The number of treasury shares mentioned above is equivalent to 66.75% of the planned purchase and 5.67% of VHM‘s total listed shares. As a result, the company’s outstanding shares decreased to 4.1 billion after the aforementioned treasury stock purchases.

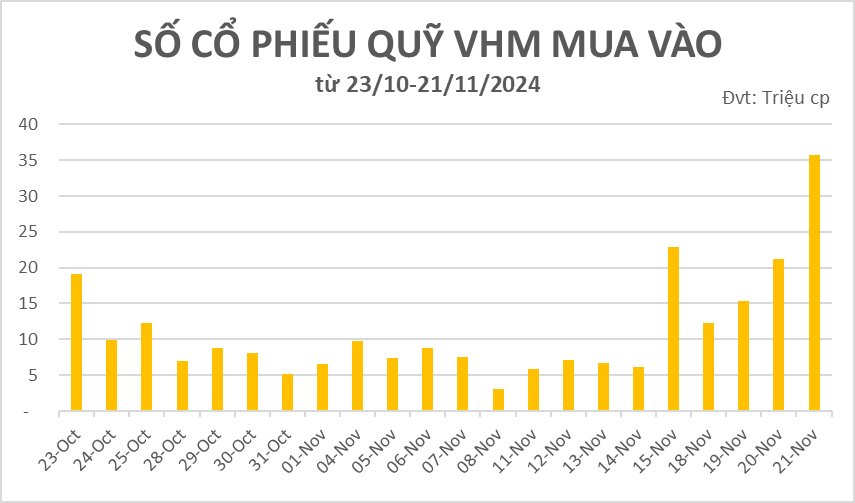

Looking back at VHM‘s journey, it can be seen that the treasury stock purchases were accelerated at the beginning and end of the trading registration period. November 21 was the last day and also the day when this real estate company bought the most treasury shares, with more than 35.7 million shares, equivalent to 9.66% of the planned purchase.

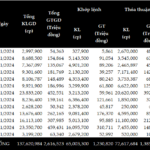

Source: HSX

|

Between October 23 and November 21, VHM‘s share price fell by more than 10%, closing at 43,300 VND per share on November 21. It appears that the positive news about the Company’s stock purchases was reflected in the share price before the Company started buying. Specifically, from the time VHM announced the Resolution of the General Meeting of Shareholders by taking opinions in writing (04/09/2024) to October 22, the share price increased by more than 16%, reaching 48,250 VND per share at the end of the session on October 22.

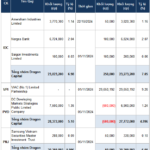

| Price movement of VHM shares from the beginning of September until now |

If calculated based on the closing-adjusted transaction value of each session, VHM is estimated to have spent nearly VND 10.5 trillion on the above 247 million treasury shares.

On the other hand, on the last day VHM bought treasury shares (November 21), foreign investors strongly net sold this stock with a value of nearly VND 961 billion, KBC ranked second with just over VND 148 billion.

According to the plan, VHM expects to buy back a maximum of 370 million treasury shares, equivalent to 8.5% of the total outstanding shares. The company announced that the purpose of the buyback is to protect the company’s and shareholders’ interests as the market price of VHM shares is currently lower than their intrinsic value.

The source of capital for the buyback is from the undistributed after-tax profit as of December 31, 2023, according to the 2023 audited financial statements. Accordingly, VHM‘s undistributed after-tax profit at this time is more than VND 133 billion, up nearly 34% compared to the beginning of the year.

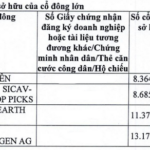

“Foreign Ownership Limit Increased to 70% for TNH, Attracting Big Players to Take a Bite”

The Joint Stock Company TNH Hospital Group (HOSE: TNH) has successfully concluded its public offering of 15.2 million shares, achieving a 100% subscription rate. Following this issuance, foreign investors now hold a substantial 47.74% stake in the company, highlighting the strong confidence and interest from the international investment community.