.2 percentage points to 4.1% per annum. The 4-month savings rate now stands at 4.2% per annum, a 0.6 percentage point increase from the previous adjustment. As for the 5-month savings rate, it has gone up by 0.7 percentage points to 4.3% per annum.

ABBank has maintained the interest rates for other terms. The 6-month term offers an interest rate of 5.3% per annum, while the 7-8 month and 9-11 month terms both have a rate of 5.5% per annum. The 12-month term stands at 5.9% per annum, and the 15-18 month term remains at 6.2% per annum. ABBank offers the highest interest rate of 6.3% per annum for the 24-month term.

ABBank’s latest online savings interest rate table.

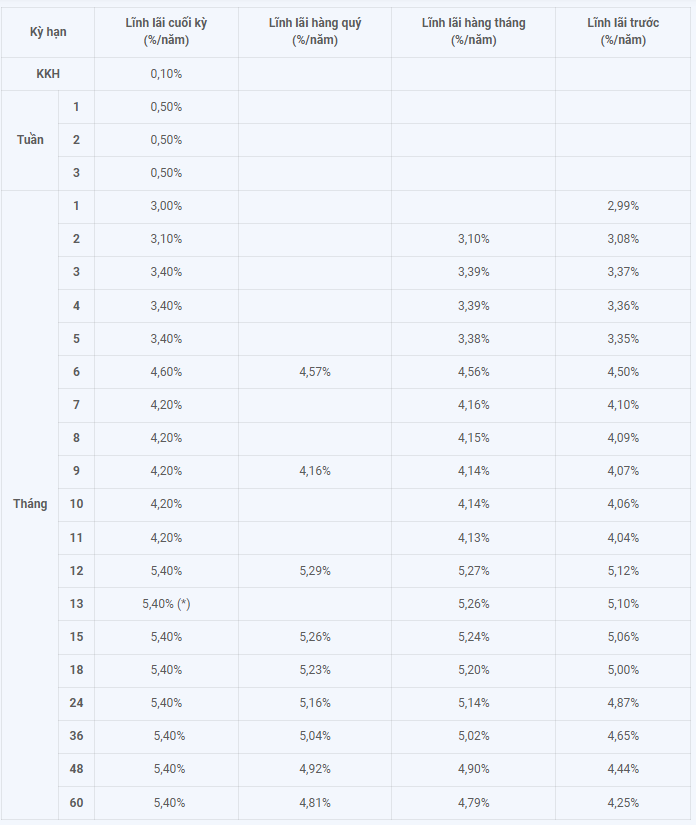

ABBank has kept the interest rates for personal customer deposits at the counter, with interest payable at the end of the term. The interest rate table for personal customer savings at terms ranging from 1 to 60 months varies from 3.2% to 5.4% per annum.

To elaborate, the 1-month and 2-month terms offer savings rates of 3% and 3.1% per annum, respectively. The 3-month term has a bank interest rate of 3.4% per annum, while the 6-month term stands at 4.6% per annum. The 9-month term offers an interest rate of 4.2% per annum, and the 12-month term is at 5.4% per annum.

ABBank’s counter savings interest rates.

Currently, ABBank is one of the leading banks in the system, offering an impressive interest rate of 6.3% per annum for the 24-month term for online deposits, with no requirements on the amount deposited.

The Power of Persuasive Writing: Captivating Headlines

“Will Banks Lower Interest Rates Again? – A Critical Analysis for Savvy Investors”

The State Bank has instructed financial institutions to simplify loan procedures and employ technology to reduce the overall lending rate.

VietinBank: Leading the Pack in Operational Income

As per the Q3 2024 financial statements, VietinBank has emerged as a leader in Vietnam’s banking industry, boasting top-tier figures in terms of operating income and pre-provision profit from business operations. This remarkable performance underscores the bank’s adeptness in leveraging its earning assets to generate robust revenue and profits.

The Dollar Dilemma: Navigating the Currency Conundrum.

The USD/VND exchange rate has been extremely volatile, causing concern for businesses that import raw materials for production.

The Central Bank Governor: We Will Intervene in the Foreign Exchange Market During Times of Significant Volatility

Governor Nguyen Thi Hong affirmed that the State Bank of Vietnam (SBV) remains steadfast in its commitment to flexible exchange rate management, adapting to market fluctuations. The exchange rate is currently allowed to fluctuate within a band of +/- 5%. “In the event of significant market volatility, the State Bank will consider selling foreign currencies to stabilize and meet the needs of the people,” she added.