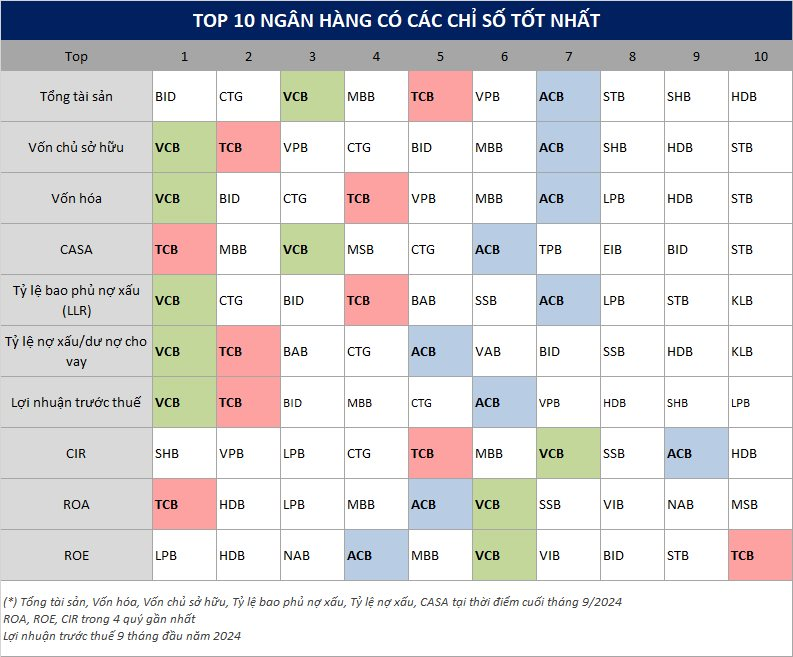

On the other hand, some banks demonstrated a more “well-rounded” performance, leading the industry in a range of metrics, effectively managing costs, maintaining low risk, and ensuring high profitability.

Techcombank stands out for its presence in the Top 10 across numerous crucial banking indicators, showcasing both high profitability and superior asset quality. Notably, Techcombank boasts the highest ratio of non-term deposits (CASA) and the highest Return on Assets (ROA) in the industry.

Although ACB doesn’t rank within the Top 3 in the metrics mentioned below, it consistently maintains its position within the Top 10. ACB currently holds the third-highest Return on Equity (ROE) over the last four quarters and is among the top five banks with the highest ROA and lowest non-performing loan ratios.

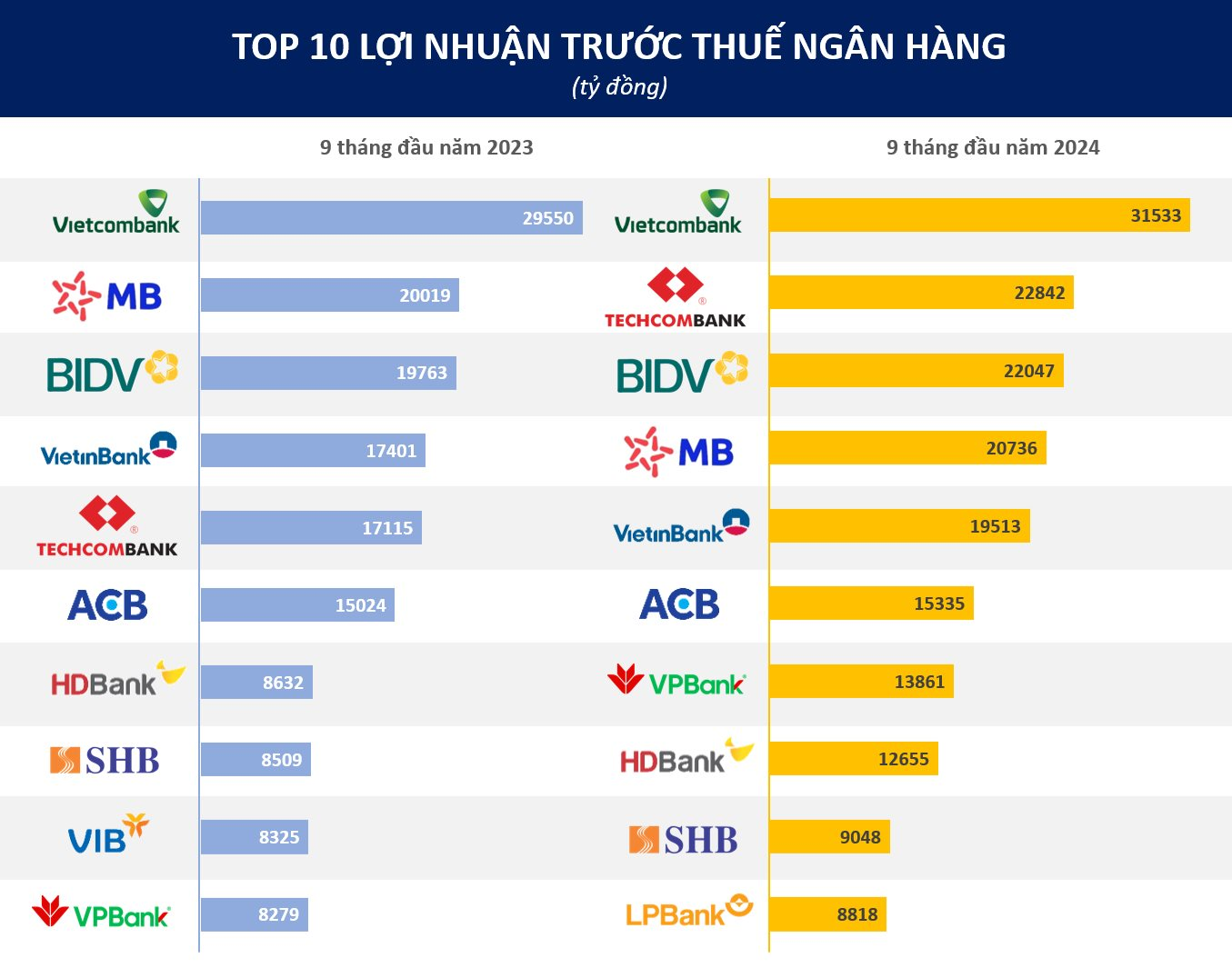

Vietcombank also dominates the rankings, boasting the highest market capitalization on the stock exchange, the highest profits, and the best bad debt coverage ratio in the industry.

Other banks consistently featured in the Top 10 include BIDV and VietinBank, the two largest banks in terms of total assets. They consistently rank highly for their CASA ratios, low non-performing loan ratios, and profitability.

Data source: Wichart and author’s compilation.

VietinBank Wins Double Annual Report Awards at VLCA 2024

On November 16, 2024, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank – stock code: CTG) was honored with two prestigious awards: “Top 10 Enterprises with the Best Annual Report in the Finance Group” and “Outstanding Progress for Annual Report” at the 2024 Listed Companies Awards organized by the Ho Chi Minh City Stock Exchange (HOSE).

The Race to Recover: Banks Compete to Auction Off Billion-Dollar Debts of Kenton Node’s Mega-Project Developer

The Vietnam Bank for Investment and Development (BIDV) announces the auction of the debt owed by Tai Nguyen Construction Production Trading Co., Ltd. to the bank. The debt includes all outstanding principal and interest, as well as any accrued fees up to the point of the debt sale transaction.

The Hoard of ‘Staggering’ Evidence and Assets Seized in the Van Thinh Phat Group Case

As of now, the total amount held in the account of the Ho Chi Minh City Department of Civil Judgment Enforcement, transferred by the Ministry of Public Security’s Investigation Agency and deposited by individuals and organizations in the Van Thinh Phat case, stands at over VND 4,250 billion and USD 27 million (equivalent to VND 685 billion).