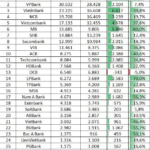

Asset risks were mitigated by limited lending exposure to the typhoon-affected areas, with smaller banks bearing the brunt of net interest margin pressure and credit costs. Banks’ asset risks remained stable in the first nine months of 2024 (9T2024), with limited impact from Typhoon Yagi, particularly on state-owned banks (SOBs) and larger banks. The industry’s average return on total assets (ROAA) dipped slightly to 1.5% in 9T2024 from 1.6% in the first six months of 2024, with smaller banks being the most affected by a narrowing net interest margin (NIM) and higher credit costs.

Non-performing loans (NPLs) creation varied across bank sizes.

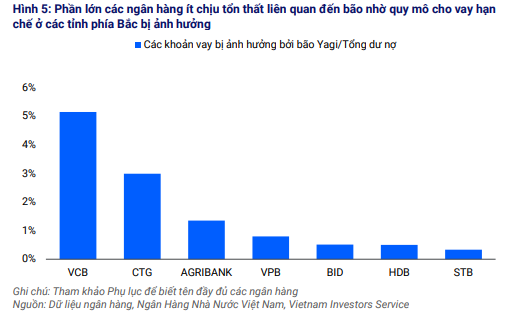

Most banks incurred minimal losses related to the typhoon due to their limited lending exposure in the affected northern provinces. Credit exposure to clients affected by the typhoon accounted for approximately 1% of the industry’s total outstanding loans, mainly attributed to state-owned banks operating in these provinces. Supportive measures from the State Bank of Vietnam (SBV), such as debt restructuring and providing low-interest loans to affected borrowers, will help ease their debt servicing burden. The industry’s problem loans ratio remained broadly stable at 2.4% quarter-on-quarter.

Larger banks, including state-owned banks, witnessed a slowdown in new NPL formation, benefiting from the resolution of large exposures (CTG) and tighter lending standards, particularly for new consumer loans (VPB). In contrast, NPLs continued to rise at banks focusing on retail and small and medium-sized enterprise (SME) clients (PGB, SGB, VIB, OCB, LPB). VIS Ratings estimates that about 30% of banks have weak asset risk profiles, up from 22% in 2023. For the full year 2024, it expects the industry’s NPL ratio to stabilize at 2.3-2.4% as banks complete write-offs in the fourth quarter.

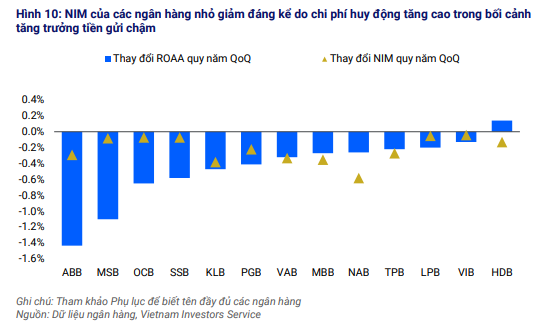

NIM compression

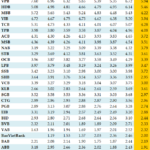

Industry profit growth decelerated due to NIM compression, with smaller banks bearing the additional brunt of higher credit costs.

Most banks reported a quarterly decline in ROAA and NIM, with smaller banks experiencing the most significant profit drop due to higher funding costs amid intense competition. These banks, along with some mid-sized banks, witnessed asset quality deterioration and elevated credit costs. Larger banks exhibited divergent profit trends; some were affected by lower insurance, foreign exchange (FX), and securities investment income, while others benefited from previous risk reduction efforts that substantially lowered credit costs and boosted loan recovery gains.

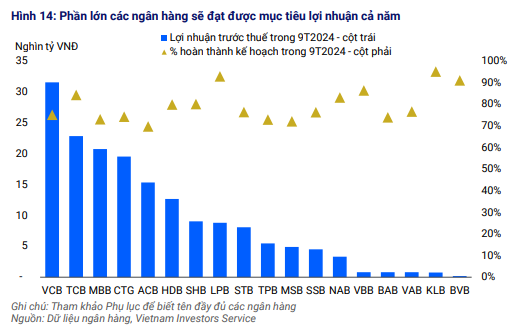

VIS Ratings expects most banks to meet their full-year profit targets, particularly state-owned and larger banks with strong corporate loan growth. With the continued improvement in credit growth, it anticipates the industry’s ROAA to recover to 1.6% for the full year 2024, up from 1.5% in the previous year.

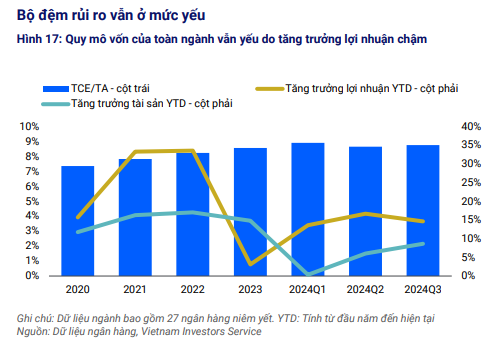

Risk buffers remain weak

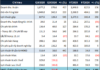

As of the third quarter, the industry’s tangible common equity (TCE) to tangible assets (TA) ratio remained unchanged quarter-on-quarter at 8.8%, as profit growth decelerated. Nearly 20% of the banks in the assessment have weak capital adequacy profiles, including smaller banks with thin profits and some state-owned banks facing constraints in raising new capital.

The industry’s loan loss coverage ratio (LLCR) improved slightly by 1% quarter-on-quarter to 83% at the end of the third quarter, led by CTG due to higher provisioning and reduced problem loans. MBB’s LLCR declined to a five-year low of 69% as a large real estate corporate loan turned non-performing. Most mid-sized and smaller banks continued to have LLCRs below the industry average. Some banks (CTG, VCB) are awaiting regulatory approval to complete dividend payments in shares, which will help them retain capital.

Liquidity risks are rising

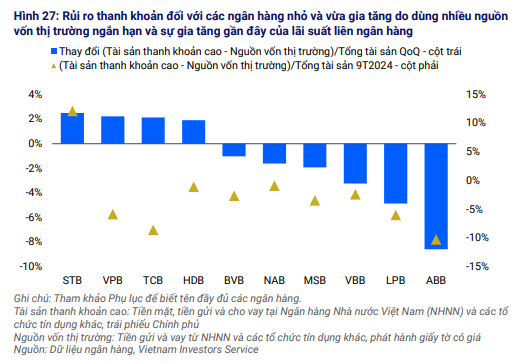

Notably, the report also highlights rising liquidity risks as banks increasingly rely on short-term market funds, and interbank rates have surged. The industry’s current account savings account (CASA) ratio remained stable at 19% of total customer loans in 9T2024. OCB recorded the largest increase of 3% year-on-year, attributable to its digital transformation efforts. The industry’s loan-to-deposit ratio (LDR) remained high at 106%. Smaller and mid-sized banks (BVB, ABB, LPB, NAB, MSB) incurred higher funding costs to retain deposits and increased short-term interbank borrowings.

Since mid-October 2024, the overnight interbank rate has surged by 3.5%, reaching an average of 6%, amid exchange rate pressures and tighter market liquidity. If interbank rates persist at elevated levels, they will heighten liquidity risks for smaller and mid-sized banks.

The Impact of Soaring Interbank Interest Rates on Banks: A Critical Analysis

The VIS Rating assessment highlights the potential risks faced by small and medium-sized banks if the interbank interest rates remain elevated in the coming months. This could lead to a challenging liquidity situation for these financial institutions, warranting careful monitoring and strategic responses.

The Bank’s NIM is Thinning

The Q3 2024 NIM for banks across the board witnessed a decline compared to Q2, indicating the industry is grappling with a host of challenges. A stark contrast is emerging between large and small banks, giving rise to an uneven competitive landscape. This dynamic environment demands that banks adopt more agile strategies to enhance their performance and keep pace with the evolving market conditions.