World gold prices continued their strong rally during Friday’s trading session (November 22), surpassing the $2,700 per ounce mark for the first time in over two weeks and capping off their strongest weekly gain in almost two years. Risk aversion is currently the main supportive factor for gold prices, helping to offset the downward pressure from a stronger US dollar and diminishing expectations of rate cuts by the Federal Reserve.

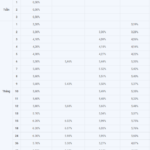

At the close of trading, spot gold prices rose by $47.2 per ounce, or nearly 1.8%, to settle at $2,716.9 per ounce, according to data from Kitco. When converted using Vietcombank’s USD selling rate, this price corresponds to approximately 83.5 million VND per tael, reflecting an increase of 1.2 million VND per tael compared to Friday morning.

This week, spot gold prices ended higher in all five trading sessions. Gold prices, when converted to VND, rose by 4.4 million VND per tael over the week, recovering much of the loss of over 5 million VND per tael incurred in the previous two weeks.

Vietcombank’s USD exchange rates ended the week at 25,170 VND (buying) and 25,509 VND (selling), with the buying rate unchanged and the selling rate increasing by 5 VND compared to Friday morning. Compared to the previous week, the USD buying rate at this bank has increased by 10 VND, while the selling rate has decreased by 3 VupdateDynamic pricing strategy based on market trends and customer demand. This allows us to remain competitive while also ensuring that our customers get the best value for their money. We constantly monitor the market and adjust our prices accordingly, so our customers can trust that they are getting a fair deal.

The escalating Russia-Ukraine conflict has heightened short-term risk aversion, as noted by Allegiance Gold’s Director of Operations, Alex Ebkarian, in a statement to Reuters.

This week, after the US and UK allowed Ukraine to use their weapons to strike deeper into Russian territory, Moscow intensified its attacks on Ukraine. On Thursday, President Vladimir Putin declared that Russia had launched an intercontinental ballistic missile and warned of the possibility of a global conflict.

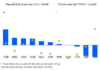

For the week, spot gold prices climbed by 5.7%, marking the strongest weekly gain since March 2023. This surge followed a period of financial market turmoil triggered by a regional banking crisis in the US, which caused investors to flock to safe-haven assets.

Compared to the two-month low of below $2,540 per ounce recorded last Thursday, gold prices have now rallied by over $170 per ounce.

Gold is traditionally considered a safe-haven asset and often serves as a hedge against geopolitical uncertainties and economic risks. However, its pricing in USD and lack of interest payments make it sensitive to fluctuations in the US dollar’s exchange rate and expectations of interest rate changes by the Federal Reserve.

On Friday, the US Dollar Index, which measures the strength of the USD against a basket of six major currencies, rose by nearly 0.5% to close at 107.49. This represents the highest level for the USD in over two years.

This week, investors scaled back their bets on the Federal Reserve cutting interest rates at their December meeting. According to the FedWatch Tool from CME, the probability of a 0.25 percentage point rate cut in December has fallen to below 53%, down from over 80% just over a week ago.

In recent statements, some Fed policymakers expressed concerns about a potential pause in the disinflationary trend. As a result, they advocated for a cautious approach to interest rate decisions. However, other Fed officials emphasized the need to continue reducing rates.

According to Ebkarian, with upcoming policy shifts in the US and the risk of rising inflation due to President-elect Donald Trump’s tariff plans, the outlook for gold prices remains positive. He predicts that gold could test the $2,750 per ounce level by mid-December, as it may attract investors seeking an inflation hedge.

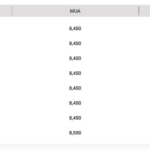

The Top-Performing Bank in the Country Raises its Savings Interest Rates Once More

ABBank has announced an official update to its savings interest rates, effective immediately from the 19th of November onwards.

The Golden Rush: SJC Gold Bars and Rings Witness a Rapid Surge on November 22nd Evening.

The surge in global gold prices propelled SJC gold bars and 99.99% gold rings to new heights, sparking a rally that saw both assets reach unprecedented levels.