The afternoon session saw a continuation of the tug-of-war from the morning, with the market cautiously awaiting the response of bottom-fishing funds. The T+ day was the session that saw the market dip below the 1200-point level. In a surprising turn of events, foreign investors turned net buyers in the afternoon, reversing the net selling position from the morning session.

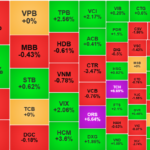

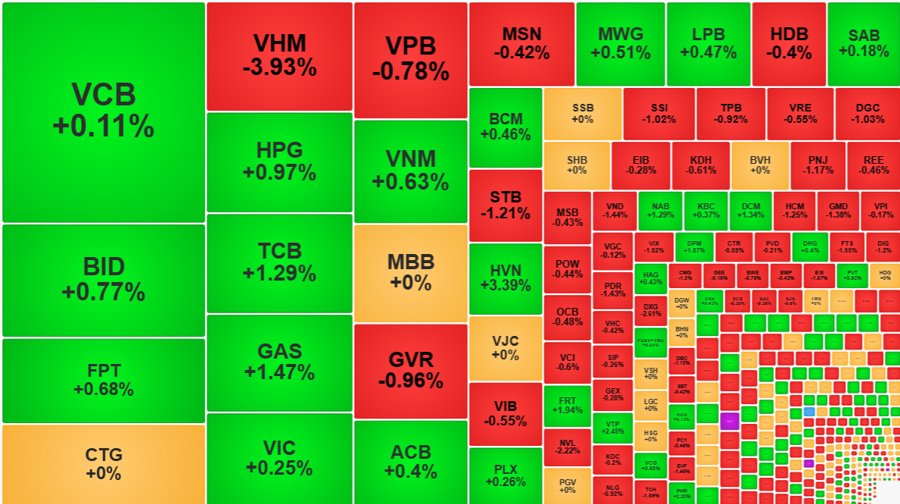

The VN-Index closed slightly lower, down 0.23 points (-0.02%) with a slight bias towards decliners: 151 gainers and 213 losers. Compared to the morning session, the situation worsened (VN-Index up 3.45 points with 177 gainers and 158 losers), confirming some selling pressure.

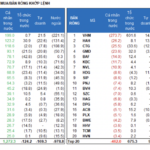

HoSE’s liquidity also increased by more than 47% in the afternoon compared to the morning session, reaching VND6,266 billion. The number of stocks that fell by more than 1% was 77, also significantly higher than in the morning (39 stocks). Real estate and securities stocks saw considerable selling pressure.

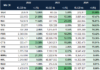

VHM, of course, remained the stock to watch as it continued its downward trend, falling another 1.42% in the afternoon. For the full day, VHM declined by 3.93%. This stock had gained 7.6% in the previous five sessions, while the deadline for the share buyback program approached. Meanwhile, DXG also witnessed significant selling pressure, with liquidity almost matching that of VHM at VND358.7 billion, resulting in a 2.61% drop in its share price. DXG’s T+ stocks had gained over 7% as of this morning. Other notable real estate stocks included PDR, which fell 1.43% with a liquidity of VND128.2 billion; TCH, down 1.59% with VND95.3 billion; DIG, down 1.2% with VND93.2 billion; and NVL, down 2.22% with VND92.3 billion…

The securities sector also faced considerable selling pressure, with only VFS, EVF, DSE, and TVB ending in positive territory, while 15 stocks fell by more than 1%. Major securities stocks like SSI, VND, HCM, and VCI didn’t see the steepest declines, but VIG, IVS, ORS, and SBS all lost over 2%. The group had a combined liquidity of over VND100 billion, including SSI, VIX, and HCM.

When assessing short-term selling pressure, the two most important factors are liquidity and the extent of price declines. If prices fall significantly with high trading volume, it indicates a substantial amount of selling pressure, causing a wider price decline. Conversely, if liquidity is low while prices drop sharply, it suggests that buyers may be “letting go” in anticipation of lower prices. Additionally, if the price decline is minimal, it could be due to limited selling (in low liquidity situations) or strong buying support (in high liquidity situations).

Despite the VN-Index’s slight bias towards decliners at the end of the session, trading activity was not overly high. Out of the 77 stocks that fell by more than 1%, only a third (28 stocks) had trading volumes of VND10 billion or more. The nine stocks with liquidity exceeding VND100 billion were all from the real estate and securities sectors mentioned earlier. This group accounted for approximately 21% of the total number of stocks and 25.7% of the HoSE’s matched liquidity.

The slight decline in the VN-Index today was largely due to the drop in VHM. This stock saw a significant sell-off of 1.12 million shares in the ATC session, causing its price to fall from VND41,900 to VND41,600, a loss of 3.93% compared to the reference price. This single stock accounted for a loss of 1.7 points from the VN-Index, and just before the ATC session – when VHM was down 3.23% – the index was still up slightly by 0.02 points. Nonetheless, the blue-chip group largely maintained its momentum today. The VN30-Index fell by 0.05%, with 13 gainers and 11 losers. GAS led the gains, rising by 1.47%, followed by TCB with a 1.29% increase and HPG with a 0.97% gain, all of which are among the Top 10 largest market caps.

On the other hand, there was a noticeable selling pressure in this blue-chip basket. Apart from VHM, only STB, SSI, and GVR saw significant declines, while the rest mostly fluctuated. The number of gainers also outnumbered the losers. Meanwhile, the basket’s liquidity decreased by 23% compared to the previous day, contrasting with a 40% increase in the Midcap basket and a 30% rise in the Smallcap basket.

In an unexpected turn of events, foreign investors turned net buyers in the afternoon, purchasing a net amount of VND182.1 billion on HoSE, offsetting the net selling of VND151.2 billion in the morning session. For the full day, they were net buyers to the tune of VND30.9 billion. HDG stood out with net buying of VND241.8 billion, followed by TCB with VND105.6 billion, FPT with VND60.1 billion, MWG with VND43.1 billion, DPM with VND32.9 billion, MBB with VND31.5 billion, and CTG with VND51.8 billion.

The Art of Trading: Navigating the Stormy Seas of Short-Term Risks

The Asean stock market is expected to witness short-term rebounds in the coming sessions. However, investors are advised to remain cautious and avoid a buying frenzy or panic-selling in their short-term trades.

The Bottom Fishing Lure: A Tantalizing Strategy for Investors.

The market witnessed a few more minutes of price suppression at the start of the afternoon session before bottom-fishers stepped in. The breadth changed slowly, but the indices climbed quickly, indicating that large-cap stocks were leading the charge. As the momentum spread, hundreds of stocks surged past reference levels, and hundreds of others narrowed their losses significantly. The market staged a strong signaling session around the 1200-point mark.

The Flow of Funds: Has the Market Reached the “Wash-Out” Phase?

The sharp declines in the last two sessions of the past week have significantly dampened market sentiment, with experts also being cautious when referring to the “bottom” of this correction phase.