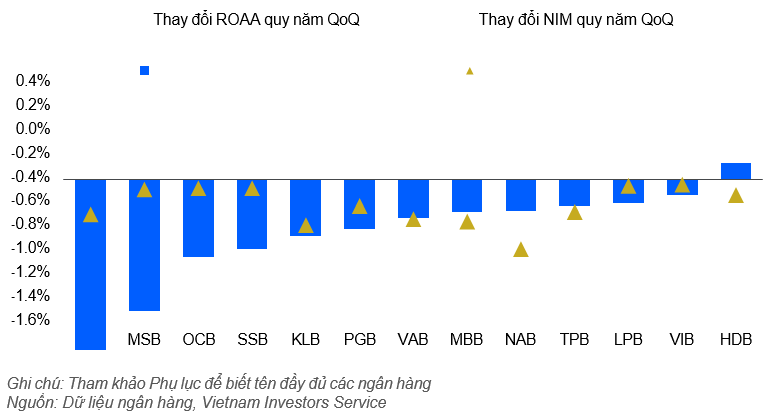

The September 2024 bank report released by VIS Rating showed a slight decrease in the industry’s average return on total assets (ROAA) to 1.5% for the first nine months of 2024, compared to 1.6% in the first six months.

However, there was an increase in liquidity risk for small and medium-sized banks, attributed to their reliance on short-term market funds in a context of slow deposit growth and recent hikes in interbank interest rates.

“By the end of 2024, we expect a slowdown in the growth of high-yield mortgage lending and new non-performing loans to contribute to stabilizing profits and asset quality for banks,” the report emphasized.

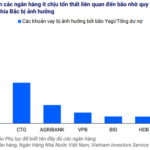

According to VIS Rating, most banks suffered minimal losses related to the storm due to limited lending in the affected northern provinces. The total credit balance for customers impacted by the storm accounted for approximately 1% of the industry’s total balance, mainly attributed to state-owned banks (SOBs) operating in those provinces. Supportive measures from the State Bank, such as debt restructuring and providing low-interest loans to affected borrowers, also helped ease the repayment burden for customers.

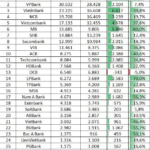

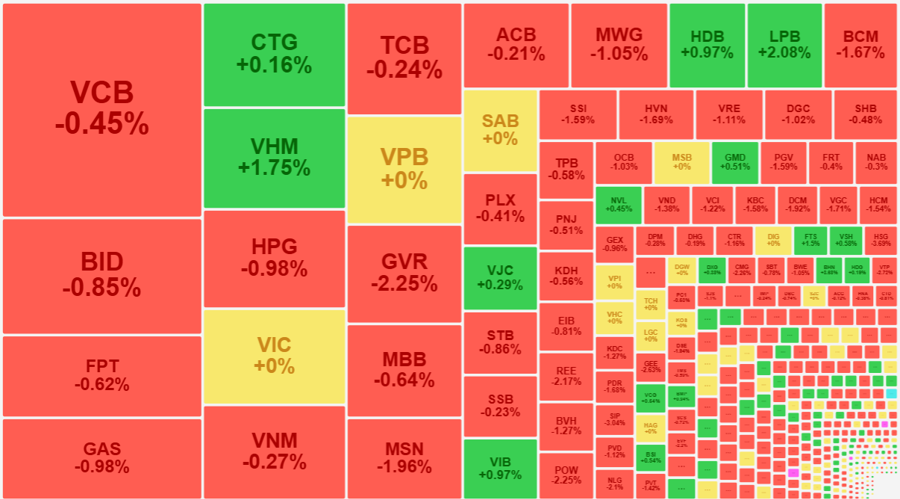

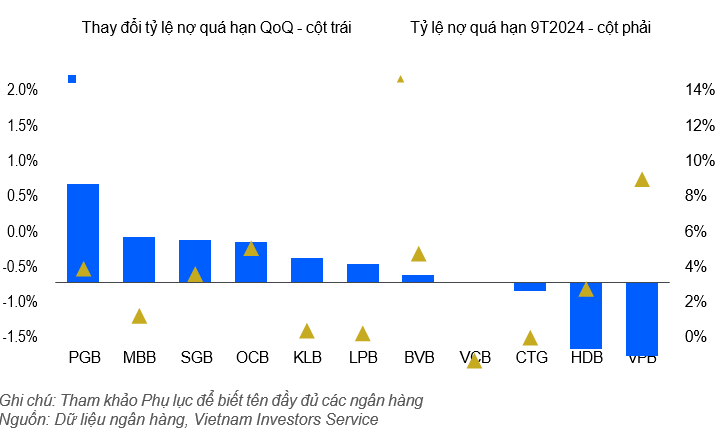

The credit rating agency’s observations revealed that the industry’s non-performing loan ratio remained stable at 2.4% from the previous quarter. Large banks, including SOBs, witnessed a slowdown in the formation of new non-performing loans, thanks to the improvement of a large non-performing loan (for example: CTG) and tighter lending standards, especially for new consumer loans (for instance: VPB). In contrast, non-performing loans continued to rise at banks focusing on individual customers and small and medium-sized enterprises (SMEs) (for example: PGB, SGB, VIB, OCB, LPB)

“We assess that approximately 30% of banks have a weak asset risk profile, an increase from 22% in 2023. For the full year 2024, we expect the industry’s non-performing loan ratio to stabilize at 2.3-2.4% as banks complete debt write-offs in Q4,” VIS Rating highlighted.

The industry’s profit growth slowed due to narrowing net interest margins and higher credit costs for small banks. Most banks reported quarterly declines in ROAA and net interest margin (NIM); small banks experienced the most significant profit declines due to higher funding costs in a competitive deposit market.

These banks and some medium-sized banks (for example: VIB, OCB) experienced asset quality deterioration and high credit costs. Profit trends among large banks were mixed; some banks (for instance: TCB, MBB, ACB) were impacted by lower insurance, foreign exchange (FX), and securities investment income, while others benefited from previous risk reduction efforts, leading to significantly lower credit costs (for example: VPB) and higher recovery profits (for example: CTG, VCB)

“We expect most of the 25 banks in our analysis to meet their full-year profit targets, particularly the SOBs and large banks with strong corporate lending growth. With continued improvement in credit growth, we anticipate the industry’s ROAA to improve to 1.6% for the full year 2024, up from 1.5% in the previous year,” VIS Rating analyzed.

Notably, experts also pointed out that the risk buffer remains weak. As of the first nine months of 2024, the industry’s tangible common equity (TCE) to tangible assets (TA) ratio remained unchanged QoQ at 8.8% due to slower profit growth.

It is worth mentioning that nearly 20% of the banks in VIS Rating’s assessment have a weak capital safety profile, including small banks with thin profits and some SOBs restricted in raising new capital. The industry’s loan loss coverage ratio (LLCR) increased slightly by 1% QoQ to 83% at the end of the first nine months of 2024, led by CTG due to increased loan loss provisions and reduced non-performing loans. MBB’s LLCR decreased to a five-year low of 69% as a large real estate loan turned non-performing.

Most small and medium-sized banks continued to have LLCRs below the industry average. Some banks (for example: CTG, VCB) are awaiting regulatory approval to complete dividend payments in shares, which will allow them to retain capital.

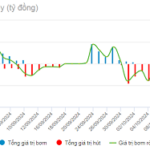

Additionally, liquidity risk is also on the rise as banks increasingly rely on short-term market funds and face higher interbank interest rates. The industry’s current account savings account (CASA) ratio remained stable at 19% of total customer loans in the first nine months of 2024. OCB recorded the most significant increase, 3% QoQ, due to its digital transformation efforts. The industry’s loan-to-deposit ratio (LDR) remained high at 106%.

According to VIS experts, small and medium-sized banks (for example: BVB, ABB, LPB, NAB, MSB) incurred higher funding costs to maintain deposits and increase short-term interbank borrowing.

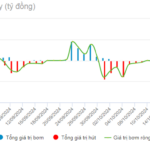

Market updates also reflect that, since mid-October 2024, the overnight interbank interest rate has increased by 3.5%, reaching an average of 6% due to exchange rate pressures and tighter market liquidity. “If interbank interest rates remain high in the coming period, it will increase liquidity risk for small and medium-sized banks,” VIS Rating experts opined.

The Ultimate Guide to Bank Risk Buffers: Strengthening Your Financial Safety Net

The banking sector report, released by VIS Rating on November 20, 2024, revealed a concerning trend. According to the report, nearly 20% of the assessed banks demonstrated weak capital safety profiles. This issue was particularly prominent among small and medium-sized banks, which also faced heightened liquidity risks due to their reliance on short-term market funds and the rise in interbank interest rates.

An Essential Circular on the Classification and Retention of Loan Groups in the Banking Sector is Nearing its Expiry

The Circular 02 issued by the State Bank of Vietnam (SBV), which provides guidelines on debt restructuring and allows for the retention of the original debt classification, will expire on December 31, 2024.

“Interbank Overnight Rates Plummet as Liquidity Pressure Eases”

Through open market operations (OMO), the State Bank of Vietnam (SBV) injected a net amount of VND 50.55 trillion into the system last week (November 4-11, 2024), swiftly stabilizing the overnight interbank interest rate.