Market liquidity increased compared to the previous trading session, with the VN-Index matching volume reaching over 649 million shares, equivalent to a value of more than 15.1 trillion dong; HNX-Index reached over 51.8 million shares, equivalent to a value of more than 887 billion dong.

VN-Index started the afternoon session with a tug-of-war at the reference level, although selling pressure reappeared, but the index still closed in positive territory. In terms of impact, VHM, FPT, CTG, and TCB were the most positive influences on the VN-Index, with an increase of over 2.6 points. On the other hand, MWG, GAS, VTP, and TMS were the most negative influences, but their impact was not significant.

| Top 10 stocks with the strongest impact on the VN-Index on 20/11/2024 |

Similarly, the HNX-Index also had a positive performance, with the index positively impacted by DHT (+7.23%), CEO (+3.6%), MBS (+1.87%), DTK (+2.48%), etc.

|

Source: VietstockFinance

|

The materials sector was the group with the strongest gain, up 1.75%, mainly driven by FPT (+1.85%), CMG (+0.19%), PIA (+3.32%), and VTB (+0.95%). This was followed by the real estate and energy sectors, with increases of 1.57% and 1.36%, respectively. On the other hand, the telecommunications sector saw the biggest decline in the market, falling by 4.63%, mainly due to VGI (-6.15%), CTR (-0.51%), TTN (-5.81%), and MFS (-7.29%).

In terms of foreign trading activities, they continued to be net sellers on the HOSE exchange, focusing on VHM (338.88 billion dong), FPT (289.64 billion dong), MSB (176.04 billion dong), and HPG (157.27 billion dong). On the HNX exchange, foreign investors net sold more than 53 billion dong, focusing on SHS (23.57 billion dong), PVS (13.78 billion dong), IDC (7.5 billion dong), and MBS (2.75 billion dong).

| Foreign investors’ buying and selling activities |

Morning Session: Bottom-fishing cash flow entered the market strongly as VN-Index reached the support level

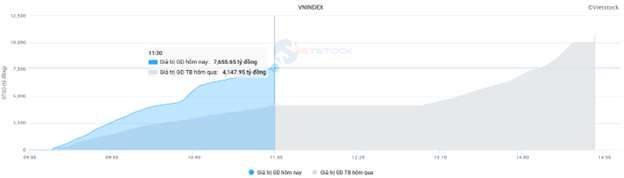

Bottom-fishing cash flow entered the market strongly after the index fell below 1,200 points, led by the real estate group. At the end of the morning session, the VN-Index temporarily stood at 1,214.77 points, up 9.62 points, or 0.8%; HNX-Index also increased by 0.71%, to 221.24 points. Buyers regained the upper hand after a series of suppressed days, with 395 gainers and 218 losers.

The matching volume of the VN-Index reached over 327 million units, equivalent to a value of more than 7.6 trillion dong, nearly double the low of the previous morning. The HNX-Index recorded a matching volume of nearly 26 million units, with a value of over 458 billion dong.

Source: VietstockFinance

|

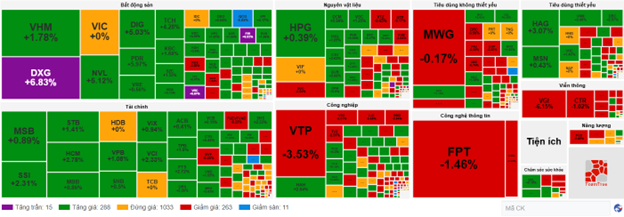

The real estate group took the lead and became the market leader this morning. Many stocks surged with high liquidity, notably DXG (+6.21%), VHM (+2.37%), NVL (+4.65%), DIG (+4.27%), PDR (+5.22%), KBC (+2.82%), CEO (+3.6%), SZC (+1.41%), HDG (+3.13%), HDC (+4.77%), and NLG (+2.57%). However, QCG continued to hit the floor early, marking the second consecutive session after the State Securities Commission announced the suspension of auditors who signed the 2023 audited financial statements of the company.

The materials and financial groups are also attracting positive cash flow. Most stocks recovered significantly, such as HPG (+1.77%), HSG (+1.91%), GVR (+1.48%), VGC (+1.87%); BID (+1.79%), MBB (+1.51%), VPB (+1.08%), STB (+1.72%), TPB (+2.22%), SSI (+2.1%), and HCM (+2.78%).

On the other hand, the telecommunications group fell sharply by more than 4% due to pressure from VGI, which has a dominant market capitalization (-6.15%). Similarly, the information technology and industrial groups were also in the red, mainly due to the impact of FPT (-0.77%), CMG (-1.68%); ACV (-0.99%), MVN (-2.6%), VEF (-3.72%), VEA (-2.59%), and VTP (-3.45%).

The downside in the morning session came from foreign investors, who net sold more than 954 billion dong on the HOSE exchange. Of this, FPT was net sold for more than 438 billion dong, accounting for nearly half of the value. On the HNX exchange, foreign investors net sold more than 34 billion dong, focusing on selling SHS the most.

10:45 am: Cash flow chooses real estate stocks, VN-Index regains 1,200-point mark

The main indices shifted from a tug-of-war at the reference level to a breakthrough, with trading volume improving in the morning session, reflecting investors’ more optimistic sentiment. As of 10:40 am, the VN-Index increased by 6.08 points, trading around 1,211 points. The HNX-Index rose by 1.08 points, trading around 220 points.

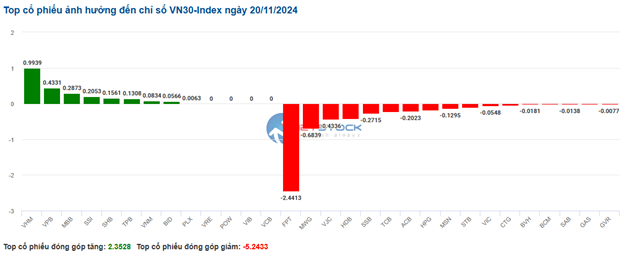

Stocks in the VN30 basket continued to be divided, with selling pressure slightly outweighing buying interest. Specifically, FPT, MWG, VJC, and HDB took away 2.44 points, 0.68 points, 0.43 points, and 0.42 points from the index, respectively. Conversely, VHM, VPB, MBB, and SSI were the codes that helped to hold the index in positive territory, contributing more than 1.8 points.

Source: VietstockFinance

|

The telecommunications sector recorded the deepest decline in the market, falling by 7.53%. Most stocks in the sector were in the red, such as VGI down 8.44%, CTR down 1.88%, TTN down 6.4%, ELC down 1.01%, etc. From a technical perspective, during the morning session of November 20, 2024, the sector index plummeted and broke below the Middle line of the Bollinger Bands, while the MACD and Stochastic Oscillator indicators both gave sell signals and continued to point downward, indicating a deteriorating outlook for this group.

Source: https://stockchart.vietstock.vn/

|

On the other hand, the real estate and financial sectors witnessed a strong recovery, with gains of 1.53% and 0.84%, respectively, despite the breadth remaining mixed. Specifically, buying interest returned to residential real estate stocks such as VHM up 1.9%, DXG up 6.52%, NVL up 4.19%, PDR up 1.49%…, and stocks like SSI up 1.05%, HCM up 2.22%, VPB up 0.54%, VCI up 1.55%…,

Conversely, some stocks continued to trade in negative territory, including VRE down 0.28%, IDC down 0.37%, VIC down 0.12%, HDB down 0.81%, TCB down 0.22%, VCB down 0.11%…,

Compared to the opening, buyers had a slight advantage. There were 288 gainers and 263 losers.

Source: VietstockFinance

|

Opening: VN-Index loses 1,200-point mark

At the start of the November 20 session, as of 9:30 am, the VN-Index edged lower amid cautious sentiment from the beginning of the session. Buyers were struggling, with nearly 165 gainers and over 251 losers, indicating that selling pressure was prevailing.

The Nasdaq Composite index advanced on Tuesday (November 19) as investors shrugged off concerns about escalating geopolitical tensions between Russia and Ukraine, boosted by gains in Nvidia’s shares.

At the close of the November 19 session, the Nasdaq Composite added 1.04% to 18,987.47 points, while the S&P 500 gained 0.4% to 5,916.98 points. In contrast, the Dow Jones lost 120.66 points (or 0.28%) to 43,268.94 points.

Large-cap stocks such as VCB, VHM, and NVL led the market gains, contributing more than 1 point to the index. Conversely, stocks such as FPT, MWG, and GVR weighed on the market, dragging the index down by more than 1.5 points.

As of 9:30 am, the telecommunications services sector was the group with the most negative impact on the market, falling by 5.26%. Notably, stocks such as VGI fell 7.24%, CTR declined 1.79%, ELC dropped 1.82%, TTN lost 5.81%, FOX decreased 1.87%, YEG slid 1.82%,…

The downward trend continued, and by 9:40 am, the index had officially lost the 1,200-point mark, falling more than 6 points to 1,198.6.

Technical Analysis for the Afternoon Session on November 20th: A Shift from Pessimism to Optimism

The VN-Index and HNX-Index both climbed, with a significant surge in trading volume during the morning session, indicating an improvement in investor sentiment.

Technical Analysis for the Session on November 22: A Tale of Diverging Fortunes

The VN-Index and HNX-Index rose in tandem, with the emergence of a Doji candlestick pattern indicating investor indecision in the market. This cautious sentiment is reflected in the hesitancy of buyers and sellers, resulting in a stalemate that led to the formation of the Doji. As the markets hover at these levels, investors are carefully weighing their options, considering the potential risks and rewards of their next move.

The Market Beat: Foreigners End Selling Streak

The market closed with slight losses, as the VN-Index dipped by 0.23 points (-0.02%) to finish at 1,228.10, while the HNX-Index shed 0.47 points (-0.21%), closing at 221.29. The market breadth tilted towards decliners, with 371 tickers in the red versus 341 in the green. Meanwhile, the large-cap VN30 index displayed a more balanced performance, with 11 tickers losing ground against 13 advancing stocks and 6 remaining unchanged.

The Optimistic Outlook: Can We Expect a Positive Shift?

The VN-Index surged amidst a recent spate of losses, indicating a strong rebound. Accompanying this rise was a surge in trading volume, surpassing the 20-day average, signifying a return of liquidity to the market. The Stochastic Oscillator, a key technical indicator, has now entered oversold territory and is signaling a buy. Should this indicator continue to climb, we can expect a further positive shift in market sentiment.