Bottom-fishing stocks that turned a decent profit this afternoon saw relatively weak selling pressure. Liquidity remained low, and most stocks fluctuated within a narrow range, which is a positive sign.

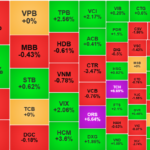

The blue-chip stocks held their value well, except for VHM and a few others that saw minor declines. In fact, there were more gainers than losers in the VN30 group, and their liquidity also decreased.

From a T+ wave-riding perspective, the two previous sessions that saw rapid gains provided a significant advantage, and it’s only natural that some speculators would want to cash out. Short-term trades in an uncertain market environment are not unexpected. Yesterday presented a similar opportunity for bottom-fishers, but liquidity was small, and the same was true today.

On the one hand, this suggests that there will be an increasing amount of cheap stocks being accumulated, gradually building up buying pressure for the upcoming uptrend. On the other hand, the low liquidity and narrow fluctuations indicate a good self-balancing ability. Overall, the trend of holding onto stocks reflects higher expectations, a notable change similar to the previous bottom formations in April and July when these expectations spread and helped form the bottom.

Of course, there will still be stocks that decline more than the rest, depending on supply and demand and the “quality” of their holders. Today, some real estate and securities stocks faced significant pressure, with exceptionally high liquidity and deep price drops. However, when looking at the broader picture, stocks are mostly experiencing small fluctuations and average liquidity remains low. The two exchanges matched only 11.2k billion today, far from the expected average of 15k billion.

Today’s price stability has resulted in a positive weekly candlestick pattern for the VNI. The market has at least established a bottom and provided insights into the “test” of supply and demand around the 1200-point threshold. As many investors still pay attention to the index, this will help reinforce the overall sentiment.

The market has now gone through the most intense phase of the correction. Sentiment has run the gamut from hope and disappointment to fear and doubt. The exchange rate story has largely faded, even though the USDX has surpassed the October 2023 peak and reached a 15-month high. Foreign investors have also reduced their selling, and today they even net bought slightly. When sentiment calms down, things tend to return to normal, and the seemingly dangerous reasons from yesterday suddenly lose their impact.

What’s missing now is the confidence of the money holders. The market can easily form a bottom with very small liquidity, and it can also quickly turn around with weak money flow. However, to create a real uptrend, strong money flow is necessary. Big players need to enter the game, and expectations need to gradually increase. When the market will reach this phase is uncertain, but it’s clear that the most fearful moment has passed.

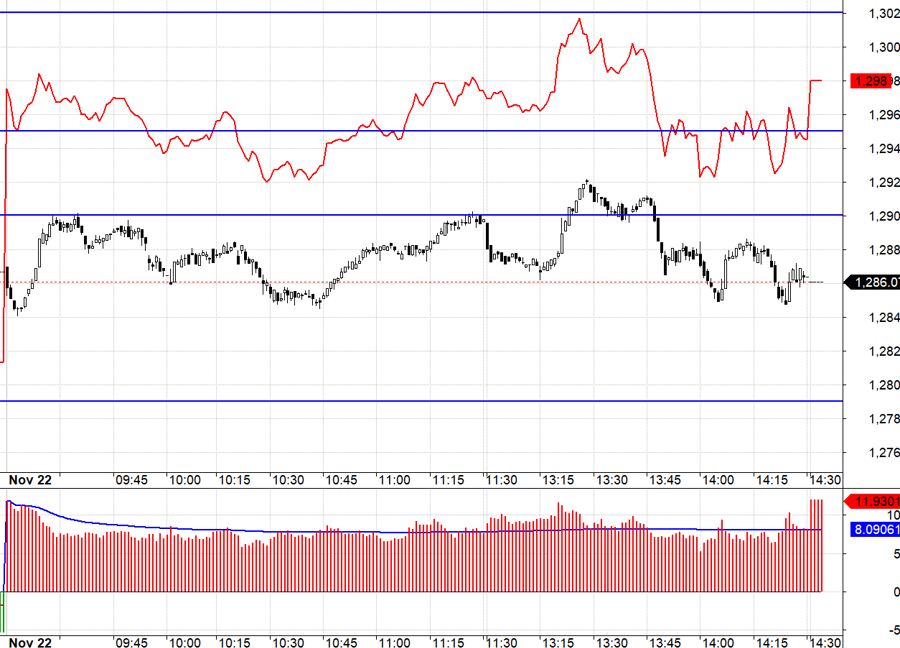

Today, the futures market experienced a term structure reversal, and F1 accepted a very wide spread, averaging 8 points during the session and closing at nearly 12 points, double the basis of F2 yesterday. The significant increase in OI confirms that the Long side is accepting this increased risk, which also implies high expectations for the underlying market.

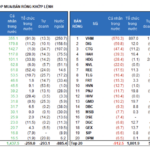

However, such a wide basis makes trading difficult. VN30 hovered within the range of 1290.xx – 1279.xx, mostly sticking close to 1290.xx. There was no clear leading stock, and the wide basis made it challenging to find a standard Long setup. There were a few Short entries when VN30 failed to test 1290.xx successfully, but the decline in range did not meet expectations, resulting in insignificant profits.

The ability to balance short-term pressure and the gradual approach of December is a favorable condition for the market at this point. While it may not immediately attract large capital inflows, there are also no significant dangers that could push the market into a deep decline.

VN30 closed today at 1286.07. The nearest resistance for the next session is 1290, 1295, 1302, 1306, 1316, and 1323. Supports are at 1278, 1270, 1265, 1260, and 1255.

“Blog chứng khoán” reflects the personal views of the author and does not represent the opinions of VnEconomy. The perspectives and assessments are solely those of the individual investor, and VnEconomy respects the author’s viewpoint and writing style. VnEconomy and the author are not responsible for any issues arising from the published investment views and opinions.

The Bottom Fishing Lure: A Tantalizing Strategy for Investors.

The market witnessed a few more minutes of price suppression at the start of the afternoon session before bottom-fishers stepped in. The breadth changed slowly, but the indices climbed quickly, indicating that large-cap stocks were leading the charge. As the momentum spread, hundreds of stocks surged past reference levels, and hundreds of others narrowed their losses significantly. The market staged a strong signaling session around the 1200-point mark.

Stock Market Blog: Cash “Stalking” the Bottom

The market witnessed a strong wave of bottom-fishing this afternoon. Although it’s uncertain whether 1200 is the bottom, it’s evident that funds are “lying in wait” around this level. The current correction is similar to the previous two instances—even with a smaller amplitude—and as panic reaches its peak, that’s when money comes in for the “rescue.”

The Proactive Investor: Navigating the Stock Market

The market is experiencing significant volatility around the 1200 mark for the VNI, indicating that this area is a key supply-demand battleground. Today’s bottom-fishing efforts were more effective than those on November 18th, with a notable improvement in buying power.