Nearly Half of Banks Witness a Drop in CASA

According to statistics from the State Bank of Vietnam (SBV), as of August 2024, total means of payment (excluding issuances of securities purchased by other domestic credit institutions) reached nearly VND 16.7 quadrillion, a more than 4% increase compared to the end of 2023. Within this, deposits from economic organizations stood at over VND 6.8 quadrillion, a 0.05% decrease compared to the end of 2023; while household deposits reached over VND 6.9 quadrillion, a 6% increase compared to the end of 2023.

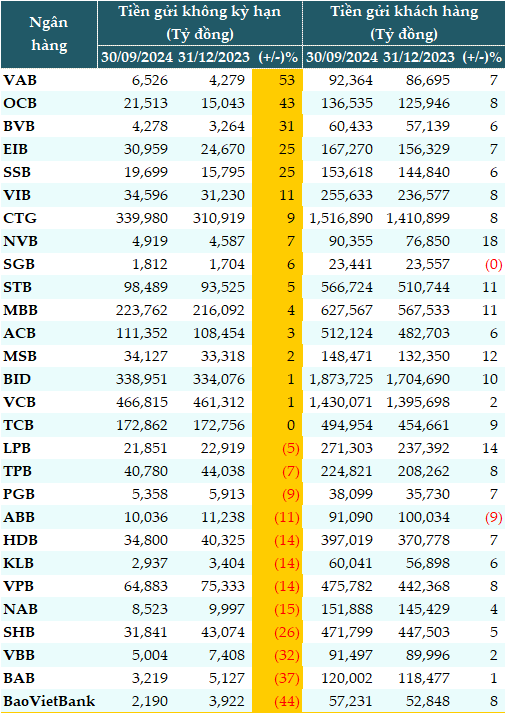

Data from VietstockFinance shows that as of September 30, 2024, total customer deposits at 28 banks exceeded VND 10.6 quadrillion, a 7% increase compared to the beginning of the year. Of this, total current account and savings account (CASA) deposits amounted to over VND 2 quadrillion, a 2% increase compared to the start of the year.

Out of the 29 banks, 12 witnessed a decline in CASA compared to the beginning of the year, with an average decrease of 19%. BaoVietBank saw the sharpest drop (-44%), followed by Bac A Bank (BAB, -37%), and Vietbank (VBB, -32%).

On the other hand, banks that recorded increases in CASA did so at an average rate of 14%, including VietABAnk (VAB, +53%), OCB (+43%), and BVBank (BVB, +31%).

The highest CASA in the system belonged to the state-owned group, with Vietcombank (VCB, VND 466,815 billion, +1%), VietinBank (CTG, VND 339,980 billion, +9%), and BIDV (VND 338,951 billion, +1%).

In the private group, MBB continued to lead (VND 223,762 billion, +4%), followed by Techcombank (TCB, VND 172,862 billion) and ACB (VND 111,352 billion, +3%).

|

CASA at banks as of September 30, 2024

Source: VietstockFinance

|

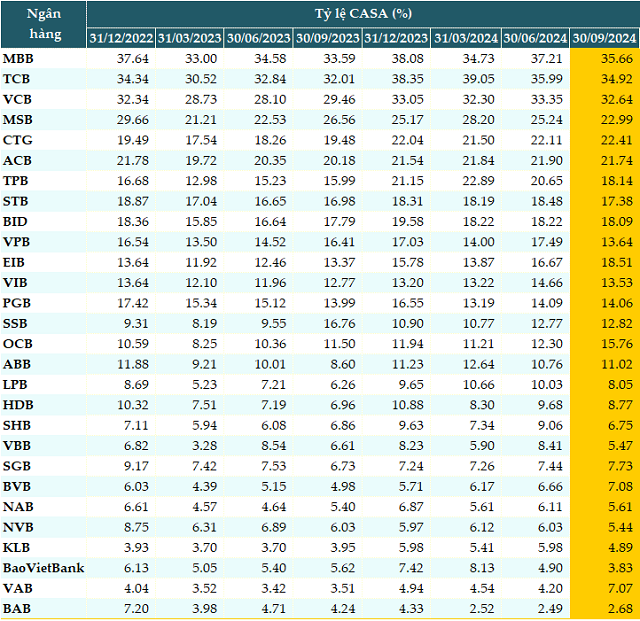

20 out of 28 Banks Witnessed a Decline in CASA Ratio

As of the end of Q3 2024, 20 out of 28 banks saw a decrease in the CASA ratio compared to the beginning of the year, and 13 banks experienced a decline compared to Q2. MBB led the banking system in terms of the CASA ratio, reaching 35.66%, despite a more than 2-percentage-point drop compared to the beginning of the year. This was followed by TCB with 34.92%, a 3-percentage-point decrease. Vietcombank (VCB) ranked third with 32.6%, and MSB was fourth with 22.29%.

A decrease in the CASA ratio means a reduction in low-cost funds from non-term deposits, forcing banks to rely more on term deposits or other borrowings with higher interest rates, leading to increased funding costs. This directly impacts the bank’s competitiveness when faced with cost pressures.

Additionally, a lower CASA hampers the bank’s ability to maintain its net interest margin (NIM) as there are fewer low-cost funds available for lending or investing at higher-yielding interest rates. Higher funding costs make it challenging for banks to offer attractive credit packages or be flexible to attract customers, potentially resulting in a loss of business to competitors with cheaper funding sources.

A representative from MSB shared that the CASA ratio in the total funding structure slightly decreased in Q3 compared to the previous quarter, mainly due to an increase in term deposits. MSB continues to prioritize CASA as a competitive advantage to minimize funding costs.

Meanwhile, a spokesperson from TCB attributed their success to the introduction of the “Techcombank account” in January 2024, which ushered in an “era of automatic profitability.” This innovative account type has attracted significant interest and provided optimal returns for customers. As a result, in Q3, TCB achieved a record-high CASA balance (including the “Automatic Profitability” balance) of VND 200,300 billion, contributing to the increase in the CASA ratio.

|

CASA Ratio at Banks

Source: VietstockFinance

|

Banks Need to Strengthen Sustainable Funding for the Future

Assoc. Prof. Dr. Nguyen Huu Huan, a senior lecturer at the University of Economics Ho Chi Minh City, opined that while bank deposits have increased, this growth is mainly in term deposits. As deposit interest rates have risen, people are less inclined to keep their money in non-term accounts, opting for savings accounts instead.

Additionally, with limited potential in other investment channels, individuals are less likely to maintain significant balances in transactional accounts, further contributing to the shift towards term deposits.

The decrease in deposits from economic organizations can be attributed to the seasonal nature of business cycles, as enterprises require more funds to boost production and business activities. A similar trend is observed with household deposits, as individuals need money for year-end expenditures.

Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking at Nguyen Trai University, also attributed the significant drop in CASA in Q3 to the increase in term deposit interest rates, prompting customers to switch to term deposits to take advantage of higher interest rates.

Furthermore, in Q3, certain segments of the real estate and bond markets showed signs of recovery, especially as the economy exhibited positive growth trends. Individual and corporate customers withdrew funds from CASA to invest in real estate, bonds, or even gold – traditional investment avenues that remain attractive during economic fluctuations.

With economic growth comes an increase in production and business activities, particularly among small and medium-sized enterprises. These businesses transfer funds from non-term accounts to invest in production to meet new orders. For them, a CASA account serves merely as a temporary holding place before funds are channeled into actual business operations.

The CASA ratio is not just a number but a key factor in maintaining low funding costs, improving net interest margins, and sustaining a competitive edge for banks. However, in a dynamic economic landscape with evolving investment trends, enhancing the CASA ratio demands that banks be more flexible and creative in meeting customer needs. This is the opportune moment for banks to invest significantly in long-term strategies, not just to retain customers but also to expand their CASA portfolios and fortify sustainable funding sources for the future.

Introducing the “Vietnam Pavilion – National Pavilion of Vietnam” on the Alibaba E-Commerce Platform

To support international businesses, especially European enterprises, in seeking product information, business partners, and market expansion in Vietnam, the Trade Promotion Agency – Ministry of Industry and Trade of Vietnam is pleased to introduce the “Vietnam National Pavilion – Vietnam Pavilion” on the Alibaba.com e-commerce platform.

Today’s Interest Rates 22-11: How Much Interest Will You Earn on a 1 Billion VND Time Deposit?

The recent uptick in deposit rates has pushed long-term interest rates at many commercial banks beyond the 6% per annum mark.

“Forging a Comprehensive Partnership: BIDV and VRG’s Vision for 2024-2029”

On November 18, 2024, in Ho Chi Minh City, the Bank for Investment and Development of Vietnam (BIDV) and the Vietnam Rubber Group (VRG) signed a comprehensive cooperation agreement for the period of 2024 – 2029, marking an important milestone in the relationship between the two organizations.