According to data shared at the consultation seminar “The Impact of Applying a 5% VAT Rate on Fertilizers” organized by the Vietnam General Agricultural and Rural Development Association, the Vietnam Tax Consulting Association, and the Vietnam Foreign Trade University in October 2024, experts calculated that with the option of switching to a 5% VAT rate for fertilizers, there is room for a respective decrease in the prices of domestically produced urea, DAP, and LAN fertilizers by 2%, 1.13%, and 0.87%.

VAT AS THE BASIS FOR FERTILIZER PRICE REDUCTION

The price of NPK may increase insignificantly (0.09%) or remain unchanged. However, the prices of imported urea, DAP, NPK, SA, and potash fertilizers will increase, with NPK imports potentially rising by 5%.

Given the current market structure, where domestically produced fertilizer consumption accounts for over 70% while imported fertilizer consumption is less than 30%, domestic fertilizer producers will be able to lead the adjustment of market prices.

With the implementation of a 5% VAT rate on fertilizers, the production cost of domestic fertilizers will decrease, and there will be room for a reduction in their selling prices. This will have a ripple effect, causing importers to also lower their fertilizer prices to match the market trend, ultimately benefiting the farming community.

At the symposium “VAT on Fertilizers: For a Sustainable Agricultural Development” organized by the New Energy/PetroTimes Magazine on November 17, 2024, National Assembly Deputy Trinh Xuan An, a member of the National Defense and Security Committee of the XV National Assembly, stated that the government’s proposal to apply a 5% VAT rate on fertilizers is entirely reasonable and scientifically grounded.

“I believe there is no basis for claiming that a 5% VAT rate will increase fertilizer prices. In discussing the impact of the VAT rate, we should maintain an objective and scientific perspective instead of being conservative or using strong words like ‘we don’t care, applying a 5% VAT rate will increase prices and hurt farmers.’ Therefore, decisions should be based on scientific calculations rather than subjective or emotional thinking,” Mr. Trinh Xuan An frankly expressed.

According to Mr. An, this is not just a matter of tax science but also involves emotions and logic. It is imperative to make decisions based on a comprehensive understanding of the situation, a principle consistently applied by the National Assembly Standing Committee during discussions and consultations for the Law on Tax Administration.

“The Party and State would never implement policies that adversely affect farmers or the country. This is an unchanging principle to ensure that businesses and farmers can operate without hindrance,” emphasized National Assembly Deputy Trinh Xuan An.

EXPERT PERSPECTIVE ON THE IMPACT OF THE 5% FERTILIZER TAX

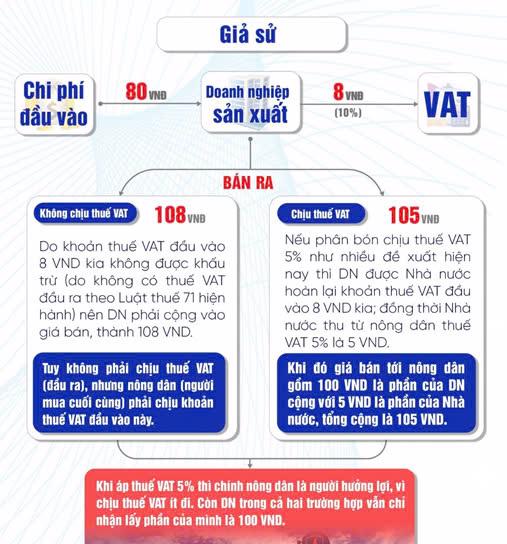

Analyzing the impact of the 5% VAT rate on fertilizer prices, Mr. Nguyen Van Duoc, a permanent member of the Vietnam Tax Consulting Association, provided an example: For a domestic fertilizer production enterprise and an import enterprise, if the selling price excluding VAT is VND 100, the input cost is VND 80, and the initial expected profit is VND 20, there will be differences in their pricing structures.

If the domestic enterprise cannot deduct input VAT, it will have to pay an additional VND 8 in VAT, leading to increased production costs and reduced profits. To maintain the target profit, the selling price must be increased by VND 8 to compensate for the tax expense. As a result, the actual product price paid by farmers will be VND 108, putting them at a disadvantage as they have to bear the higher cost.

With a price of VND 108, the domestic production enterprise can ensure its target profit to sustain production, while the import enterprise only needs a price of VND 100. Moreover, if the import enterprise sets prices based on market mechanisms, they could also increase their selling price to VND 108, in which case consumers may have to pay an additional VND 8 in taxes for imported fertilizers due to this tax policy.

Additionally, due to the tax policy advantage, the group of fertilizer import enterprises has a competitive edge in pricing, not to mention quality and after-sales service, which creates difficulties for domestic production enterprises and leads to unequal competition, potentially resulting in long-term monopolies as domestic enterprises become exhausted, incur losses, or even go bankrupt.

Therefore, tax expert Nguyen Van Duoc affirmed the necessity of switching to a 5% VAT rate for fertilizers to create room for price reduction. This approach aligns with scientific principles, economic interests, and the harmonious interests of all parties involved.

“Exempting fertilizers from VAT will lead to many inconsistencies. Since input VAT cannot be deducted and must be included in the enterprise’s expenses, profits will decrease, forcing them to add the un-deducted input VAT to the selling price. Consequently, farmers indirectly bear the tax burden, suffering a “double loss” from counterfeit fertilizers and high-cost fertilizers, while the state may also face tax revenue losses,” added Mr. Duoc.

In contrast, fertilizer import enterprises benefit from not having to pay VAT on imports for semi-finished or finished fertilizer products. They are also not subject to output VAT, so their profits are not affected by tax policies.

TOWARDS A SUSTAINABLE AGRICULTURAL FUTURE

Concurring with this view, PGS. TS Dinh Trong Thinh, an economic expert, shared: “I feel distressed that Vietnam’s fertilizer technology has not kept up with global advancements. Therefore, I strongly urge the National Assembly to make an accurate decision on the VAT rate for fertilizers to improve fertilizer quality and enhance the value of Vietnamese agricultural products, thereby strengthening the foundation of our agriculture-based economy.”

According to Mr. Thinh, countries worldwide prioritize support for agricultural production. For instance, in China, taxes on imported raw materials for fertilizer production are reduced by 50% or even waived entirely, and VAT rates are also kept low. When exporting, they receive full support for storage fees and domestic taxes from the Chinese government, which gives them a significant advantage and strong competitive edge when selling to Vietnam.

“The same is true for Russia and the United States. Hence, I believe that providing the right incentives through VAT policies is crucial for fertilizer products to propel Vietnamese agriculture forward. During my recent visit to the Mekong Delta agricultural region, I learned that farmers primarily use fertilizers for rice and other crops. However, they shared that Vietnamese fertilizers are not yet competitive compared to foreign products,” Mr. Thinh observed.

For these reasons, PGS. TS Dinh Trong Thinh hopes that the amended VAT Law will apply a 5% VAT rate to fertilizers to promote the enhancement of fertilizer quality and the availability of advanced equipment and materials, ultimately meeting the needs of the farming community.

The Tax Evasion Crackdown: Unraveling the Web of Corporate Deceit

Many businesses have recently disclosed regulatory decisions regarding penalty charges and tax arrears.

“The Fertilizer Industry’s Plea: Remove the 5% VAT or Risk Our Decline and Halt Production.”

The latest amendments to the Value-Added Tax Law fail to address the long-standing issue faced by the domestic fertilizer industry. As a result, this vital sector continues to be discriminated against, excluded from the scope of value-added tax applicability. This exclusion puts the industry at risk of reverting to the decline and stagnation witnessed during 2015-2020, threatening its very survival.

The Top 5 Tax Agents in Ho Chi Minh City: An Outstanding 2024 Lineup

On October 11th, the Ho Chi Minh City Business Association honored 84 outstanding entrepreneurs and 93 exemplary businesses for 2024. Among those recognized were five members of the Ho Chi Minh City Tax Consultancy and Agency Association (HTCAA): THTAX, Tri Luat, Trong Tin, Truong Gia, and An Doanh.

“Handy Techniques: Overcoming Challenges with Ease” with Ca Mau Fertilizer

In the wake of the devastating floods that wreaked havoc in Northern Vietnam, the Ca Mau Petroleum Fertilizer Joint Stock Company (PVCFC – Ca Mau Fertilizer) swiftly mobilized a range of practical support initiatives to aid affected farmers in recovering from this tragedy. The company’s immediate response reflected its commitment to standing by the side of the resilient farming community as they navigated through these challenging times, working towards rebuilding their livelihoods and regaining stability in their lives.

A Proposal to Increase the Special Consumption Tax on Alcoholic Beverages

The proposal to levy a special consumption tax on beverages with a sugar content exceeding 5 g/100 ml is a step towards encouraging healthier choices. With a growing awareness of the health implications of excessive sugar consumption, this move could potentially incentivize consumers to opt for lower-sugar alternatives and promote a shift towards a healthier lifestyle.