The reason why Ms. Linh only purchased nearly 85% of the registered amount was due to a “failure to reach an agreement.”

The trading method used was a combination of matching orders and negotiations. According to the average price of MSN shares during the trading registration period, which was 73,640 VND/share, it is estimated that Ms. Nguyen Yen Linh spent approximately 626 billion VND to own 0.59% of MSN’s capital.

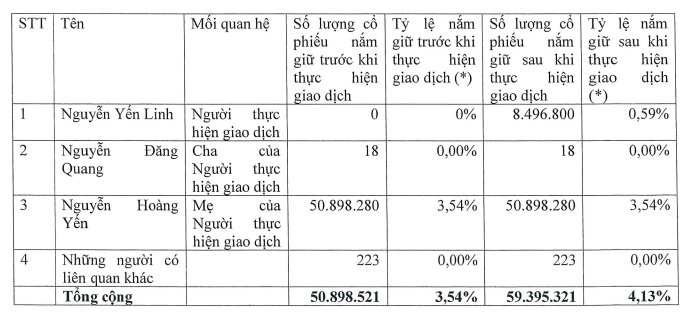

In addition to Ms. Linh, Mr. Nguyen Dang Quang, Chairman of the Board of Directors of MSN, owns 18 MSN shares, and his wife, Ms. Nguyen Hoang Yen, a member of the Board of Directors of MSN, holds nearly 50.9 million MSN shares (3.54%). In total, the group related to the Chairman of the Board of Directors of MSN currently owns nearly 59.4 million MSN shares, equivalent to 4.13%.

Source: MSN

|

On November 1, 2024, Masan Group announced that SK Investment Vina I Pte. Ltd. (SK Group) had successfully transferred 76 million MSN shares through a negotiated method. After the transaction, SK Group’s ownership ratio in MSN was 3.67% of the charter capital, and they were no longer a major shareholder in MSN.

According to Masan Group, the transaction was led by large institutional investors with a long-term investment vision based in Asia, Europe, and the United States. Additionally, the remaining shares of SK Group in MSN will be restricted from transfer as per convention. This helps maintain stability in the shareholder structure of Masan Group while the company continues to drive growth and implement strategic initiatives.

In parallel, SK Group will transfer 7.1% of WinCommerce (WCM) shares to Masan Group for 200 million USD. WCM is a company that owns and operates a retail chain with over 130 WinMart supermarkets and more than 3,600 WinMart+/WiN mini-supermarkets.

The increased ownership in WCM strengthens MSN’s ability to control and promote the growth of its core business in the long term. As part of its investment strategy, Masan will have the right to purchase the remaining shares of SK Group in WCM in the future at SK’s original investment cost. The partial transfer of ownership in WCM allows SK Group to realize profits while continuing its long-term investment in MSN through the extension of the put option.

On the HOSE, MSN’s share price has increased by nearly 7% since the beginning of the year and is currently trading at around 71,500 VND/share (as of the morning session on November 22, 2024), with an average daily trading volume of 5 million shares.

| MSN Share Price Movement since the Beginning of the Year |

Han Dong

The Rise of the Securities Companies: Can Masan Reach its Audacious Target of 2,000 Billion VND Net Profit?

In the first nine months of 2024, Masan achieved a remarkable profit of 1.308 trillion Vietnamese dong after allocation of minority interests, surpassing its initial plans by a significant margin. With this impressive performance, the company is well on its way to achieving its ambitious full-year net profit target of 2 trillion Vietnamese dong, as per the positive scenario laid out.

Masan: Confident to Achieve 2024 Profit Plan of $86 Million

In Q3 2024, Masan reported a staggering 701 billion VND in profit, an astonishing nearly 14-fold increase compared to the same period last year, and surpassing its quarterly profit plan by 130% in the base-case scenario. The company is now focused on the final quarter, aiming to get closer to its ambitious 2,000 billion VND profit goal for the year.