Illustration

Vietnamese Banks on the Stock Exchange Lend an Additional 1,160 Trillion VND in the First Nine Months

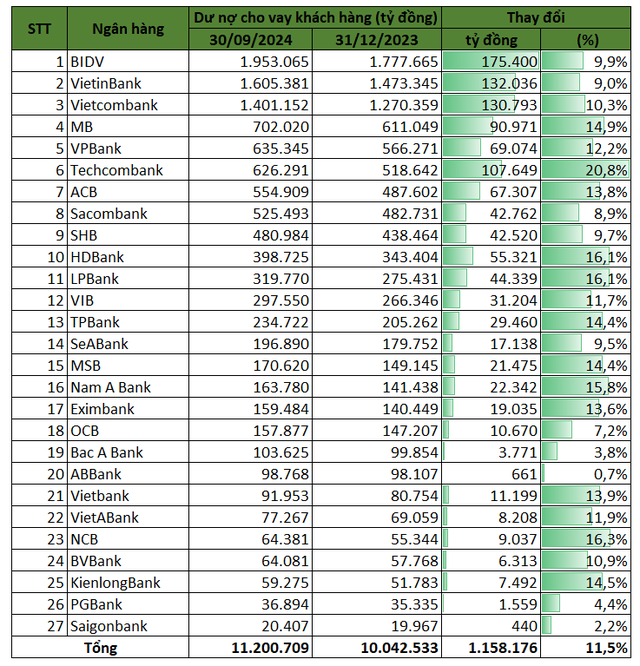

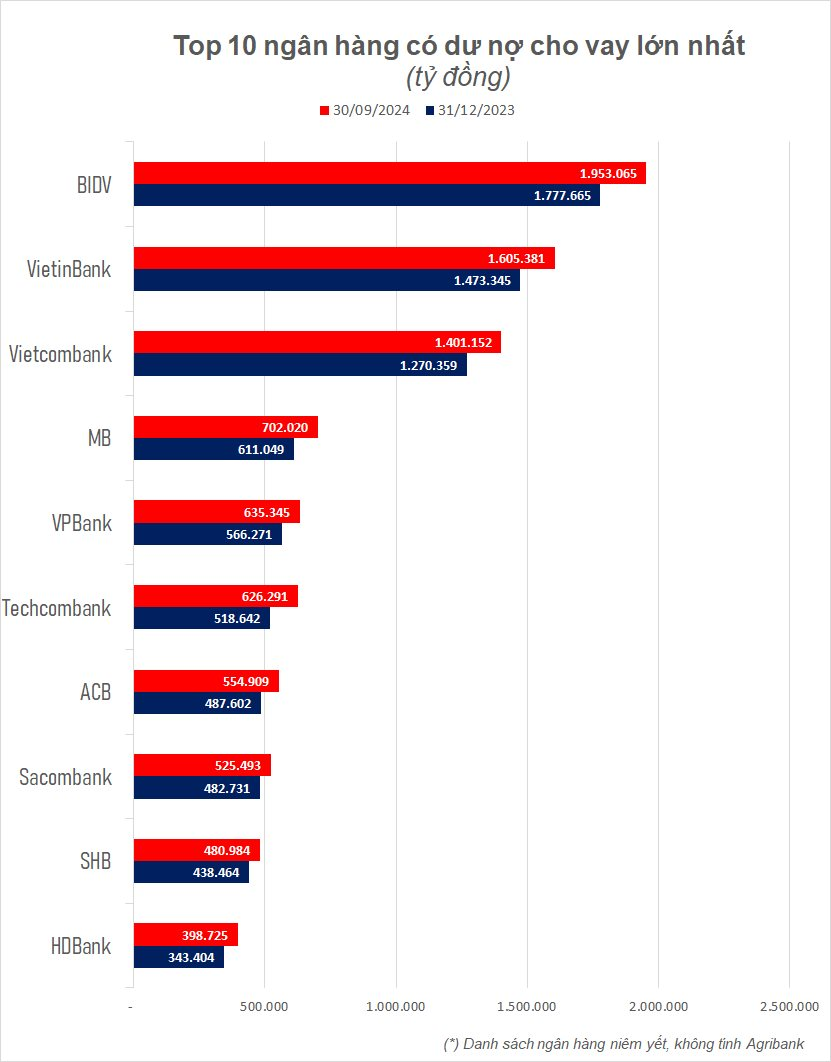

According to consolidated financial statements for Q3 2024, the total outstanding loans of 27 banks listed on the Vietnamese stock exchange reached over 11,200 trillion VND by the end of September, an increase of 1,160 trillion VND compared to the end of 2023 (a corresponding increase of 11.6%).

BIDV maintained its position as the bank with the largest customer loan balance in the system, with more than 1,953 trillion VND, an increase of 175,400 billion VND, or 9.9%, from the previous year. On average, in the first nine months of 2024, BIDV lent an additional 19,500 billion VND per month, equivalent to the total amount lent by the 15 smallest banks on the stock exchange combined.

With this growth rate, it is highly likely that the bank’s outstanding loans will reach the 2 trillion VND mark by the end of 2024. This would be a record-high loan balance for a Vietnamese bank.

VietinBank ranked second on the list with outstanding loans of 1,605 trillion VND, up 9% from the beginning of the year. In the first nine months, VietinBank’s customer loans increased by more than 132,000 billion VND, equivalent to an increase of approximately 14,700 billion VND per month.

The third position was held by Vietcombank, one of the “Big Four” state-owned banks, with total outstanding loans of over 1,401 trillion VND as of the end of September, an increase of 10.3%. Vietcombank recorded the highest loan growth rate among the Big Four.

Thus, the three state-owned banks in the group lent an additional 438,229 billion VND in the first nine months, accounting for 37.8% of the total increase in outstanding loans of the 27 banks on the stock exchange. At the same time, the total outstanding loans of these three “giants” as of the end of September reached nearly 4,960 trillion VND, accounting for 44% of the total outstanding loans.

In the joint-stock group, MB and VPBank were the two banks with the largest loan scales, reaching 702,020 billion VND and 635,345 billion VND, up 14.9% and 12.2% from the beginning of the year, respectively. Meanwhile, Techcombank demonstrated remarkable growth with a total outstanding balance of 626,291 billion VND, a 20.8% increase – the highest in the industry.

The Top 10 banks with the largest loan balances also included familiar names such as ACB (554,909 billion VND), Sacombank (525,493 billion VND), SHB (480,984 billion VND), and HDBank (398,725 billion VND).

On the other hand, Kienlongbank, PGBank, and Saigonbank were the banks with the smallest loan balances in the system.

In terms of loan growth rate, Techcombank led the industry with a 20.8% increase. Following closely were NCB (up 16.3%), LPBank and HDBank (up 16.1%), Nam A Bank (up 15.8%), MB (up 14.9%), TPBank and MSB (up 14.4%), and ACB (up 13.8%), among others.

Meanwhile, some banks recorded lower-than-average loan growth rates, including ABBank (up 0.7%), Saigonbank (up 2.2%), Bac A Bank (up 4%), PGBank (up 4.4%), OCB (up 7.2%), and Sacombank (up 8.9%).

Credit Growth is Expected to Continue to Diverge

Since the beginning of the year, when credit growth showed slow progress and even declined in Q1, the State Bank of Vietnam (SBV) has implemented various measures to promote lending.

From the start of 2024, the SBV assigned credit growth targets to credit institutions, corresponding to an average growth rate of about 15%. This approach differed from previous years, when the SBV allocated credit limits in multiple installments and required banks to submit requests for limit increases.

According to the SBV’s leadership, this change conveyed a message to banks that capital injection into the economy this year must be more robust, decisive, and responsible.

In August, the SBV allowed banks that had achieved 80% of their annual limit to proactively increase their credit limits. In addition, the SBV continuously encouraged credit growth in the field of production and business.

Thanks to the SBV’s timely directives and the recovery of credit demand, credit growth for the entire economy reached 9% as of September 30, 2024. According to the Governor of the SBV, the target of a 15% increase for the year is entirely feasible.

At the Conference of the Government’s Standing Committee with joint-stock commercial banks held in late September, leaders of several banks expressed confidence in their credit growth prospects for 2024 and requested the SBV to relax credit limits for well-performing banks.

At the event, Kim Byoungho, Chairman of HDBank, shared that the bank’s credit growth had exceeded 15% compared to the beginning of the year, while its non-performing loan ratio stood at 1.74%. To promote credit growth, HDBank’s representative suggested that the SBV consider assigning additional targets to credit institutions with strong capital provision capabilities based on a balance of management objectives and a review of the situation in Q4.

On the other hand, some banks still recorded credit growth rates below expectations.

According to Nguyen Duc Thach Diem, CEO of Sacombank, despite implementing various solutions and incentive mechanisms, Sacombank’s credit growth did not meet expectations due to certain challenges: Capital demand remained low as exports and domestic consumption had not recovered; Many businesses scaled down their operations and were cautious about risks, leading to a reluctance to borrow.

Additionally, buyers’ incomes decreased, while the supply of affordable housing for residential needs was insufficient. Real estate companies/projects continued to face difficulties due to incomplete legal procedures and severely weakened financial capabilities.

Apart from the factor of reduced consumer income due to economic difficulties, the proliferation of lending applications with relaxed conditions and no collateral requirements also contributed to the slow growth of consumer credit by dividing the market share.

As a solution, Sacombank’s CEO suggested the need to further reduce capital costs and lower lending interest rates to enhance capital accessibility. At the same time, she proposed that the government maintain an expanded fiscal policy to stimulate aggregate demand, implement tax and fee reduction measures to directly support consumer demand, and increase purchasing power in the economy.

According to Vietcombank Securities’ forecast, credit demand will accelerate in the second half of 2024, driven by retail lending (especially home loans) and the recovery of the real estate market, production, exports, and public investment. Similarly, VPBank Securities pointed to FDI, imports and exports, industrial real estate, and consumption, along with low deposit interest rates, as drivers of credit growth.

Phu Hung Securities (PHS) predicted that large joint-stock commercial banks with strong ecosystems or expertise in corporate lending, such as Techcombank, ACB, HDBank, LPBank, and MSB, would achieve optimistic credit growth rates. In contrast, the state-owned group, including Vietcombank, VietinBank, and BIDV, recorded weaker credit and profit growth than the industry average due to their lower risk appetite.

The Power of Persuasive Writing: Captivating Headlines

“Will Banks Lower Interest Rates Again? – A Critical Analysis for Savvy Investors”

The State Bank has instructed financial institutions to simplify loan procedures and employ technology to reduce the overall lending rate.

What the Bad Debt Situation of Banks Reveals

Strong credit growth, largely driven by an increase in business lending, has kept non-performing loan ratios stable in Q3 compared to the previous quarter. However, a closer look at individual bank groups reveals a different story, with underlying risks still prevalent. In particular, there are notable concerns within the smaller commercial banking groups that warrant attention.

The Year-End Interest Rate Crunch

The end of the year always brings a surge in demand for capital, especially for businesses and individuals seeking funds to expand production, stock up for the Lunar New Year, and meet festive consumer demands. In response, commercial banks have started to increase deposit interest rates to secure stable funding.

“HCM City Credit Up 6.87% in October 2024”

As of late October 2024, Ho Chi Minh City’s total outstanding credit reached an impressive VND 3,785 trillion, reflecting a steady growth of 0.98% from the previous month and a significant 6.87% increase compared to the end of 2023. This indicates a consistent expansion in the city’s credit activities over the past few months.