With the ability to manage thousands of data attributes per customer, banks can now not only identify their customers but also understand their needs, timing, and preferences. Illustration: VNA |

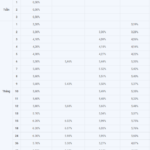

In the first half of 2024, a large commercial bank in Vietnam reported that its data system had reached a level of sophistication where it could manage 1,000 defined attributes per customer. This significant advancement sets the foundation for personalized services and enhanced customer experiences.

This data collection and management approach raises an intriguing question: Are modern retail banks beginning to resemble fast-moving consumer goods (FMCG) companies?

Consider the similarities: FMCG companies are known for attracting consumers through pricing, promotions, and convenience. In the banking sector, this is becoming a reality. Customers are no longer bound by traditional family ties or proximity when choosing a bank. Instead, they are opting for institutions that offer immediate value, such as cash-back rewards, fee-free transfers, promotional interest rates, or easy online credit access.

By managing thousands of data attributes per customer, banks can now not only identify you but also anticipate your needs, timing, and preferred methods. Just as a beverage brand can lose customers to a competitor’s attractive discount campaign, today’s bank customers are also willing to switch if they find a better deal elsewhere, making loyalty a luxury.

A can of soda needs to taste good, but it also needs to have appealing packaging and be readily available on the shelf. Similarly, a modern banking app must be feature-rich, fast, user-friendly, and meet the ever-increasing expectations of customers.

Retail banking is thus exhibiting characteristics akin to FMCG in certain aspects, particularly in terms of customer substitutability and flexibility in switching between banks. This trend is prominent in the financial industry, driven by intensifying competition and the widespread adoption of digital technology.

Imagine a bank with millions of customer accounts, yet none are actively used. This could occur due to: (i) dormant accounts where customers cease transacting, opting to use other banks or e-wallets for their daily transactions and payments, (ii) a frustrating user experience with slow apps and clunky interfaces driving customers away, or (iii) a lack of technological innovation, where outdated systems fail to meet customers’ evolving needs, such as personal financial management (PFM), QR code payments, or quick loan approvals.

The race to digital transformation in the banking industry is accelerating rapidly. Banks that fail to adapt risk losing not only customers but also their market position.

By embracing data cleansing, system integration, and the application of artificial intelligence (AI) and machine learning in a comprehensive manner, Vietnamese banks can catch up with their global counterparts. This will enable them to break free from the challenges of data silos and incremental system improvements.

Tuấn Linh

The Top-Performing Bank in the Country Raises its Savings Interest Rates Once More

ABBank has announced an official update to its savings interest rates, effective immediately from the 19th of November onwards.

Revolutionizing the Banking Experience: VietinBank’s Synchronized Approach to Customer Satisfaction

Complying with Decision 2345 of the State Bank on the deployment of security and safety solutions in payment, VietinBank has implemented biometric authentication for customers since July 1, 2024, and has been recognized as one of the pioneering and effective implementers of this significant directive.

The Digital Pioneer: Forging a Creative and Unified Digital Culture

In the digital age, the ever-evolving landscape of technology has significantly impacted all industries, particularly the banking sector. Military Commercial Joint Stock Bank (MB) has fostered a robust digital culture, enabling it to not only keep pace with staffing demands but also create an innovative and cohesive work environment.

VietinBank Wins Double Annual Report Awards at VLCA 2024

On November 16, 2024, the Joint Stock Commercial Bank for Industry and Trade of Vietnam (VietinBank – stock code: CTG) was honored with two prestigious awards: “Top 10 Enterprises with the Best Annual Report in the Finance Group” and “Outstanding Progress for Annual Report” at the 2024 Listed Companies Awards organized by the Ho Chi Minh City Stock Exchange (HOSE).