Nearly Half of Banks Experience CASA Decline

According to statistics from the State Bank of Vietnam (SBV), as of August 2024, total means of payment (excluding issuances of securities purchased by other domestic credit institutions) reached nearly VND 16.7 quadrillion, a more than 4% increase compared to the end of 2023. Within this, deposits from economic organizations totaled over VND 6.8 quadrillion, a 0.05% decrease from the end of 2023; while household deposits reached over VND 6.9 quadrillion, a 6% increase from the previous year.

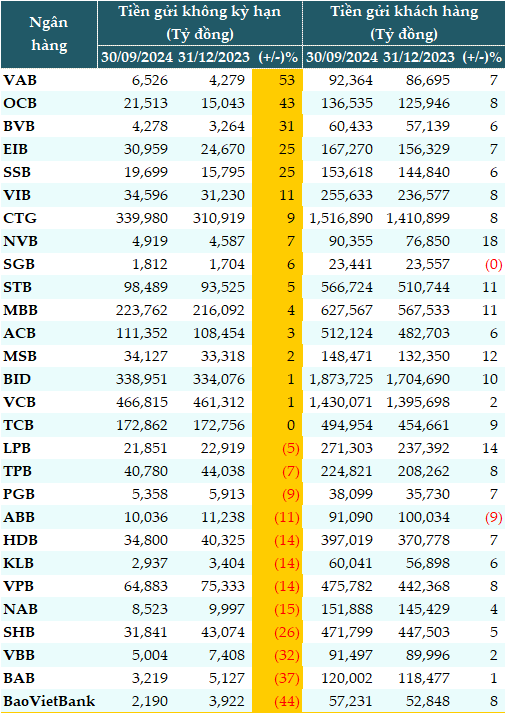

Data from VietstockFinance shows that as of September 30, 2024, total customer deposits at 28 banks exceeded VND 10.6 quadrillion, a 7% increase from the beginning of the year. Short-term deposits (CASA) accounted for more than VND 2 quadrillion, a 2% increase from the start of 2024.

Out of 29 banks, 12 experienced a decline in CASA, with an average decrease of 19%; notably, BaoVietBank saw the sharpest drop (-44%), followed by Bac A Bank (BAB, -37%), and Vietbank (VBB, -32%).

On the other hand, banks like VietABAnk (VAB) witnessed a remarkable 53% increase in CASA, followed by OCB (+43%) and BVBank (BVB, +31%).

State-owned banks maintained their lead in CASA, with Vietcombank (VCB) at VND 466,815 billion (+1%), VietinBank (CTG) at VND 339,980 billion (+9%), and BIDV at VND 338,951 billion (+1%).

In the private sector, MBB retained its top position with VND 223,762 billion (+4%), followed by Techcombank (TCB) and ACB with VND 172,862 billion and VND 111,352 billion, respectively (+3%).

|

CASA across banks as of September 30, 2024

Source: VietstockFinance

|

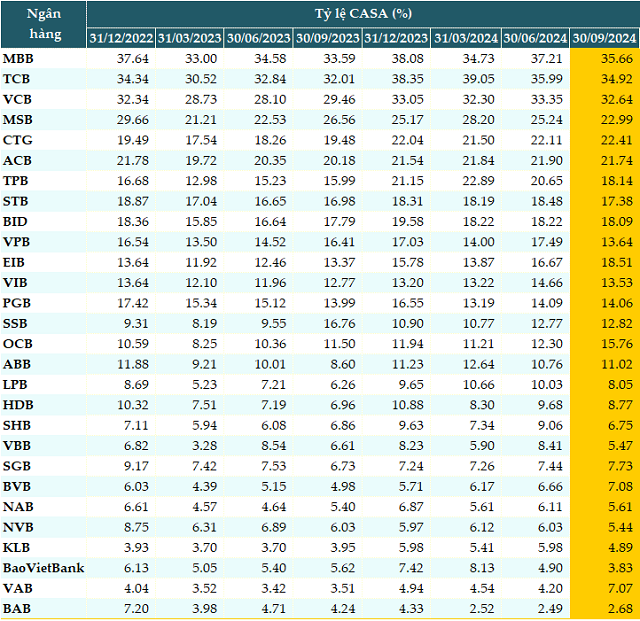

20 out of 28 Banks Witnessed a Decline in CASA Ratio

As of Q3 2024, 20 out of 28 banks experienced a decrease in their CASA ratio compared to the beginning of the year, and 13 banks saw a decline from Q2. MBB led the industry with a CASA ratio of 35.66%, despite a slight drop from the start of the year. Techcombank (TCB) followed closely with 34.92%, a 3-percentage point reduction. Vietcombank (VCB) and MSB ranked third and fourth with 32.6% and 22.29%, respectively.

A lower CASA ratio indicates a decrease in low-cost funds from short-term deposits, compelling banks to rely more on term deposits or other borrowings with higher interest rates, resulting in increased funding costs. This directly impacts the bank’s competitiveness as they face pressure from elevated funding costs.

Additionally, a decline in CASA undermines the bank’s ability to maintain net interest margins (NIM) as there are fewer low-cost funds available for profitable lending or investment activities. Higher funding costs hinder the bank’s ability to offer attractive credit packages or flexible terms to attract customers, potentially leading to a loss of business to competitors with lower-cost funds.

A representative from MSB shared that their CASA ratio within the funding structure experienced a minor dip in Q3, mainly due to an increase in term deposits. MSB continues to prioritize CASA as a strategic advantage to minimize funding costs.

In contrast, Techcombank (TCB) attributed their success in Q3 to the introduction of the “Techcombank account,” which offers automatic profitability to customers. As a result, their CASA balance (including the “Profitability Auto” feature) reached a record high of VND 200,300 billion, contributing to an overall increase in their CASA ratio.

|

CASA Ratios across Banks

Source: VietstockFinance

|

Banks Need to Strengthen Sustainable Funding for the Future

Assoc. Prof. Dr. Nguyen Huu Huan, Senior Lecturer at the University of Economics Ho Chi Minh City, opined that while bank deposits have increased, this growth is primarily in term deposits. As deposit rates rise, individuals are less inclined to keep their money in non-term accounts, opting for savings accounts instead.

Additionally, with limited attractive investment channels, people are less likely to maintain significant balances in transactional accounts, further contributing to the shift towards term deposits.

The decrease in deposits from economic organizations can be attributed to seasonal fluctuations, as businesses require more funds during production and trading periods. A similar trend is observed with household deposits as individuals need money for year-end expenditures.

Mr. Nguyen Quang Huy, CEO of the Faculty of Finance and Banking at Nguyen Trai University, echoed similar sentiments, attributing the decline in CASA in Q3 to the rise in term deposit interest rates, prompting customers to opt for higher returns.

Furthermore, Q3 witnessed a resurgence in certain real estate and bond market segments, particularly as the economy showed signs of recovery. Individual and corporate customers withdrew funds from CASA to invest in these traditional yet appealing channels during economic fluctuations, including real estate, bonds, and even gold.

In a growing economy, small and medium-sized enterprises have heightened production and business activities, prompting them to transfer funds from non-term accounts to support their operations. For these businesses, CASA accounts serve as a temporary holding place before funds are allocated for actual business activities.

Maintaining a healthy CASA ratio is crucial for banks to sustain low funding costs, improve net interest margins, and retain their competitive edge. However, amidst economic fluctuations and evolving investment trends, enhancing CASA ratios demands that banks become more agile and innovative in meeting customer needs. This is the opportune moment for banks to invest in long-term strategies that not only retain but also expand their CASA portfolios, thereby solidifying sustainable funding for the future.

The Top-Performing Bank in the Country Raises its Savings Interest Rates Once More

ABBank has announced an official update to its savings interest rates, effective immediately from the 19th of November onwards.

“Banks Reap the Benefits as Savings Account Interest Rates Rise”

With an increasing number of banks offering attractive interest rates on savings accounts, the battle for idle funds is heating up. In today’s market, which banks are offering interest rates above 6% per annum on deposits? It’s time to explore the options and make your money work harder.